Euronet (EEFT) Up 11.4% in Past Month: More Growth Ahead?

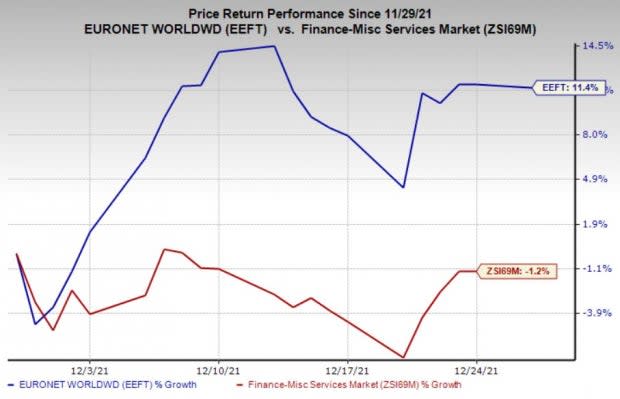

Euronet Worldwide, Inc.’s EEFT shares have jumped 11.4% in the past month against the 1.2% decline of the industry, thanks to greater exposure, faster economy recovery, and strong results of Electronic Funds Transfer and Money Transfer businesses. The company has not only managed to navigate through last year’s coronavirus-induced market volatility but also positioned itself for better returns in the future.

Image Source: Zacks Investment Research

Headquartered in Leawood, KS, Euronet is a leading electronics payments provider. The company offers payment and transaction processing and distribution solutions to financial institutions, retailers, consumers as well as service providers. It has a market cap of $6.3 billion.

Can It Retain Momentum?

The answer is yes and before we get into the details, let us show you how its estimates for 2021 stand. The Zacks Consensus Estimate for 2021 earnings per share currently stands at $3.86, signaling a 36.9% year-over-year increase. EEFT beat earnings estimates in two of the last four quarters and missed twice, with an average surprise of 2.6%. The Zacks Consensus Estimate for 2021 revenues is pegged at $3 billion, indicating a 20.5% year-over-year rise.

Now let’s delve into what’s driving the Zacks Rank #3 (Hold) stock.

Digital transactions of the company have been performing well over the past few months. It took a few initiatives such as expanding its digital media content in Australia that includes Uber, Netflix and Spotify. The company took various measures to boost the geographic extension of its digital presence through EEFT’s mobile application and real-money transfer.com. This year, it launched the app in Lithuania and forged a partnership with Bret Bank in France to pay pensions to French expats. It also unveiled content distribution with Fame Height, a white label platform for game influencers, through digital channels across 14 countries.

Euronet’s top-line improvement has been impressive, witnessing a CAGR of 11.6% during the 2015-2019 period on the back of solid segmental results and its diversity across products and geographies. Although in 2020, EEFT’s revenues declined 9.7% due to lower transactions following the COVID-19 pandemic, the same bounced back 23% year over year in the first nine months of 2021. We are hopeful that the company’s top line will continue delivering strong numbers on the back of solid segmental results, a slew of product and service launches as well as new and exciting geographic options.

The strong inorganic growth strategy is also impressive. Several initiatives such as ATM network participation agreements and the launch of card issuing products poise the company well for growth. Euronet inked a deal with Vietcom bank, one of the largest commercial banks in Vietnam to offer pass-through DCC services. The company also agreed to buy Piraeus Bank's merchant-acquiring business in Greece. Euronet also signed an agreement with the Bank of the Philippine Islands, OTP Bank in Romania, BPI, to take over 300 of their existing ATMs. All these initiatives poise the company well for future expansion.

Risks

Despite the upside potential, there are a few factors that are impeding the stock’s growth lately. Rising expenses weigh on EEFT's margins. It might escalate as the company consistently invests in technology and other expansion initiatives. Over the past nine months of 2021, total operating costs increased 14%. Also, its high leverage can affect financial flexibility. Nevertheless, we believe that a systematic and strategic plan of action will drive long-term growth.

Key Picks in Finance

Some better-ranked players in the Finance space include Alerus Financial Corporation ALRS, MoneyGram International, Inc. MGI and Houlihan Lokey, Inc. HLI. While Alerus Financial and MoneyGram sport a Zacks Rank #1 (Strong Buy), Houlihan Lokey has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Based in Grand Forks, ND, Alerus Financial provides numerous financial services to clients. Its financial strength is reflected by massive total assets of $3.2 billion at third quarter-end, which increased 5.4% for the first nine months of 2021. Rising investment securities will likely keep boosting ALRS’ asset position in the coming quarters.

Alerus Financial’s bottom line for 2021 is expected to jump 11.1% year over year to $2.80 per share. It has witnessed two upward estimate revisions in the past 60 days and no movement in the opposite direction. Alerus Financial beat earnings estimates thrice in the last four quarters and missed once, with an average surprise of 23.6%.

Headquartered in Dallas, TX, MoneyGram’s new business line named MoneyGram as a Service represents a significant growth opportunity in a market estimated to be worth $17 billion in 2024. Via this service, the company is looking to monetize its API-driven infrastructure, which enables instant access to 125 different currencies via its global cash network.

MoneyGram’s 2021 earnings estimates have increased 140% to 24 cents per share in the past 60 days. It has witnessed two upward estimate revisions in the past 60 days compared with none in the opposite direction. MGI beat earnings estimates twice in two of the last four quarters, met once and missed on the other occasion.

Houlihan Lokey — headquartered in Los Angeles, CA — provides multiple financial services to clients all over the world. Its growing footprint in Europe and Asia’s investment banking services field will help HLI boost strategic and shareholder value in the coming days. Rising average transaction fees will help HLI increase corporate finance revenues.

The full-year 2022 bottom line of Houlihan Lokey is expected to rise 37.7% year over year to $6.36 per share. In the past 60 days, it has witnessed three upward estimate revisions and no downward movement. HLI beat earnings estimates in all the last four quarters, with an average of 39.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MoneyGram International Inc. (MGI) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

Alerus Financial (ALRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance