Equifax, Experian: how much of our data do they hold - and how safe is it?

Between them Britain's two biggest credit agencies, Experian and Equifax, control billions of items of data relating to all of our borrowing and other financial commitments - and much else beside.

These agencies store all of our credit card balances and outstanding mortgage debts, our commitments to mobile phone contracts and even the sums of money coming into and out of our bank accounts each month.

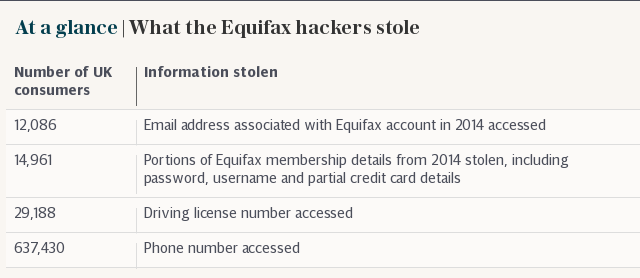

This makes them a tantalising target for criminals. The latest Equifax security breach, revealed last month, is now understood to have affected close to 700,000 UK-based customers.

The US firm is now contacting affected customers in Britain. The stolen data is said to include email addresses, certain passwords and phone numbers. It has said the risk of identity theft is likely to be low, but is offering to help those affected by the breach with free account-tracking services.

But what does Equifax, and its counterpart Experian, actually do for us? And do we have any choice but to entrust them with our information?

What are credit reference agencies for?

On most occasions when you apply for credit - from a credit card to a mobile phone contract - the provider of the credit will check your credit history according to files held about you by an agency.

The process works both ways. The lenders or phone companies pay to access the agencies' files. They also provide the agencies with information about how well the customers go on to manage their credit cards, phone repayments and so on.

Eventually agencies build up enough information to give you a “credit score”. The highest scores tend to go to those people who have a long history of managing several types of credit and always meeting repayments.

Equifax and Experian are Britain's most established reference agencies, with CallCredit being the third largest. Most lenders started to use them on a large scale 20 years ago. Prior to that lending decisions had been laborious and slow.

Experian explains its purpose as helping companies “quickly make fair, consistent, responsible and profitable” decisions on lending to a customer.

Who owns Equifax and Experian?

Both Equifax and Experian are publicly listed and owned by shareholders. Experian is based in Dublin but also has offices in Manchester and California. It made $4.5bn (£3.4bn) in revnue last year.

Equifax is based in the American city of Atlanta and has more than 800 million customers. It made $3.1bn (£2.4bn) in 2016.

How do agencies make their money?

Agencies collate borrowers' data and package it for lenders. They offer other services helping lenders and other providers decide where to give credit and how much to charge for it.

They also make money from consumers by providing a range of "credit monitoring" services so that people can check their own likelihood of being offered loans, and to help prevent fraud and identity theft. The services offered by Experian and Equifax can cost up to £15 per month.

Is the data accurate?

Not always. As credit reference agencies rely on information from other sources, any mistakes or inaccuracies could find their way onto your credit report - to devastating effect. There are occasions when the agencies themselves are to blame.

Telegraph Money has reported in the past on the consequences a single mistake can have. Reader Jonathan Dickson was turned down for two mortgages due to a default erroneously placed on his record by his energy supplier Scottish Power.

Despite fully paying his bills, the energy company had recorded a default which meant he was viewed as too risky a proposition by mortgage lenders. Scottish Power eventually admitted its mistake and paid him £7,000.

Identity theft can also lead to things like credit cards being taken out in your name, which can leave your credit score in tatters.

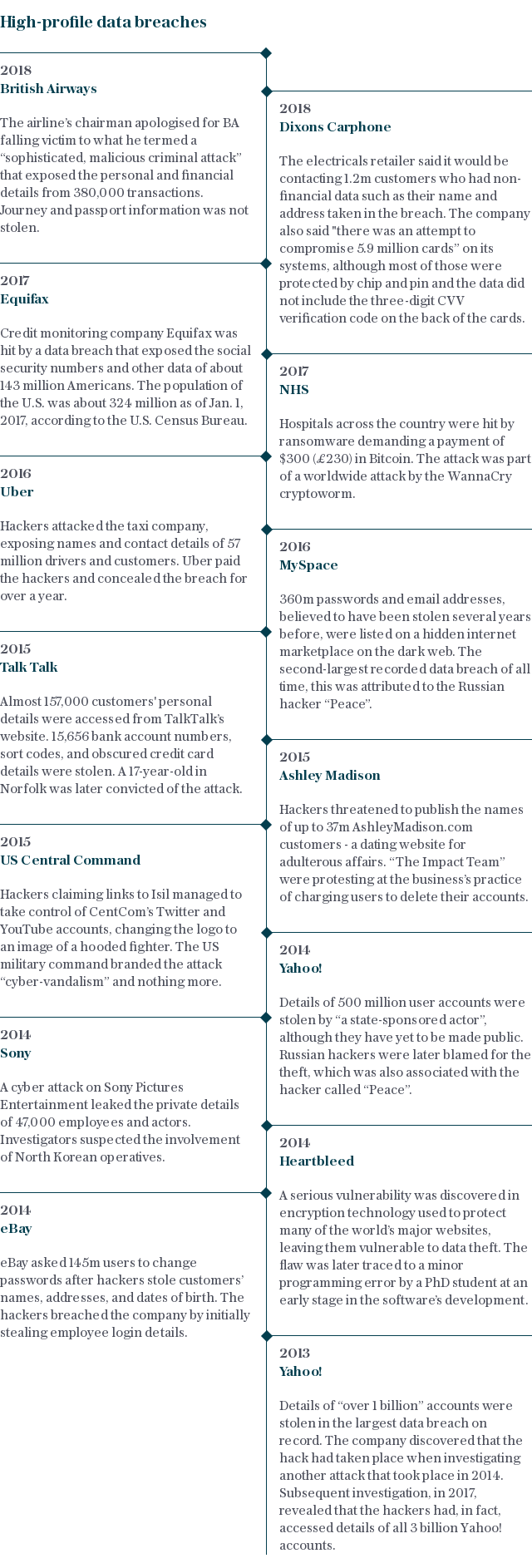

Is Equifax the first data breach involving a credit reference agency?

This year’s breach is far from the first. Equifaxwas the subject of a lawsuit after one of its websites was attacked in May last year, resulting in the theft of 430,000 customers’ personal data.

They also suffered a smaller breach between April 2013 and January 2014.

Dublin-based Experian has had its own data security problems. The company warned in 2015 that as many as 15 million mainly American customers' personal data could be at risk after an attack over a two year period.

This was the second large-scale breach of personal information involving Experian customers, following an attack on a company linked to the firm in 2014 which reportedly exposed the data of 200 million people, also in America.

What should you do in relation to the latest Equifax breach?

In the wake of the latest breach, Equifax has offered all of its customers free access to its credit monitoring service, regardless of whether their data was stolen. This will track all of your credit activity and tip you off if someone fraudulently attempts to take out credit in your name.

All the other standard advice for preventing identity theft and fraud of course still apply. This includes using different passwords for different accounts which you regularly change, keeping a close eye on your bank account for unrecognised activity and not buying things from cold callers or people knocking on the door.

Yahoo Finance

Yahoo Finance