Estee Lauder (EL) Ups FY24 Profit View on Q3 Earnings Beat

The Estee Lauder Companies Inc. EL reported third-quarter fiscal 2024 results, with the top and the bottom line increasing year over year. Quarterly net sales and earnings surpassed the Zacks Consensus Estimate. Asia travel retail experienced a return to organic sales growth, as developed and emerging markets across Asia/Pacific, Europe, the Middle East & Africa (EMEA) and Latin America further contributed to the positive performance.

Considering macroeconomic challenges — including softness in overall prestige beauty in mainland China and geopolitical volatility in certain regions — management is lowering its organic net sales outlook for the fiscal 2024. The company is increasing and tightening its adjusted earnings per share (EPS) outlook for the year.

Quarter in Detail

The company posted adjusted earnings of 97 cents per share, surpassing the Zacks Consensus Estimate of 48 cents. The bottom line increased significantly from earnings of 47 cents reported in the year-ago quarter. Adjusted EPS came in at $1.02 cents at constant currency or cc.

The Estee Lauder Companies Inc. Price, Consensus and EPS Surprise

The Estee Lauder Companies Inc. price-consensus-eps-surprise-chart | The Estee Lauder Companies Inc. Quote

Net sales of $3,940 million surpassed the Zacks Consensus Estimate of $3,924.8 million. However, the metric increased 5% from $3,751 million reported in the year-ago quarter.

Organic net sales increased 6%, mainly driven by double-digit growth in EMEA, stemming from improved sales in Asia travel retail. The increase in Asia travel retail can be attributed to higher shipments, courtesy of better retail sales trends and retailer inventory levels among other reasons. The growth in organic net sales also shows strength in developed and emerging markets across Asia/Pacific, The Americas and EMEA. The company experienced net sales growth across nearly all product categories, with skincare emerging as the standout leader.

The gross profit came in at $2,833 million, up 9% year over year. Gross margin came in at 71.9%, up from 69.1% reported in the year-ago quarter.

The operating income came in at $531 million, up 79% from $297 million reported in the year-ago period. Operating income margin expanded to 13.5% from 7.9% reported in the year-ago quarter.

Product-Based Segment Results

Skin Care’s sales were up 8% year over year to $2,060 million. Makeup revenues grew 3% year over year to $1,136 million. In the Fragrance category, revenues of $575 million were in line with the year-ago quarter’s figure. Hair Care sales totaled $143 million, down 3% year over year.

Regional Results

Sales in the Americas increased 3% year over year at $1,117 million. Revenues in the EMEA region grew 12% to $1,647 million. In the Asia-Pacific region, sales inched down 1% to $1,176 million.

Other Updates

The Zacks Rank #3 (Hold) exited the quarter with cash and cash equivalents of $3,701 million, long-term debt of $7,265 million and total equity of $5,744 million.

The net cash flow provided by operating activities for nine months ended Mar 31, 2024, was $1,471 million. Capital expenditures during this time amounted to $702 million. The company returned $710 million to shareholders through dividend payouts.

In a separate press release, the company declared a quarterly dividend of 66 cents per share on Class A and Class B shares. The dividend will be paid out on Jun 17, 2024, to shareholders of record as of May 31.

Image Source: Zacks Investment Research

Fiscal 2024 Outlook

For fiscal 2024, management now projects a net sales decline of 2-3%. The company had earlier expected the metric in the range of a 1% decline and a 1% increase. Organic net sales are anticipated to decline 1-2%. Organic net sales were earlier anticipated in the range of a 1% decline and a 1% increase in the fiscal 2024.

Adjusted EPS are expected in the band of $2.14-$2.24, suggesting growth from $3.46 reported in the fiscal 2023. Adjusted EPS were earlier expected in the band of $2.08-$2.23. Adjusted EPS are projected to decline 33-36% at cc compared with a decline of 34-38% projected earlier. The company’s guidance assumes an annual effective tax rate of nearly 35%.

Q4 Guidance

For the fourth quarter of fiscal 2024, The Estee Lauder Companies anticipates reported net sales to grow 5-9% year over year. Organic net sales are likely to increase 6-10% in the quarter. Reported EPS is projected to be between 11 and 22 cents. Adjusted EPS, on a cc basis, are expected to increase more than 100% to 19-29 cents at cc.

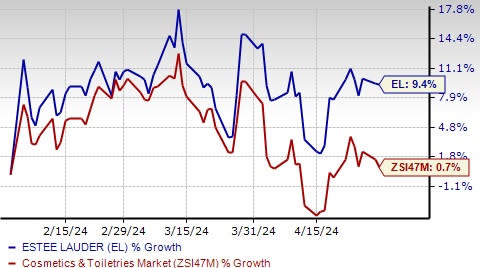

The stock has gained 9.4% in the past three months compared with the industry’s growth of 0.7%.

3 Top Staple Picks

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2 (Buy). VITL has a trailing four-quarter average earnings surprise of 155.4%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 19.5% and 30.5%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 19.3% from the year-ago reported numbers.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 41.6% each from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance