Equinix (EQIX) Q2 AFFO Beats Estimates, Revenues Rise Y/Y

Equinix Inc.’s EQIX second-quarter 2022 adjusted funds from operations (AFFO) per share of $7.58 surpassed the Zacks Consensus Estimate of $7.30. The figure grew 8.1% from the prior-year quarter’s $7.01.

EQIX’s results reflect steady growth in colocation and inter-connection revenues. During the second quarter, Equinix’s total inter-connections reached 435,800, rising 2% sequentially and 7.2% year over year.

Total quarterly revenues came in at $1.82 billion, lagging the Zacks Consensus Estimate by 0.2%. However, the top line improved 10% year over year, marking the 78th consecutive quarter of top-line growth.

Per Charles Meyers, president and CEO of the company, “The demand environment and our pipeline remain robust despite a complex global macroeconomic and political landscape, as we continue to enable digital leaders on their transformation journey.”

Quarter in Detail

Recurring revenues were $1.7 billion, up 10.7% from the year-ago quarter. However, non-recurring revenues fell nearly 5% to $109.7 million.

Revenues from the three regions increased on a year-over-year basis as well. Revenues from the Americas, EMEA and the Asia Pacific rose 10.7%, 11.4% and 4.8% to $830.9 million, $599.2 million and $387.1 million, respectively.

The adjusted EBITDA came in at $860.3 million, up 8% year over year. Adjusted EBITDA margin rose sequentially to 47.3% from 46%.

AFFO increased 9.4% to $691.4 million year over year.

EQIX spent $35 million on recurring capital expenditure in the second quarter, down 23% on a year-over-year basis. Recurring capital expenditure was 1.9% of revenues in the second-quarter 2022. Non-recurring was reported at $450 million, shrinking 30.4% year over year. However, the figure climbed 15.7% sequentially.

Balance Sheet

Equinix exited second-quarter 2022 with cash and cash equivalents of $1.9 billion, up from $1.7 billion reported as of Mar 31, 2022. The available liquidity was $5.8 billion as of Jun 30, 2022. This comprised cash, cash equivalents and $4 billion of its undrawn revolver and excludes restricted cash and outstanding balance of letters of credit.

Its net leverage ratio was 3.8 and the weighted average maturity was 8.9 years as of Jun 30, 2022. On Jun 2, Fitch Ratings upgraded Equinix’s credit ratings to BBB+.

Dividend Update

Concurrent with the second-quarter 2022 earnings release, Equinix’s board of directors approved a quarterly cash dividend of $3.10 per share. This dividend will be paid out on Sep 21, 2022, to its shareholders on record as of Aug 17, 2022.

Guidance

For third-quarter 2022, Equinix projects revenues between $1.827 billion and $1.847 billion, a 1-2% increase over the prior quarter. The adjusted EBITDA is expected between $831 million and $851 million.

For the full year, AFFO per share is estimated between $28.77 and $29.10, suggesting a 6-7% increase from the prior year. The Zacks Consensus Estimate for the same is pegged at $29.19.

For 2022, Equinix estimates to generate total revenues of $7.259-$7.299 billion, indicating growth of 9-10% from 2021. The company expects to incur $30 million of acquisition-related integration costs. Management predicts adjusted EBITDA of $3.323-$3.353 billion and an adjusted EBITDA margin of 46%.

Equinix carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

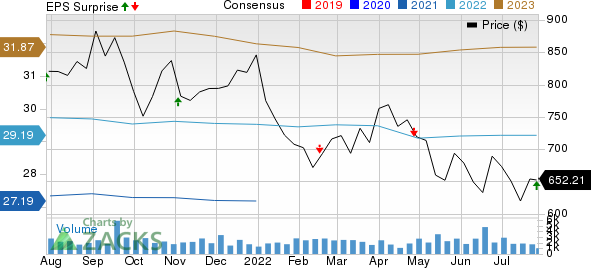

Equinix, Inc. Price, Consensus and EPS Surprise

Equinix, Inc. price-consensus-eps-surprise-chart | Equinix, Inc. Quote

Performance of Notable REITs

UDR Inc. UDR reported second-quarter 2022 FFO as adjusted per share of 57 cents, in line with the Zacks Consensus Estimate. The figure is 16.3% higher than the prior-year quarter’s 49 cents.

UDR’s quarterly results reflect an increase in revenues from rental income that fueled the quarter’s top-line growth. Robust operating trends and strong pricing power were major contributing factors.

Alexandria Real Estate Equities, Inc. ARE reported second-quarter 2022 adjusted FFO per share of $2.10, surpassing the Zacks Consensus Estimate of $2.06. The reported figure also compared favorably with the year-ago quarter’s $1.93.

ARE witnessed continued healthy leasing activity and rental rate growth during the quarter.

Boston Properties Inc.’s BXP second-quarter 2022 FFO per share of $1.94 beat the Zacks Consensus Estimate of $1.85. The figure also compared favorably with the year-ago quarter’s $1.72.

BXP’s quarterly results reflect growth in the bottom line. Also, it experienced strong leasing activity during the quarter.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance