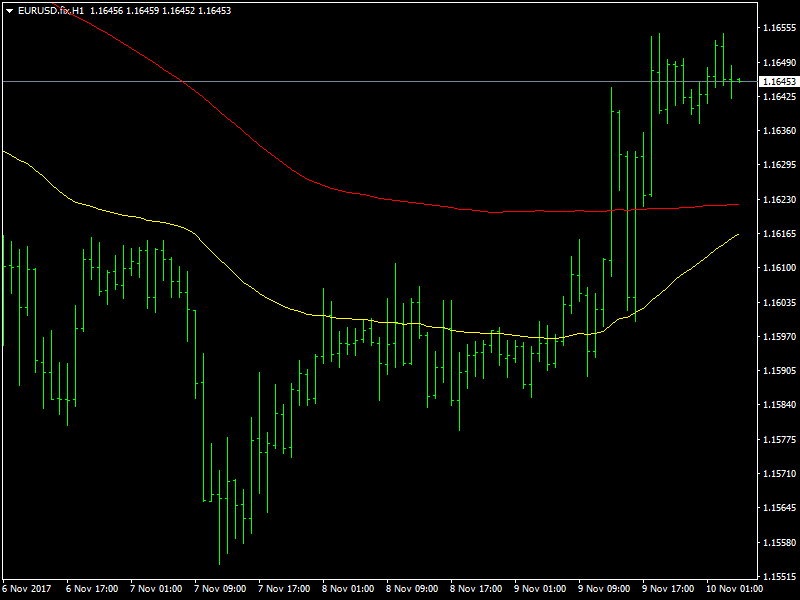

EUR/USD Daily Fundamental Forecast – November 10, 2017

The EURUSD pair finally managed to find some traction and gain some volatility for the first time this week as the dollar fell all across the board yesterday. We have had very little volatility in the pair through the course of the week as the steadiness in the dollar and the lack of any economic news to push the market in a specific direction had led to a kind of stalemate in the euro which led to drying up of the volatility in the markets.

EURUSD Moves Higher on Dollar Weakness

The only event that has been underlying in the markets ever since the beginning of the week has been the tax reform bill which Trump and his team have been trying to implement. Though there has been good support for the bill, the implementation was the key as there were reports that the corporate tax cut plan, which is part of the reform bill, would be delayed by a year. This report turned out to be true as the plan was revealed and it indeed turned out that the corporate tax cut would be delayed by a year.

This is viewed as a setback to the corporates who were expecting to benefit from the tax cut this year itself. It was also seen as a setback for Trump and his team who were trying to push through the plan desperately hard especially after having failed to push through with the healthcare reform bill. This weakened the dollar all across the board and helped the EURUSD to push through the 1.16 region and it trades just below the 1.1650 region as of this writing and looks slightly bullish once again.

Looking ahead to the rest of the day, we do not have any major news from the Eurozone or the US with it being a bank holiday in the US today. So, expect some dryness in the liquidity for today leading to consolidation and ranging on either side of 1.1650 for the day.

This article was originally posted on FX Empire

More From FXEMPIRE:

NZD/USD Price Forecast November 10, 2017, Technical Analysis

FTSE 100 Price Forecast November 10, 2017, Technical Analysis

GBP/JPY Price Forecast November 10, 2017, Technical Analysis

DAX Index Price Forecast November 10, 2017, Technical Analysis

Dow Jones 30 and NASDAQ 100 Price Forecast November 10, 2017, Technical Analysis

Yahoo Finance

Yahoo Finance