EUR/USD Daily Fundamental Forecast – January 19, 2018

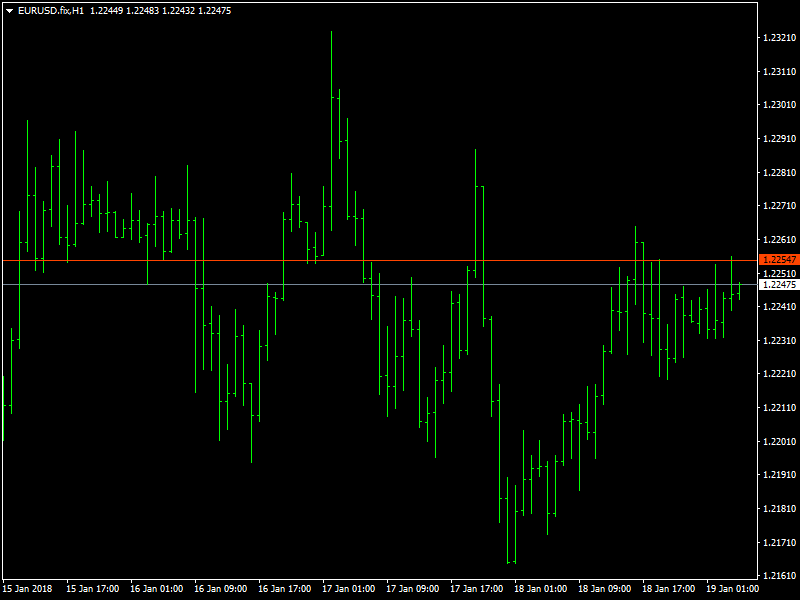

The EURUSD pair continues to chop around and this has been the case since the beginning of the week. After rising continuously over the last few weeks, the same kind of trend was expected this week as well but since the start, we have seen the pair caught in a tight range between the 1.22 and 1.23 regions. Though it did briefly threaten to break through the 1.22 region during the week, that move was only short lived and the pair is back in the mid 1.22s as of this writing.

EURUSD Continues to be Choppy

It does matter that this week has been the start of the second half of the month when the economic data from the different parts of the world begin to dry up. So far this week, there has not been any major news from the Eurozone and the US and this has also contributed due to the mixed trading that we have been seeing. The only focus has been the need to avert a shutdown in the US but that has become quite commonplace nowadays in the US that the markets do not treat it seriously and expect the crisis to be averted one way or the other.

Also, the ECB has not followed through much on its stance of gradual shift in policy and with no updates on that aspect, the euro has been meandering along. The focus has clearly been on the dollar for this week which has managed to hold steady with the expectations of more rate hikes in the following months with the market expecting 3 rate hikes during the course of the year.

Looking ahead to the rest of the day, once again this week, we do not have any major news from the US or the Eurozone for the day and hence we can safely expect a lot of consolidation to happen during the day with the dollar expected to hold steady.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance