Equinor (EQNR) Scores Deal to Supply Gas to UK's Centrica

Equinor ASA EQNR entered an agreement with Centrica to supply additional gas to the U.K. for the next few years in response to the country’s mounting energy crisis.

The U.K., along with many other European buyers, cut off Russian energy supplies after the country’s attack on Ukraine. Energy suppliers are rushing to stockpile gas supplies for this winter amid the depressed market.

Per the terms of the new agreement, Equinor would supply additional 1 billion cubic meters (bcm) of gas to London-based energy supplier Centrica, bringing the total volume to be supplied to more than 10 bcm per year. This represents about 13% of the annual gas consumption in the U.K. and establishes Norway as the country’s primary gas supplier.

Centrica is a leading provider of electricity and gas to British consumers. The company has been working with suppliers and the government to meet the country’s energy requirements. The agreement will help address the energy needs for the next few years, proceeding toward replacing the gas supplied by Gazprom as the company pledged to exit all contracts with the exporter.

Equinor usually delivers 20-22 bcm of gas to the U.K. per year, which covers more than a quarter of the demand. The company cited that it is open to more long-term contracts with European buyers in the current market circumstances.

The latest agreement would strengthen the U.K.’s energy security for the next few years. It supports vital domestic supplies and bolsters the strategic relationship between the U.K. and Norway.

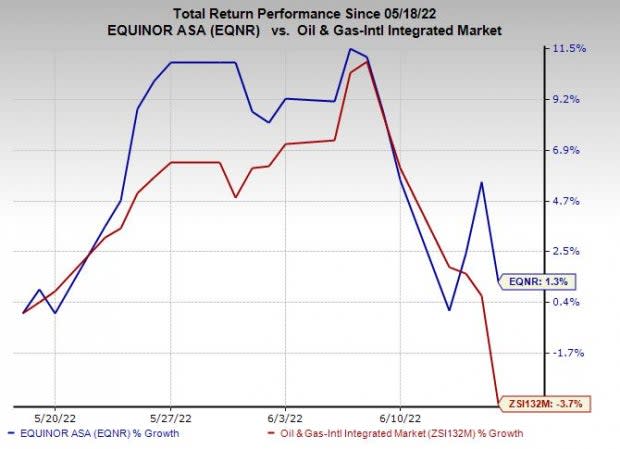

Price Performance

Shares of Equinor have outperformed the industry in the past month. The stock has gained 1.3% against the industry’s 3.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Equinor currently flaunts a Zack Rank #1 (Strong Buy).

Investors interested in the energy sector might look at the following companies that also presently sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Exxon Mobil Corporation XOM is one of the leading integrated energy companies in the world. XOM currently has a Zacks Style Score of A for Growth and Momentum. It is expected to see an earnings growth of 90.7% in 2022.

As of Mar 31, 2022, ExxonMobil’s total cash and cash equivalents were $11.1 billion and debt amounted to $42.7 billion. The firm has significantly lower debt exposure than other integrated majors. Also, ExxonMobil has increased its stock repurchase program from $10 billion to $30 billion.

PBF Energy Inc. PBF, based in New Jersey, is a leading refiner of crude oil. PBF currently has a Zacks Style Score of A for Value, Growth and Momentum. It is expected to see an earnings growth of 317.6% in 2022.

In 2021, PBF Energy’s crude oil and feedstocks throughput volumes were 834.5 thousand barrels per day (bpd), higher than the year-ago figure of 727.7 thousand bpd. Moreover, it expects total throughput volumes of 865-925 thousand bpd in 2022.

Antero Resources Corporation AR is among the fast-growing natural gas producers in the United States. AR currently has a Zacks Style Score of A for Growth and Momentum. It is expected to see an earnings growth of 404.2% in 2022.

Antero Resources is targeting a capital return program of 25-50% of free cash flow annually, beginning with the implementation of the share repurchase program. The company’s board authorized a share repurchase program that enables it to repurchase up to $1 billion of outstanding common stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance