EUR/USD Mid-Session Technical Analysis for March 31, 2020

The Euro is trading sharply lower against the U.S. Dollar on Tuesday after a report showed Euro Zone inflation plunged in March on crashing oil prices, signaling a possible deflationary spiral as government lockdowns in response to the coronavirus trigger a dramatic slowdown in economic activity.

Inflation in the 19 countries sharing the Euro fell to 0.7% from 1.2% in February, Eurostat said on Tuesday, undershooting already modest expectations of 0.8%.

At 11:54 GMT, the EUR/USD is trading 1.0956, down 0.0086 or -0.78%.

Daily Technical Analysis

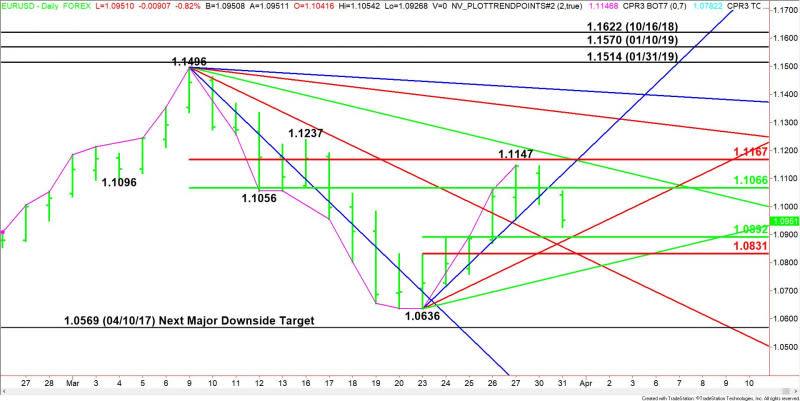

The main trend is down according to the daily swing chart. A trade through 1.1496 will change the main trend to up. A move through 1.0636 will signal a resumption of the downtrend.

The minor trend is also down. A new minor top was formed earlier today at 1.1147. A trade through this level will change the minor trend to up. This will also shift momentum to the upside.

The main range is 1.1496 to 1.0636. Its retracement zone at 1.1066 to 1.1167 is resistance. This zone stopped the rally at 1.1147 on March 27.

The short-term range is 1.0636 to 1.1147. Its retracement zone at 1.0892 to 1.0831 is the next downside target.

Daily Technical Forecast

Based on the early price action and the current price at 1.0956, we’re looking for the selling pressure to drive the EUR/USD into the retracement zone at 1.0892 to 1.0831. A pair of Gann angles are also inside the zone at 1.0876 and 1.0856. These are also valid downside targets.

Trader reaction to the retracement zone will set the tone today. If enough aggressive counter-trend buyers come in then a secondary higher bottom could form. This could create the upside momentum needed to challenge 1.1066 to 1.1167 a second time.

If 1.0831 fails as support then a secondary lower top will form at 1.1147. This could put downside pressure on the EUR/USD, leading to an eventual retest of 1.0636.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance