Esperion (ESPR) Plummets 54% Over Milestone Payment Row

The share price of Esperion Therapeutics ESPR lost 54.3% on Mar 16 after management reported a disagreement with one of its partners over certain milestone payments.

Last year,Esperion announced that it completed the cardiovascular outcomes study (CVOT) study — CLEAR — on Nexletol (bempedoic acid), evaluating its impact on the occurrence of major cardiovascular (CV) events in statin-intolerant patients with or at high risk for CV disease. The study achieved its primary endpoint of a statistically significant reduction in the risk of major adverse cardiovascular events (MACE-4) in patients who received the drug compared to those who received a placebo.

Detailed data from the study, which was announced earlier this month, showed that Nexletol significantly reduced the risk of MACE-4 and MACE-3 by 13% and 15%, respectively, compared to placebo. It also reduced the risk of heart attack and coronary revascularization by 23% and 19%, respectively, as compared with placebo.

Based on the above data, ESPR plans to submit regulatory filings in the United States and Europe in first-half 2023 for label expansion of Nexletol in CV risk reduction indication. If the drug were to be approved for this indication in Europe, Esperion would be eligible to receive a milestone payment of up to $300 million from partner Daiichi Sankyo Europe (DSE), which is based on the magnitude of risk reduction in CV. It is also eligible to receive milestone payments of up to $140 million upon achievement of other regulatory milestones, including the U.S. label expansion of the drug.

In an SEC filing on Mar 15, Esperion revealed that it communicated the above results to DSE for potential milestone payments. However, DSE conveyed disagreements with the company’s assessment that the CLEAR study would support milestone payments. Per DSE, the CLEAR study showed a 12.98% reduction in the primary endpoint, i.e., MACE-4. For the milestone payment to be triggered, the drug should have triggered at least a 15% reduction in MACE-4.

Esperion, however, strongly disagrees with DSE in this regard. Management states that based on the agreement signed with DSE, the milestone payment is triggered upon CV risk reduction and not the primary endpoint. Data from the CLEAR study has demonstrated a significant reduction of fatal and non-fatal myocardial infarction by 23%. Esperion has stated that it intends to enforce its contractual rights and seek this milestone payment from DSE. However, due to the difference of opinion between the two companies, it expects a delay in receipt of the milestone payment.

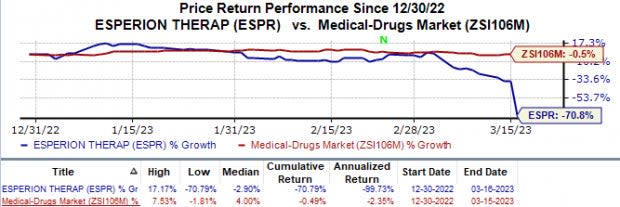

In the year so far, Esperion’s stock has plunged 70.8% compared with the industry’s 0.5% fall.

Image Source: Zacks Investment Research

ESPR has granted exclusive commercial rights to DSE for marketing Nexletol in Europe since 2019. Nexletol is being marketed as Nilemdo in Europe. Esperion is still responsible for clinical development and manufacturing activities of Nexletol in Europe.

Esperion has two approved drugs — Nexletol (bempedoic acid [180mg] and Nexlizet (bempedoic acid [180mg]/ ezetimibe [10mg] combination pill) — in its portfolio, which were approved in 2020 in the United States. These drugs are currently approved as an adjunct to diet and maximally tolerated statin therapy for treating adults with heterozygous familial hypercholesterolemia (HeFH) or established atherosclerotic cardiovascular disease (ASCVD), who require additional lowering of LDL-C in the United States. The drugs were approved in Europe for a similar indication in April 2020. In Europe, Nexletol is available as Nilemdo and Nexlizet is marketed as Nustendi.

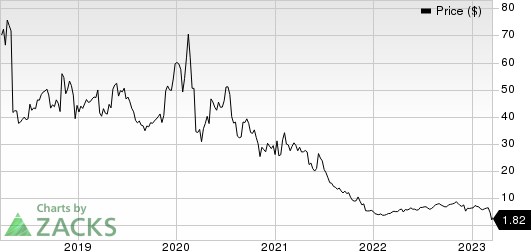

Esperion Therapeutics, Inc. Price

Esperion Therapeutics, Inc. price | Esperion Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Esperion currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Adaptive Biotechnologies Corporation ADPT, Atara Biotherapeutics ATRA and AVITA Medical RCEL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Adaptive Biotechnologies’ 2023 loss per share have narrowed from $1.30 to $1.15 in the past 30 days. During the same period, the loss per share estimates for 2024 narrowed from 99 cents to 94 cents. Shares of Adaptive Biotechnologies have risen 7.6% year-to-date.

Earnings of Adaptive Biotechnologies beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 10.75%. In the last reported quarter, ADPT delivered an earnings surprise of 24.32%.

In the past 30 days, estimates for Atara Biotherapeutics’ 2023 loss per share have narrowed from $2.28 to $2.17. During the same period, the loss per share estimates for 2024 narrowed from $1.81 to $1.62. Shares of Atara Biotherapeutics have risen 10.5% in the year-to-date period.

Earnings of Atara Biotherapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 13.50%, on average. In the last reported quarter, Atara Biotherapeutics’ earnings missed estimates by 18.03%.

In the past 30 days, estimates for AVITA Medical’s 2023 loss per share have narrowed from $1.26 to 99 cents. During the same period, the loss per share estimates for 2024 narrowed from 92 cents to 79 cents. In the year so far, shares of AVITA Medical have declined 15.0%.

Earnings of AVITA Medical beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 22.16%, on average. In the last reported quarter, AVITA Medical’s earnings beat estimates by 34.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Esperion Therapeutics, Inc. (ESPR) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

Avita Medical Inc. (RCEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance