Euronext Paris Growth Leaders With High Insider Stakes May 2024

Amidst a backdrop of fluctuating global markets, France's CAC 40 Index has shown resilience with a notable increase of 3.29%, reflecting broader European market optimism and potential monetary easing on the horizon. This positive momentum sets an intriguing stage for examining growth companies in Euronext Paris, particularly those with high insider ownership, which often signals strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 25.8% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

Adocia (ENXTPA:ADOC) | 12.9% | 104.5% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 30% |

Arcure (ENXTPA:ALCUR) | 21.6% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.6% | 68.8% |

Here's a peek at a few of the choices from the screener.

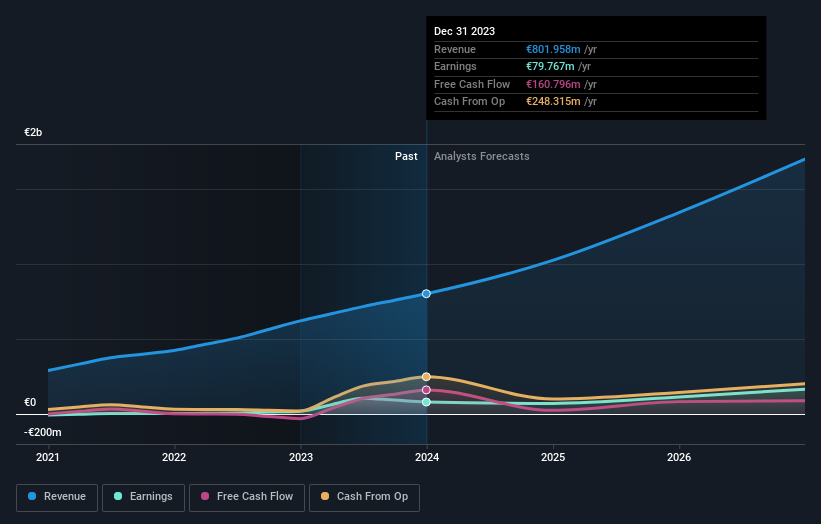

Lectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions targeting the fashion, automotive, and furniture sectors, with a market capitalization of approximately €1.26 billion.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, totaling €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Earnings Growth Forecast: 28.6% p.a.

Lectra SA, a French growth company with substantial insider ownership, is trading 19.6% below its estimated fair value. The company's earnings are projected to increase by 28.6% annually, outpacing the French market's forecast of 10.9%. Despite this strong profit growth outlook, Lectra's return on equity is expected to remain low at 13.3% in three years. Recent financials indicate a slight dip in net income and earnings per share compared to the previous year, alongside stable sales growth.

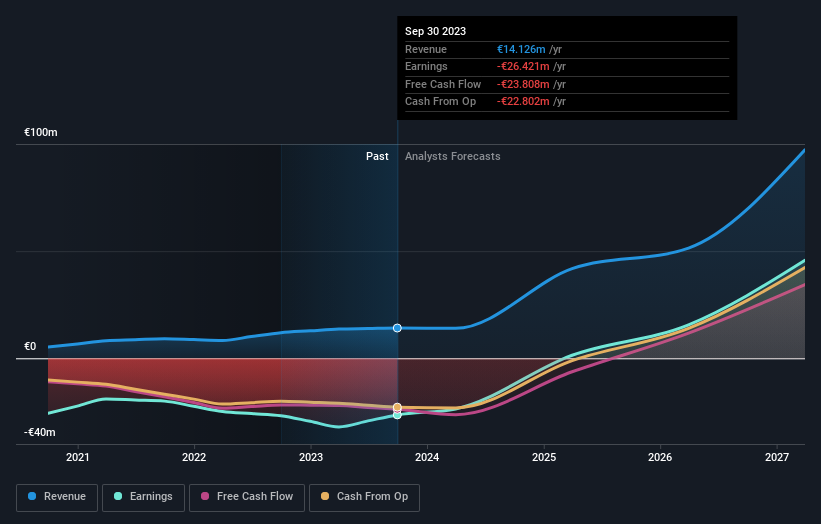

MedinCell

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable treatments across multiple therapeutic areas, with a market capitalization of approximately €428.37 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €14.13 million.

Insider Ownership: 16.6%

Earnings Growth Forecast: 68.8% p.a.

MedinCell, a French biotech firm, is poised for significant growth with expected revenue increases of 40.9% annually, outpacing the broader market's 5.8%. Although it has experienced shareholder dilution in the past year and shows high share price volatility, MedinCell's recent successful Phase 3 trial results for its schizophrenia treatment TEV-‘749 highlight its potential in the pharmaceutical industry. Furthermore, a strategic collaboration with AbbVie could bolster its development capabilities and financial prospects through substantial milestone payments and royalties.

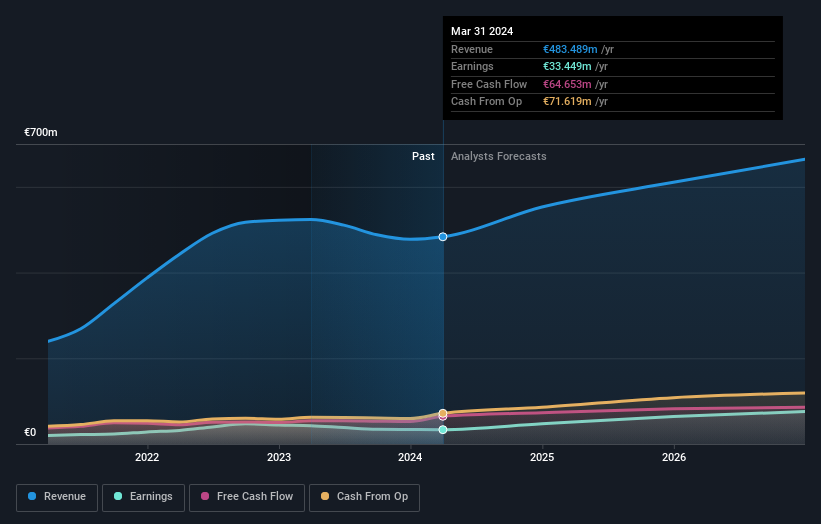

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.50 billion.

Operations: The company generates its revenue by providing digitalization services for commercial sectors across Europe, Asia, and North America.

Insider Ownership: 13.3%

Earnings Growth Forecast: 25.8% p.a.

VusionGroup S.A. has demonstrated robust growth, with earnings increasing significantly over the past year and revenues rising to €801.96 million from €620.86 million previously. Analysts expect both earnings and revenue to outpace the French market significantly in the coming years, forecasting annual growth rates of 25.8% for earnings and 24.3% for revenue. Despite this strong performance, the company's share price has been highly volatile recently, which could concern some investors looking for stability.

Unlock comprehensive insights into our analysis of VusionGroup stock in this growth report.

Upon reviewing our latest valuation report, VusionGroup's share price might be too optimistic.

Summing It All Up

Click this link to deep-dive into the 21 companies within our Fast Growing Euronext Paris Companies With High Insider Ownership screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:LSS ENXTPA:MEDCL and ENXTPA:VU .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance