The Escape Hunt (LON:ESC) Share Price Is Up 403% And Shareholders Are Delighted

It's been a soft week for Escape Hunt plc (LON:ESC) shares, which are down 20%. But that isn't a problem when you consider how the share price has soared over the last year. Indeed, the share price is up a whopping 403% in that time. Arguably, the recent fall is to be expected after such a strong rise. While winners often keep winning, it can pay to be cautious after a strong rise.

View our latest analysis for Escape Hunt

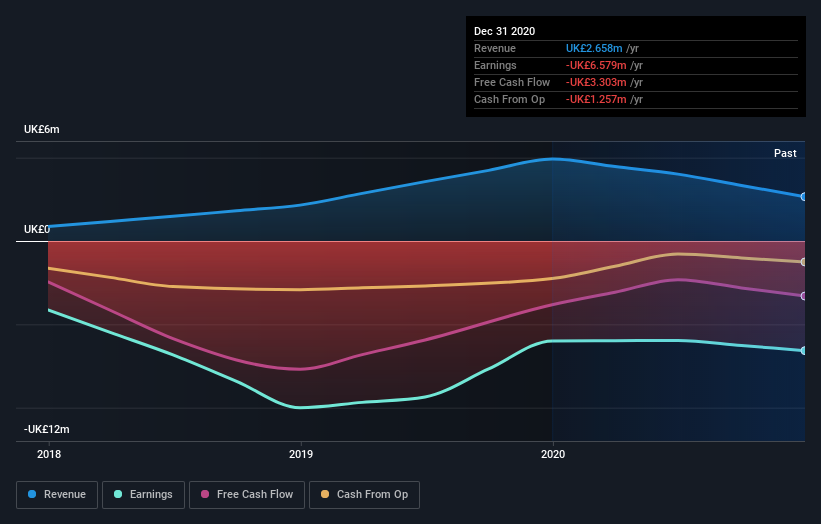

Because Escape Hunt made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Escape Hunt saw its revenue shrink by 46%. So it's very confusing to see that the share price gained a whopping 403%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Escape Hunt's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Escape Hunt rewarded shareholders with a total shareholder return of 403% over the last year. That certainly beats the loss of about 19% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Escape Hunt is showing 6 warning signs in our investment analysis , and 3 of those are potentially serious...

But note: Escape Hunt may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance