If EPS Growth Is Important To You, Callon Petroleum (NYSE:CPE) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Callon Petroleum (NYSE:CPE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Callon Petroleum

How Fast Is Callon Petroleum Growing Its Earnings Per Share?

Over the last three years, Callon Petroleum has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Callon Petroleum's EPS has risen over the last 12 months, growing from US$13.16 to US$15.07. There's little doubt shareholders would be happy with that 14% gain.

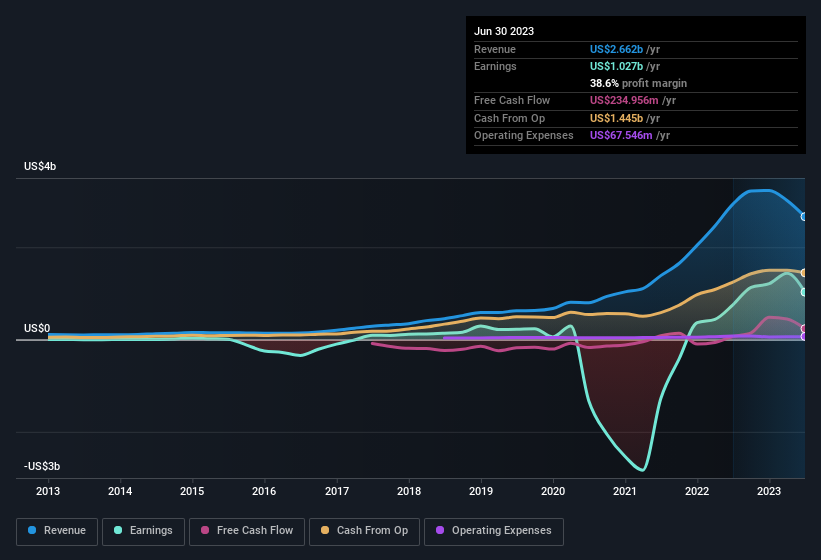

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Despite consistency in EBIT margins year on year, Callon Petroleum has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Callon Petroleum?

Are Callon Petroleum Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Callon Petroleum insiders spent a whopping US$2.1m on stock in just one year, without so much as a single sale. Knowing this, Callon Petroleum will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Independent Director, Steven Webster, who made the biggest single acquisition, paying US$1.5m for shares at about US$31.63 each.

Along with the insider buying, another encouraging sign for Callon Petroleum is that insiders, as a group, have a considerable shareholding. To be specific, they have US$46m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Joe Gatto is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Callon Petroleum with market caps between US$2.0b and US$6.4b is about US$6.8m.

Callon Petroleum offered total compensation worth US$4.2m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Callon Petroleum Deserve A Spot On Your Watchlist?

One important encouraging feature of Callon Petroleum is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 3 warning signs for Callon Petroleum (1 is concerning!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Callon Petroleum, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance