Equity Residential (EQR) Q4 FFO and Revenues Beat Estimates

Equity Residential’s EQR fourth-quarter 2020 normalized funds from operations (FFO) per share of 76 cents surpassed the Zacks Consensus Estimate of 74 cents, reflecting better-than-anticipated rental income.

Rental income in the fourth quarter came in at $613.4 million, exceeding the consensus mark of $608 million.

However, on a year-over-year basis, normalized FFO per share declined 16.5% and rental income fell 10.3%. Results reflect lower blended rates and physical occupancy compared with the year-ago period when the residential REIT delivered solid pre-pandemic results.

Management expects the first half of 2021 to be the low point in its reported numbers and anticipates noticeable improvement in the second half of the current year.

Equity Residential's president and CEO Mark J. Parrell noted, “we expect demand to accelerate and pricing to continue to improve as vaccines are widely administered and cities become more active.”

Also, in the fourth quarter, the company collected roughly 97% of its expected residential revenues.

For 2020, the company recorded normalized FFO per share of $3.26, topping the Zacks Consensus Estimate of $3.23. However, the figure declined 6.6% year on year. Rental income of $2.57 billion slipped 4.8% year on year.

Quarter in Detail

Residential same-store revenues (includes 76,535 apartment units) were down 8.2% year over year to $580.3 million, while expenses flared up 2.8% to $192.9 million. As a result, same-store net operating income (NOI) declined 12.9% to $387.4 million, year on year.

Average rental rate decreased 6.4% year on year to $2,685 during the December-end quarter, while physical occupancy contracted 190 basis points to 94.2% for the same-store portfolio.

Balance Sheet

Equity Residential exited 2020 with cash and cash equivalents of $42.6 million, down from the $45.8 million recorded at the end of 2019. Notably, with the proceeds from property sale, along with cash on hand and borrowings under its commercial paper program, the company efficiently addressed its obligations on the $750-million 4.625% unsecured notes that are due in December 2021.

Portfolio Activity

During the reported quarter, Equity Residential sold a 679-unit apartment property in downtown San Diego for $312.5 million at a disposition yield of 4.1%, resulting in an unlevered IRR of 8.8%. However, it did not acquire any assets during the quarter.

Outlook

For full-year 2021, management projects normalized FFO per share of $2.60-$2.80. This is below the Zacks Consensus Estimate of $3.04.

The company’s full-year outlook incorporates same-store revenue decline of 7-9%, expense rise of 3-4% and NOI contraction of 12-15%. Physical occupancy is expected to be 94.8-95.8%. Moreover, the company expects consolidated rental acquisitions to approximately equal consolidated rental dispositions.

For first-quarter 2021, the company projects normalized FFO per share at 65-69 cents. The Zacks Consensus Estimate for the same is currently pinned at 72 cents.

In Conclusion

Equity Residential’s impressive performance in the fourth quarter is encouraging. The company noted that there has been a 0.9% improvement in same-store physical occupancy since third quarter-end, with occupancy level moving to 95.1% on Jan 31, 2021 from 94.2% on Sep 30, 2020.

Also, the REIT noted that while pricing trends stabilized in November 2020, there was modest improvement in December 2020 and January 2021 for the first time since the onset of the pandemic.

Particularly, in the urban core portfolio (representing 23% of same store residential revenues), physical occupancy improved to 91.8% as of Jan 31, 2021 from 90.2% on Dec 31, 2020 and 89.2% on Sep 30. Blended rate was down 25.0% in January compared with the decline of 26.6% in December and down 25.0% in the fourth quarter.

Equity Residential currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

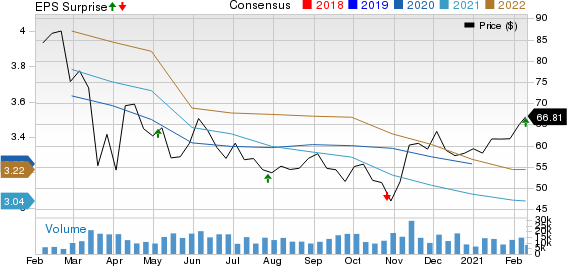

Equity Residential Price, Consensus and EPS Surprise

Equity Residential price-consensus-eps-surprise-chart | Equity Residential Quote

Performance of Other Residential REITs

AvalonBay Communities, Inc.’s AVB core FFO per share of $2.02 missed the Zacks Consensus Estimate of $2.09 for the October-December quarter. The reported figure also declined 16.9% year over year from the prior-year quarter’s $2.43. Results underlined decline in residential rental revenues on lease rates and concessions as well as uncollectible lease revenues.

Mid-America Apartment Communities, Inc. MAA, commonly referred to as MAA, reported fourth-quarter 2020 core FFO per share of $1.65, surpassing the Zacks Consensus Estimate of $1.64. Nonetheless, the reported figure marginally declined from the year-ago figure of $1.66. The residential REIT’s quarterly results were driven by an increase in average effective rent per unit for the same-store portfolio. Positive rent growth also aided same-store portfolio revenue growth during the period.

Essex Property Trust Inc. ESS reported fourth-quarter 2020 core FFO per share of $3.02, missing the Zacks Consensus Estimate of $3.12. The figure also fell 12.5% from the year-ago quarter’s $3.45. Results reflected the adverse impact of the pandemic on the company’s business. Concessions and delinquencies affected same-property revenues during the quarter.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MidAmerica Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance