With EPS Growth And More, Sun Life Financial (TSE:SLF) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Sun Life Financial (TSE:SLF). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Sun Life Financial

How Fast Is Sun Life Financial Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, Sun Life Financial has grown EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Sun Life Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Unfortunately, Sun Life Financial's revenue dropped 9.9% last year, but the silver lining is that EBIT margins improved from 8.1% to 12%. That falls short of ideal.

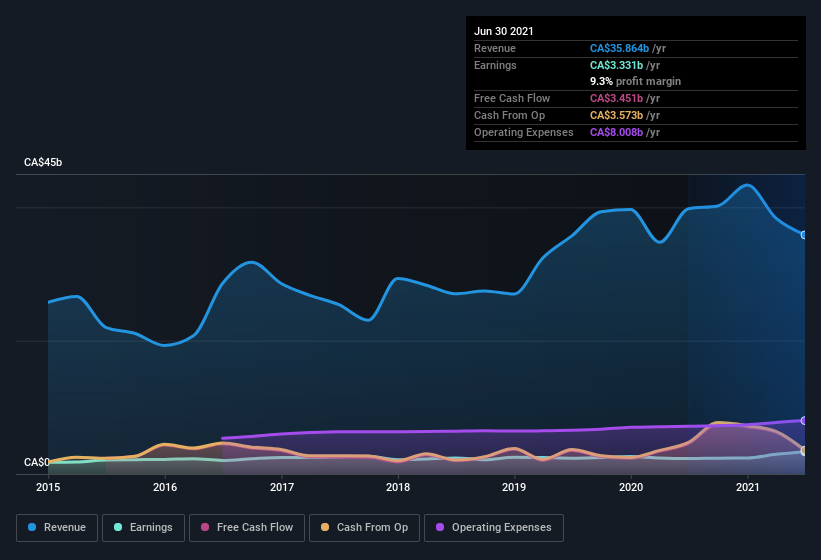

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Sun Life Financial.

Are Sun Life Financial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Sun Life Financial insiders reported share sales in the last twelve months. But the really good news is that Independent Corporate Director Stephanie Coyles spent CA$345k buying stock stock, at an average price of around CA$61.68. Big buys like that give me a sense of opportunity; actions speak louder than words.

I do like that insiders have been buying shares in Sun Life Financial, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Sun Life Financial, with market caps over CA$9.9b, is about CA$7.2m.

Sun Life Financial offered total compensation worth CA$4.5m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Sun Life Financial To Your Watchlist?

As I already mentioned, Sun Life Financial is a growing business, which is what I like to see. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Now, you could try to make up your mind on Sun Life Financial by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Sun Life Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance