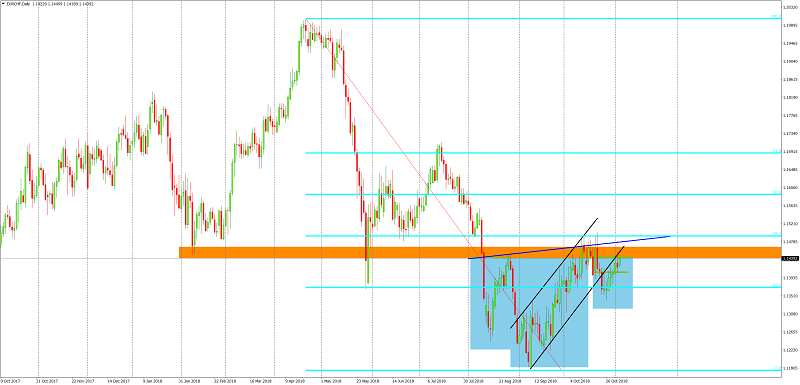

EURCHF, switch towards the buy signal

Generally speaking, October for the EUR was pretty bad. We are not talking here only about the main pair (with the USD) but about the broad market. The fortune may be changing though. The pair, where we can see the ray of light is the EURCHF.

It seems that the pair is getting ready for a major upswing. Till now, we were quite negative about the future of this instrument but the recent price movements are pointing at other direction. Our pessimistic approach was based on the fact, that the price was in a downtrend and bounced from the 38,2% Fibonacci. What is more, EURCHF broke the lower line of the flag pattern. The drop did not last too long though. 7 out of the last 8 days were positive and the price is aiming the 38,2% Fibo again. That allowed the price to create an inverse head and shoulders pattern (blue).

As long as we stay below the Fibo mentioned above, the sentiment is still negative but the breakout of this line will give us a proper buy signal. On the other hand, the price breaking the 23,6% Fibo will cancel the iH&S scenario and will open us away towards new lows.

This article is written by Tomasz Wisniewski, a senior analyst at Alpari Research & Analysis

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance