If You Like EPS Growth Then Check Out iStar (NYSE:STAR) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in iStar (NYSE:STAR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for iStar

How Fast Is iStar Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that iStar's EPS went from US$0.61 to US$3.40 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of iStar's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. iStar's EBIT margins have actually improved by 12.3 percentage points in the last year, to reach 27%, but, on the flip side, revenue was down 37%. That falls short of ideal.

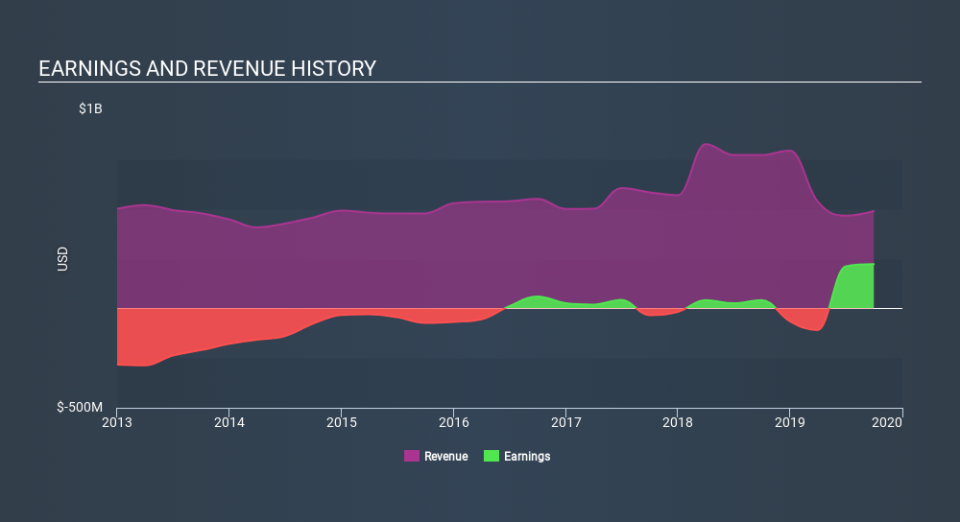

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of iStar's forecast profits?

Are iStar Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

iStar top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the President & Chief Investment Officer, Marcos Alvarado, paid US$154k to buy shares at an average price of US$12.23.

Along with the insider buying, another encouraging sign for iStar is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$45m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 5.5% of the company, demonstrating a degree of high-level alignment with shareholders.

Does iStar Deserve A Spot On Your Watchlist?

iStar's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe iStar deserves timely attention. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing iStar's ROE with industry peers (and the market at large).

As a growth investor I do like to see insider buying. But iStar isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance