Ericsson's (ERIC) Q3 Earnings Match Estimates, Revenues Fall

Ericsson ERIC reported mixed third-quarter 2023 results, wherein the bottom line matched the Zacks Consensus Estimate but the top line missed the same. The company reported a revenue slowdown year over year, owing to sluggish demand trends in North America. However, market share gains in India, South East Asia and the Middle East, driven by rising 5G investments, cushioned the top line.

Net Income

Ericsson registered a net loss of SEK 30.5 billion ($2.8 billion) or a loss of SEK 9.21 (85 cents) per share in the third quarter of 2023 against an income of SEK 5.4 billion or SEK 1.56 per share in the year-ago quarter. A decline in net sales and non-cash impairment charges of SEK 31.9 billion impacted the bottom line during the quarter. Adjusted earnings per share came in at 7 cents, in line with the Zacks Consensus Estimate.

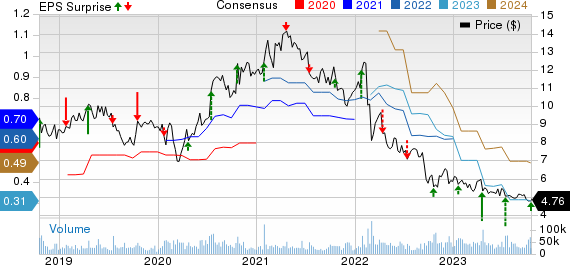

Ericsson Price, Consensus and EPS Surprise

Ericsson price-consensus-eps-surprise-chart | Ericsson Quote

Revenues

Revenues declined to SEK 64.5 billion ($5.96 billion), down 5% year over year. Net sales, adjusted for comparable units and currency, decreased 10% year over year. Despite declining sales in the Networks vertical, positive momentum in Enterprise, Cloud Software and Services verticals partially cushioned the top line. The top line missed the Zacks Consensus Estimate of $6.23 billion.

Segment Results

Networks sales were SEK 41.5 billion ($3.83 billion), down 14% from the year-ago quarter’s figure of SEK 48.1 billion. The top line missed our revenue estimate of SEK 45.8 billion. The segment’s gross margin declined to 38.9% from 44.4% in the year-ago quarter. The decline was primarily induced by a 60% sales drop in North America due to a slow rollout pace and inventory corrections. However, significant sales growth in South East Asia, Oceania and India partially reversed this declining trend.

Cloud Software and Services generated SEK 15.6 billion ($1.44 billion) in revenues, up 10% year over year, driven by growth in several market areas. The top line surpassed our revenue estimate of SEK 15 billion. Gross margin improved to 35.3% from 31.8% in the prior-year quarter. The increase was primarily driven by higher net sales and improved delivery performance.

Enterprise sales aggregated SEK 6.7 billion ($619 million), up from the year-ago quarter’s level of SEK 5 billion. Net sales beat our revenue estimate of SEK 5.7 billion. The 34% year-over-year growth was driven by healthy traction in Global Communications Platform and Enterprise Wireless Solutions. Gross margin, excluding restructuring charges, was 48.8%, flat with the year-ago quarter’s figure.

Other revenues remained relatively flat at SEK 0.7 billion ($64 million) compared with the prior-year quarter’s figure.

Region-wise, South-East Asia, Oceania and India registered revenues of SEK 13.8 billion ($1.3 billion), up 74% year over year. 5G market share gains in India drove the top line. Revenues from Europe and Latin America improved 1% year over year to SEK 15.5 billion ($1.43 billion). Net sales from North America decreased 49% year over year to SEK 13.5 billion ($1.24 billion) as a result of inventory adjustments and a reduced rollout pace.

North East Asian markets witnessed a 4% year-over-year decline after a period of high 5G investment in 2022 to SEK 5.4 billion ($499 million). Backed by growing 5G investments in the Middle East, net sales from the Middle East and African market increased to SEK 6.5 billion ($601 million), up 14% year over year. Revenues from other regions rose to SEK 9.9 billion ($915 million) from SEK 7 billion in the prior-year quarter, driven by growth in IPR licensing revenues and Enterprise Wireless solutions.

Other Details

Gross income, excluding restructuring charges, declined to SEK 25.3 billion ($2.33 billion) from the year-ago figure of SEK 28.2 billion due to lower gross margin in the Networks segment. However, the declining trend was partially compensated by higher IPR revenues. Gross margin, excluding restructuring charges, declined to 39.2% from 41.4% in the prior-year quarter.

Cash Flow and Liquidity

Ericsson generated SEK 1.4 billion ($129 million) cash from operating activities during the quarter. As of Sep 30, 2023, the company had net cash of SEK 1.6 billion ($146 million) compared with the previous year’s figure of SEK 13.4 billion.

Outlook

For the fourth quarter, management expects net sales in the Networks segment to be plagued by market uncertainty. Revenues from Cloud Software and Services are also estimated to follow less than normal seasonal patterns.

Ericsson expects gross margin to be in the range of 39-41% for the Networks segment. The company estimates operating expenses to align with seasonal trends of the past three years. The EBITA margin is approximated at 10%.

EBITA for Cloud Software and Services is anticipated to reach breakeven in 2023. For the full year, the company estimates restructuring costs of around SEK 7 billion. These restructuring charges are likely to normalize at about 0.5% of sales in 2024.

Management anticipates that uncertainty in the Mobile Networks businesses will persist in 2024. However, proactive cost optimization, improving operational efficiency and delivering more value to shareholders remain its priorities.

Zacks Rank & Stocks to Consider

Ericsson currently carries a Zacks Rank #4 (Sell).

Here are some better-ranked stocks that investors may consider.

Ubiquiti Inc. UI, carrying a Zacks Rank #2 (Buy), is a key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, presently carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Note: SEK 1 = $0.0924748 (period average from Jul 1, 2023 to Sep 30, 2023)

SEK 1 = $0.0914599 (as of Sep 30, 2023)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ericsson (ERIC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance