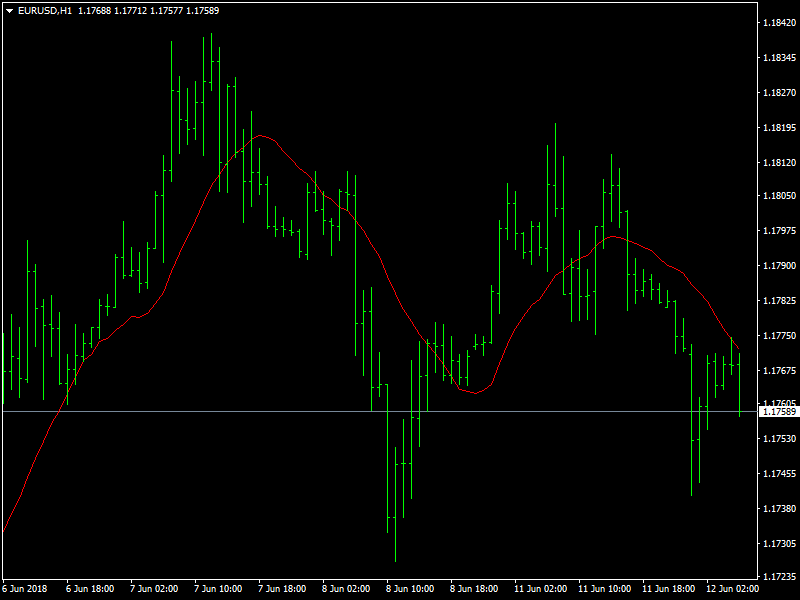

EUR/USD Price Forecast – Good Start in U.S-N.Korean Summit Causes Dollar Value to Spike

The dollar jumped to a 3-week top on Tuesday while stock markets in Asia ticked higher as a landmark U.S.-North Korea summit in Singapore raised hopes the bitter foes might be able to strike a deal to end a nuclear stand-off on the Korean peninsula. This resulted in EURUSD pair seeing slight downward slope during early Asian market hours as the pair teased 1.1740 handle however the pair has regained stability back above 1.176 handle and is trading at 1.1772 as of writing this article. The EUR/USD turned higher from 1.1510 on May 29, but the ensuing rally seems to have run out of steam in the 1.1840 neighborhood. The back-to-back hammer candles as seen in the daily chart also convey a similar message. The bullish exhaustion seems to have revived interest in the EUR puts. Currently, the one month 25 delta risk reversals are being paid at 0.575 EUR puts vs. 0.275 EUR puts on June 7.

EURUSD Lower

The rise in the implied volatility premium from 0.275 to 0.575 could be an indication the corrective rally in EUR/USD has ended and investors are preparing (buying puts) for a fresh sell-off in the single currency. The fears could come true if the US consumer price index (CPI) for May due today at 12:30 GMT beats estimates of a 0.2 percent month-on-month rise. Moreover, an above-forecast headline and core CPI reading could embolden hawks at the Fed. The USD may also pick up a strong bid if the historic Trump-Kim Summit ends on a positive note.

On the other hand, a combination of a better-than-expected German Zew survey reading and a below-forecast CPI will likely push the EUR/USD above 1.18 handle. The downfall in EURO has been shallow during today’s Asian session as traders seemed reluctant to place any aggressive bets ahead of the FOMC and the ECB monetary policy meetings. Moving forward during today’s trading session investors are looking forward to press meet scheduled at 4PM EDT where more details on US-N.Korean summit are to be released. Earlier in his comment, Trump said that the meet has gone better than most would have expected and he also mentioned that North Korea would soon begin the process of denuclearization. Expected support and resistance for the pair for today’s session are at 1.1731 / 1.1690 / 1.1650 and 1.1800 / 1.1840 / 1.1880 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance