EUR/USD Daily Forecast – Euro Holds Near Important Support Confluence Ahead of ECB

EUR/USD has been consolidating above an important support zone for the week thus far. If the pair breaks lower from here, it would set a bearish tone that could keep pressure on the single currency for weeks to come. But whether it breaks lower or not will ultimately depend on the outcome of today’s ECB meeting.

Several analysts have stated the meeting is not likely to present any material changes. There are, however, a few points of interest that might move the markets.

An adjustment to how policymakers view the inflation target is widely expected. Bloomberg published an article yesterday stating that ECB President Lagarde is considering adjusting the language of the current “below, but close to 2%” inflation goal to something more symmetric. The Federal Reserve did something similar a few years ago.

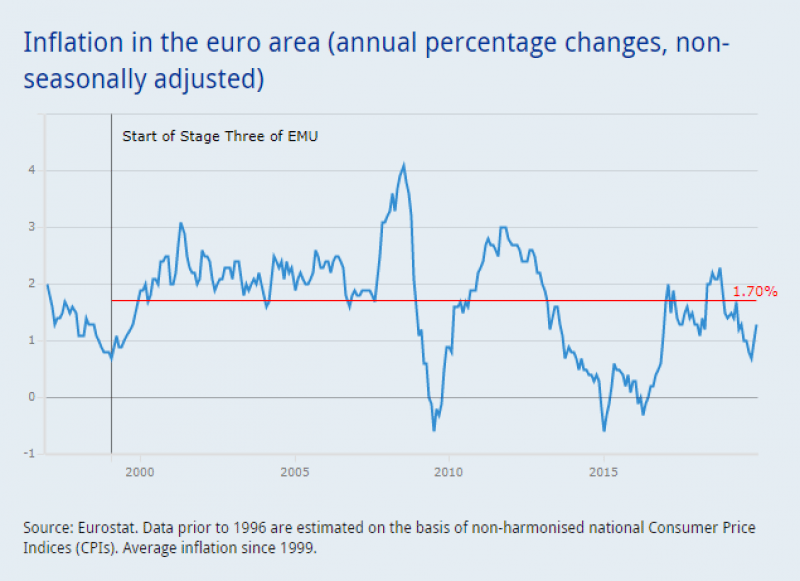

The ECB is far from reaching its inflation target despite unconventional policy measures for nearly six years now. The chart above shows that the euro area ran at 2% inflation one month in 2017 and then again for a brief period in 20108 before dropping off sharply toward the end of the year. There has been a rebound in the fourth quarter of last year although the latest reading of 1.3% is still a fair distance away from the bank’s target.

Lagarde’s response could go either way, whether she dwells on inflation persistently running below targets, or shows optimism towards the rebound. Aside from inflation, the unemployment rate has held steady at 7.5% and the last retail sales report was the strongest over the last five readings. Services and manufacturing PMI figures are showing signs of stabilization although it may be too early to tell if a bottom is in.

Technical Analysis

A major support confluence presents itself in EUR/USD. It consists of a horizontal level at 1.1072, the 100-day moving average, and a rising trendline from the October low.

The first target on a break of support comes in at 1.1025. But there’s potential for a lot more downside if the support confluence is breached.

While the pair holds above 1.1072, a rebound might carry the pair to 1.1129. This marks a horizontal level with further resistance from the 200 and 20-day moving averages slightly above it.

Bottom Line

Investors await the ECB meeting and EUR/USD is left trading in a narrow range above important support.

A break lower from support sets a bearish tone which stands to keep the pair under pressure in the weeks to come

First resistance on a rebound falls in a range between 1.1129 and 1.1135.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance