If EPS Growth Is Important To You, YTL Power International Berhad (KLSE:YTLPOWR) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in YTL Power International Berhad (KLSE:YTLPOWR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for YTL Power International Berhad

How Fast Is YTL Power International Berhad Growing Its Earnings Per Share?

YTL Power International Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, YTL Power International Berhad's EPS shot from RM0.20 to RM0.33, over the last year. Year on year growth of 67% is certainly a sight to behold.

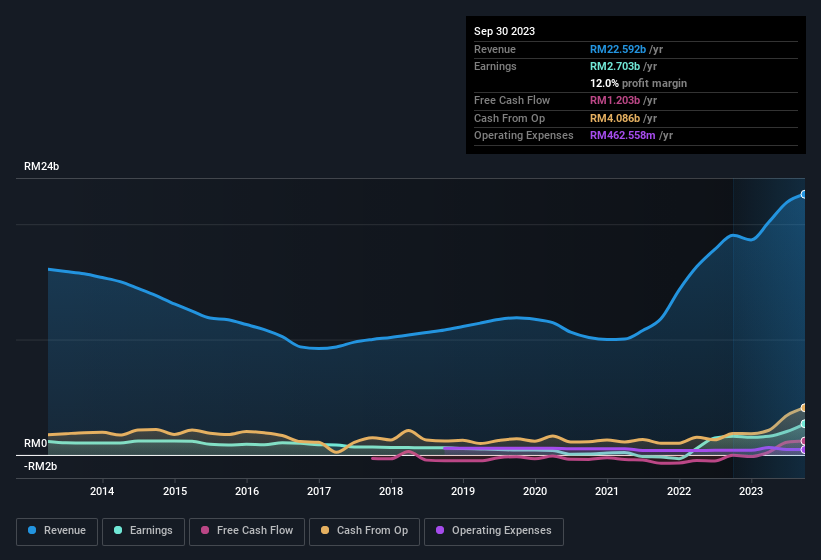

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that YTL Power International Berhad is growing revenues, and EBIT margins improved by 9.0 percentage points to 21%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for YTL Power International Berhad?

Are YTL Power International Berhad Insiders Aligned With All Shareholders?

Owing to the size of YTL Power International Berhad, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth RM1.2b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Should You Add YTL Power International Berhad To Your Watchlist?

YTL Power International Berhad's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering YTL Power International Berhad for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for YTL Power International Berhad that you should be aware of.

Although YTL Power International Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance