EUR/USD Mid-Session Technical Analysis for February 25, 2020

The Euro is trading lower against the U.S. Dollar on Tuesday as traders await the release of a U.S. consumer confidence report at 15:00 GMT. The report is expected to come in at 132.6, up slightly from the previously reported 131.6. This report could be a market mover due to the potential impact of the coronavirus on the U.S. economy.

Traders want to see if consumers are concerned that the virus will derail the U.S. economy and perhaps force the Federal Reserve to make a sooner-than-expected interest rate cut.

At 14:29 GMT, the EUR/USD is trading 1.0840, down 0.0010 or -0.11%.

Earlier today, Euro Zone government debt markets stabilized, with Italian bonds on steadier ground after suffering their worst day in over two months as Italy grappled with the worst outbreak of coronavirus in Europe.

Euro Zone money markets attach a more than 50% chance of a 10 bps rate cut by the European Central Bank by July, up from around 35% a week ago.

Daily Technical Analysis

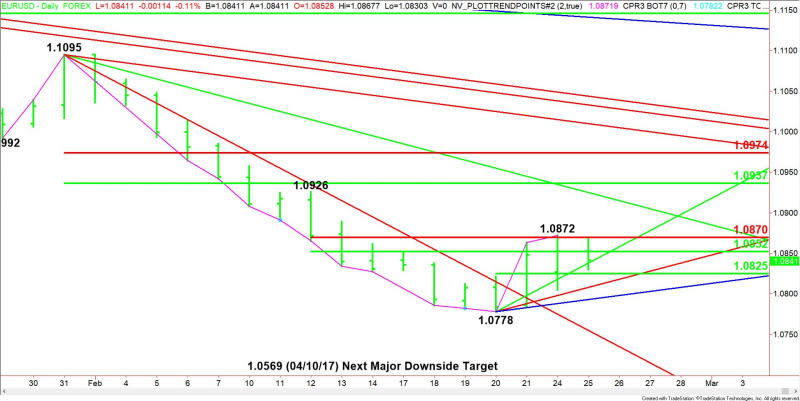

The main trend is down according to the daily swing chart. However, momentum has made a slight shift to the upside due to a change in the minor trend.

A move through 1.0872 will indicate the short-covering rally is strengthening, while a trade through 1.0778 will signal a resumption of both the main and minor down trends.

The short-term range is 1.0778 to 1.0872. Its 50% level at 1.0825 is support.

The intermediate-term range is 1.0926 to 1.0778. Its retracement zone at 1.0852 to 1.0870 is resistance.

The main range is 1.1095 to 1.0778. Its retracement zone at 1.0937 to 1.0974 is a potential upside target.

Daily Technical Forecast

Based on the early price action and the current price at 1.0840, the direction of the EUR/USD the rest of the session on Tuesday will likely be determined by trader reaction to the uptrending Gann angle at 1.0838.

Bullish Scenario

A sustained move over 1.0838 will indicate the presence of buyers. This could drive the EUR/USD into 1.0852, followed by 1.0870 and 1.0872. Overtaking 1.0872 could trigger an acceleration to the upside with potential targets a downtrending Gann angle at 1.0925 and a 50% level at 1.0957.

Bearish Scenario

A sustained move under 1.0838 will signal the presence of sellers. This could lead to a test of 1.0825, followed by a pair of uptrending Gann angles at 1.0808 and 1.0783. The latter is the last potential support angle before the 1.0778 main bottom.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Mid-Session Technical Analysis for February 25, 2020

Gold Price Forecast – Gold Markets Show Resiliency During Chaotic Session

GBP/JPY Price Forecast – British Pound Continues To Fight Japanese Yen

E-mini S&P 500 Index (ES) Futures Technical Analysis – Nearest Value Zone is 3126.25 – 3062.25

Yahoo Finance

Yahoo Finance