If You Like EPS Growth Then Check Out HarborOne Bancorp (NASDAQ:HONE) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in HarborOne Bancorp (NASDAQ:HONE). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for HarborOne Bancorp

How Fast Is HarborOne Bancorp Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud HarborOne Bancorp's stratospheric annual EPS growth of 45%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

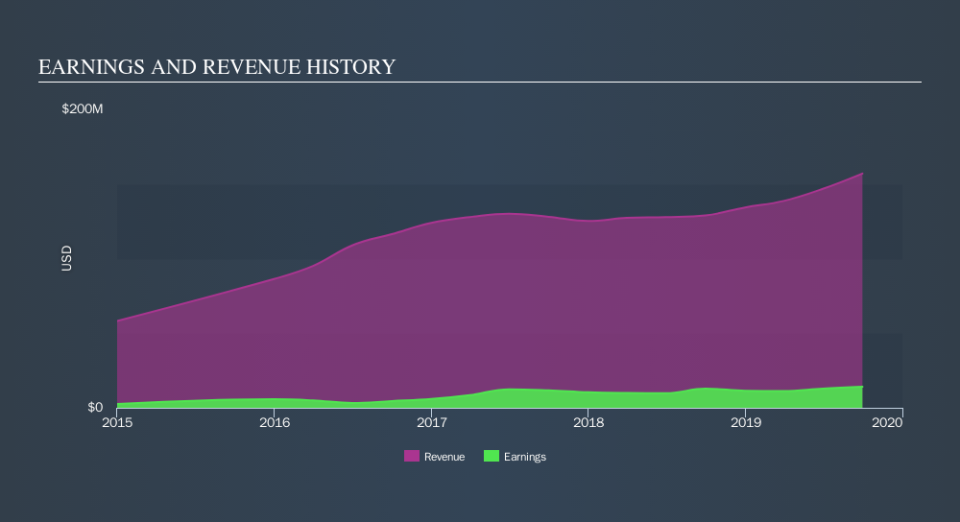

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that HarborOne Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. HarborOne Bancorp maintained stable EBIT margins over the last year, all while growing revenue 22% to US$157m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of HarborOne Bancorp's forecast profits?

Are HarborOne Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did HarborOne Bancorp insiders refrain from selling stock during the year, but they also spent US$123k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was CEO, Secretary James Blake who made the biggest single purchase, worth US$98k, paying US$9.84 per share.

The good news, alongside the insider buying, for HarborOne Bancorp bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$20m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 3.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is HarborOne Bancorp Worth Keeping An Eye On?

HarborOne Bancorp's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe HarborOne Bancorp deserves timely attention. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if HarborOne Bancorp is trading on a high P/E or a low P/E, relative to its industry.

The good news is that HarborOne Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance