EUR/USD Daily Forecast – Euro Snaps 4-day Winning Streak

EUR/USD Loses Steam on Delay of Brexit Vote

EUR/USD has had an impressive gain in October thus far, aided by demand for Sterling as the odds of a no-deal Brexit have declined significantly.

A vote was supposed to take place on Saturday that would decide on the latest Brexit deal which has already been approved by the EU. The vote, however, was delayed in favor of first passing the required regulation for an EU exit. This move was made to eliminate any loopholes that would force the UK to leave without a deal.

The EU (withdrawal agreement) bill published yesterday on the UK government website. But more importantly, it became apparent yesterday that it will likely take more than a week for this bill to pass, if it gets the required votes that is.

With this news signaling that a deal won’t be voted on anytime soon, I think EUR/USD could pare some gains at this stage.

Technical Analysis

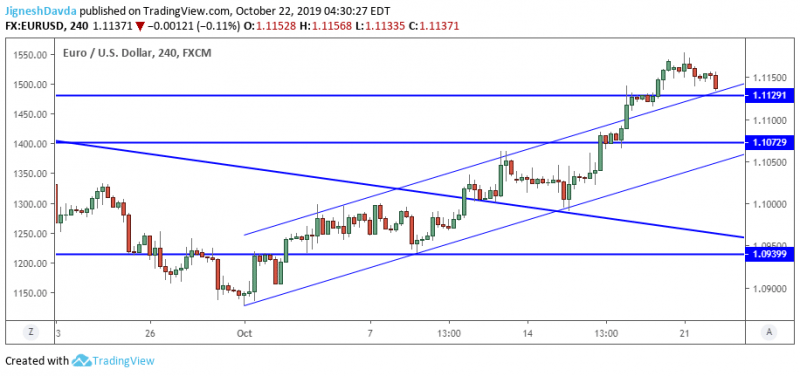

In yesterday’s forecast, I discussed major overhead resistance from a horizontal level at 1.1217. I consider it significant as the level carries confluence with the 200-day moving average.

While the level was not tested, I think there is some potential for EUR/USD to correct lower as the risk of a Brexit deal has tilted the other way.

Essentially, if the proposed withdrawal bill does not pass, it would be negative for the euro and pound. If the bill were to pass, it wouldn’t necessarily be bullish for the two currencies as the actual deal still needs to be voted on.

The first level of support for EUR/USD falls at 1.1129 which is a level that held it higher in April and May. Further, the 100-day moving average has converged toward the level to create a bit of a confluence.

This is a fairly critical area of support. A failure to hold above it could trigger a broader decline.

Bottom Line

EUR/USD is easing lower as the Brexit deal vote will likely take longer than initially expected. The vote could potentially push back to next week even.

The pair currently trades near an important support confluence at 1.1129. I think a bearish break would signal a more meaningful correction.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance