Essential Utilities (WTRG) Q4 Earnings Lag Estimates, Sales Up

Essential Utilities Inc. WTRG reported fourth-quarter 2022 operating earnings per share (EPS) of 44 cents, lagging the Zacks Consensus Estimate of 45 cents by 2.2%. The bottom line is in line with the year-ago quarter’s earnings.

Earnings in the fourth quarter were driven by rates and surcharges, increased regulated natural gas segment volume, and increased regulated water segment volume, as well as customer growth, which were offset by increased expenses and other items.

In 2022, earnings per share were $1.77, up 6% from the last year's earnings of $1.67 per share. Earnings per share were near the mid-point of the guidance of $1.75-$1.80 per share.

Total Revenues

Fourth-quarter operating revenues of $705.4 million surpassed the Zacks Consensus Estimate of $556 million by 26.9%. Total revenues improved 31.7% year over year.

In 2022, revenues were $2.28 billion, up 21.3% year over year from $1.87 billion.

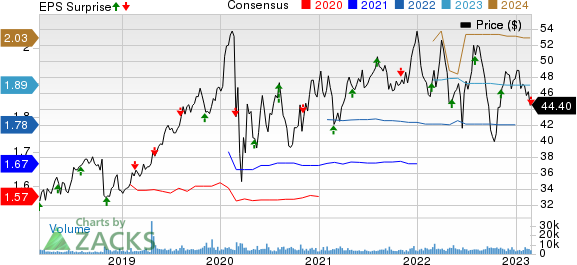

Essential Utilities Inc. Price, Consensus and EPS Surprise

Essential Utilities Inc. price-consensus-eps-surprise-chart | Essential Utilities Inc. Quote

Highlights of the Release

Essential Utilities continues to expand operations through acquisitions. In 2022, Essential Utilities acquired three water and wastewater systems, which expanded its customer base by 23,000.

Currently, Essential Utilities signed eight purchase agreements to acquire nine additional water and wastewater systems that are expected to serve 219,000 retail customers or equivalent dwelling units for $380 million.

In 2022, Essential Utilities’ regulated water segment received rate awards or infrastructure surcharges in Illinois, North Carolina, Ohio and Pennsylvania totaling $83.3 million, and the regulated natural gas segment received a rate award of $5.5 million in Kentucky.

Operation and maintenance expenses for the fourth quarter were $184.7 million, up 16.4% from the year-ago figure of $158.6 million.

Operating income was $169.9 million, up 21.7% year over year.

Interest expenses increased 30.1% to $68.7 million from $52.8 million in the year-ago quarter.

Financial Highlights

Current assets were $658.2 million as of Dec 31, 2022, compared with $437.8 million as of Dec 31, 2021. Long-term debt was $6,371.1 million as of Dec 31, 2022, higher than $5,779.5 million as of Dec 31, 2021.

Essential Utilities invested $1.06 billion in 2022 to replace and expand the water and wastewater utility infrastructure, as well as upgrade the natural gas utility infrastructure.

Guidance

Essential Utilities expects its 2023 earnings at $1.85-$1.90 per share. The mid-point of the guidance range is a tad lower than the Zacks Consensus Estimate of $1.89 per share.

Essential Utilities expects its customer base in the water segment to expand 2-3% due to acquisitions and organic customer growth.

Essential Utilities also plans to invest $1.1 billion in 2023 and $3.3 billion through 2025 to improve the water and natural gas systems and better serve customers through the use of improved information technology.

Essential Utilities expects a compound annual growth rate of 6 to 7% through 2025 and 8 to 10% through 2025 for its regulated water and regulated natural gas segments, respectively.

Zacks Rank

Currently, Essential Utilities carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

American Water Works Company AWK posted fourth-quarter 2022 operating earnings per share (EPS) of 81 cents, which surpassed the Zacks Consensus Estimate of 76 cents by 6.6%.

Long-term (three- to five-year) earnings growth of American Water Works is pegged at 8%. The Zacks Consensus Estimate for AWK’s 2022 earnings per share of $4.77 suggests year-over-year growth of 5.8%.

Primo Water Corporation PRMW reported fourth-quarter 2022 operating earnings per share of 16 cents, which lagged the Zacks Consensus Estimate of 17 cents by 5.9%.

The Zacks Consensus Estimate for PRMW’s 2023 earnings per share of 82 cents suggests year-over-year growth of 22.4%. PRMW’s current dividend yield is 1.83%.

Middlesex Water Company MSEX recorded fourth-quarter 2022 operating earnings per share of 40 cents, which lagged the Zacks Consensus Estimate of 49 cents by 18.4%.

Middlesex Water Company’s current dividend yield is 1.5%. The Zacks Consensus Estimate for MSEX’s 2023 earnings per share of $2.38 indicates a year-over-year decline of 0.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

Middlesex Water Company (MSEX) : Free Stock Analysis Report

Primo Water Corporation (PRMW) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance