Equitable Holdings Inc (EQH) Reports Mixed Q1 2024 Results: Earnings Surpass Estimates but Net ...

Net Income: Reported at $114 million, falling short of the estimated $450.32 million.

Earnings Per Share (EPS): Actual EPS was $0.30, significantly below the estimated $1.33.

Revenue: Specific revenue figures for the quarter were not disclosed, making it impossible to compare with the estimated $3719.40 million.

Non-GAAP Operating Earnings: Reached $490 million, with EPS at $1.43, surpassing the quarterly EPS estimate of $1.33.

Asset Management: Experienced positive net inflows of $3.7 billion, indicating strong demand in Retail and Private Wealth channels.

Shareholder Returns: Returned $326 million to shareholders during the quarter, aligning with the target payout ratio of 60-70%.

Total Assets Under Management/Administration (AUM/A): Increased to $974 billion, up 13% year-over-year, driven by market performance.

On April 30, 2024, Equitable Holdings Inc (NYSE:EQH) unveiled its financial outcomes for the first quarter of 2024, as detailed in its 8-K filing. The company reported a mixed financial performance with some segments outperforming while others fell below expectations.

Company Overview

Equitable Holdings Inc is a prominent financial services entity in the U.S., offering a wide range of financial solutions including variable annuities, tax-deferred investment and retirement plans, and protection solutions for individuals, families, and small businesses. Its operations are segmented into Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

Financial Performance Highlights

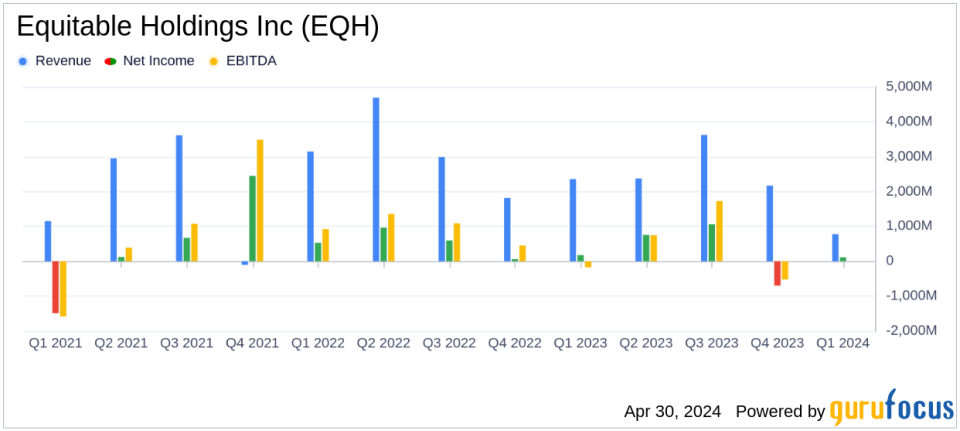

Equitable Holdings reported non-GAAP operating earnings of $1.43 per share, significantly surpassing the analyst estimates of $1.33 per share. However, the net income of $114 million ($0.30 per share) did not meet the anticipated $450.32 million, marking a notable decline from $177 million ($0.45 per share) in Q1 2023. Total assets under management and administration increased to $974 billion, up 13% year-over-year.

Segment-Wise Performance

The Individual Retirement segment exhibited strong performance with net inflows of $1.6 billion, and a 25% increase in account value driven by robust sales of spread-based RILA products. The Group Retirement segment, however, experienced net outflows of $132 million. The Investment Management and Research segment, operated by AllianceBernstein, saw active net inflows of $3.7 billion, primarily in the Retail and Private Wealth channels. Protection Solutions reported a growth in gross written premiums to $778 million, and Wealth Management operating earnings rose by 34% year-over-year.

Strategic Initiatives and Shareholder Returns

Equitable Holdings returned $326 million to shareholders in the quarter, aligning with its payout ratio target of 60-70%. The company also plans to increase its quarterly cash dividend from $0.22 to $0.24 per share in the upcoming quarter. These actions reflect a strong commitment to delivering shareholder value and confidence in the financial stability of the company.

Management's Outlook

CEO Mark Pearson emphasized the company's strategic positioning to capitalize on favorable market conditions, citing an aging population and a growing retirement savings gap as key drivers for future growth. Equitable aims to continue leveraging its strong market positions across its business segments to meet its 2027 financial targets, which include significant growth in non-GAAP EPS and holding company cash flow.

In conclusion, while Equitable Holdings Inc (NYSE:EQH) showcased a robust increase in operating earnings and strategic positioning for future growth, the substantial drop in net income highlights areas of concern. Investors and stakeholders will likely watch closely how the company navigates these challenges and capitalizes on market opportunities in the forthcoming quarters.

For further details, please refer to the full earnings report and join the upcoming earnings conference call scheduled for May 1, 2024.

Explore the complete 8-K earnings release (here) from Equitable Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance