Can I use equity release to pay for care?

The average cost of care is spiralling out of control for many families. A year in a care home can easily cost more than £50,000, with some families racking up astronomical bills.

Those with assets worth more than £23,250 in assets (slightly more in Scotland and Wales) must fund the entirety of their care themselves, with no council support. As this limit includes a home, that means anyone who owns property won’t get support.

That leaves families faced with an often severe gap when it comes to funding care for loved ones.

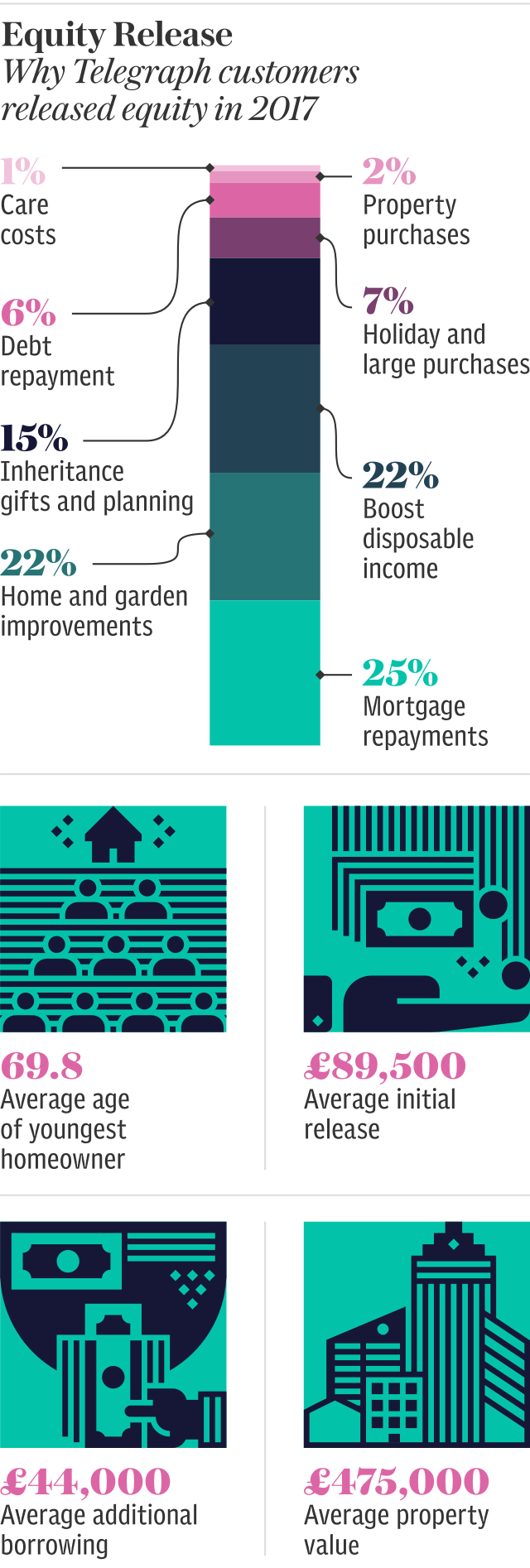

For some, equity release, which allows those over the age of 55 to borrow against the value of their homes, could be the answer. But very few people are taking up this option – roughly 1pc of those who released equity release in 2017 did so to pay for care.

So how does it work and what should you consider?

What is equity release?

More commonly known as a lifetime mortgage, equity release allows borrowers to draw money from their home. The amount is usually capped at about 50pc of the property’s value and there are usually no monthly repayments, with the interest rolling up at a compound rate until the borrower dies.

The total debt can also never exceed the value of the home, and will be cleared using the proceeds from its sale. There are plans where you clear the interest each month. Other options will protect a portion of the value for inheritance.

Interest rates tend to be higher than standard mortgages, depending on the amount borrowed, but there are no affordability checks or repayment plans.

The money can usually either be withdrawn as a lump sum, or taken out in stages as and when it is needed.

Borrow to stay in your own home for longer

One option to pay for your care using equity release could be to fund improvements that will let you stay where you are. No one actively wants to move to a care home and staying at home is almost always the preference.

But many family homes are simply not properly equipped for a person as they become older and develop increasingly complicated care needs.

Going into a care home can easily deplete a person’s assets, and lessen or eliminate the amount they are able to pass to descendants. Staying at home is a way to preserve this.

Drawing on the value of the home using a lifetime mortgage could be enough for a homeowner to install a wet room or move a bathroom downstairs, which could be the difference between being able to stay at home or having to leave.

Using equity release to fund a stay in a care home

It is far more difficult to use equity release to fund a stay in a care home, as the repayment of the loan will often be triggered by a person moving out into long-term care.

If one half of a couple needed to move to a care home then they would be able to use a lifetime mortgage, as the property would not need to be sold to repay the debt until their partner died or moved into a care home with them.

This makes equity release a difficult option for this aspect of care costs, although it could be helpful for quick, upfront funding. As the length of a person’s stay in a care home is almost impossible to predict, this can make it hard to determine how much will be needed.

Have a buy-to-let? You don’t only need to borrow against your home

Some lifetime mortgages also allow borrowing against buy-to-lets. Although still very niche, Retirement Advantage, a provider, has released a plan which allows you to take a lifetime mortgage out against a buy-to-let property.

The regulations are slightly different and the loan is not covered by the Financial Services Compensation Scheme, but it operates very much like equity release in that the balance doesn’t have to be repaid until a person’s death and there are now affordability checks.

If the family of a person who went into care decided to sell a buy-to-let they would need to pay capital gains tax on this asset, so equity release could allow them to use the money to fund a stay in a care home instead.

Unlike a regular lifetime mortgage, the move into care would not trigger repayment. There are a number of different options and the property must be let out using a regular shorthold tenancy.

Yahoo Finance

Yahoo Finance