Euronext Paris Growth Leaders With High Insider Stakes May 2024

As of May 2024, the French market has shown a slight decline with the CAC 40 Index dropping by 0.63%, reflecting a cautious stance from investors amidst mixed signals from European Central Bank policymakers. This backdrop sets an intriguing stage for examining growth companies in France, particularly those with high insider ownership which may offer unique stability and confidence in these uncertain times. In this environment, understanding the characteristics that contribute to a strong growth company—such as solid insider ownership—can be particularly valuable. Insider ownership often aligns leadership interests with shareholder goals, potentially fostering long-term value creation despite broader market volatility.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 26% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.5% | 68.8% |

Let's dive into some prime choices out of from the screener.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers a range of cloud services and hosting solutions globally, with a market capitalization of approximately €1.24 billion.

Operations: The company generates revenue primarily through three segments: Public Cloud (€140.71 million), Private Cloud (€514.59 million), and Web cloud (€179.45 million).

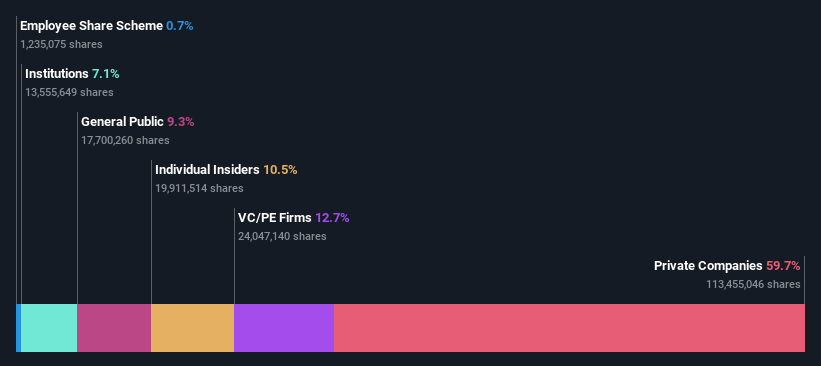

Insider Ownership: 10.5%

OVH Groupe, a French cloud service provider, is navigating through a transformation phase with significant leadership changes and strategic expansions. Recently appointing Benjamin Revcolevschi, who brings robust telecom and IT experience, the company aims to enhance its innovative edge and international presence. Despite a volatile share price and modest forecasted return on equity (3.8%), OVH is expected to turn profitable within three years with revenue growth projected at 11.3% annually, outpacing the French market average.

Solutions 30

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solutions 30 SE offers support solutions for new digital technologies across several European countries including France, Italy, Germany, the Netherlands, Belgium, Luxembourg, Poland, and Spain, with a market capitalization of approximately €231.82 million.

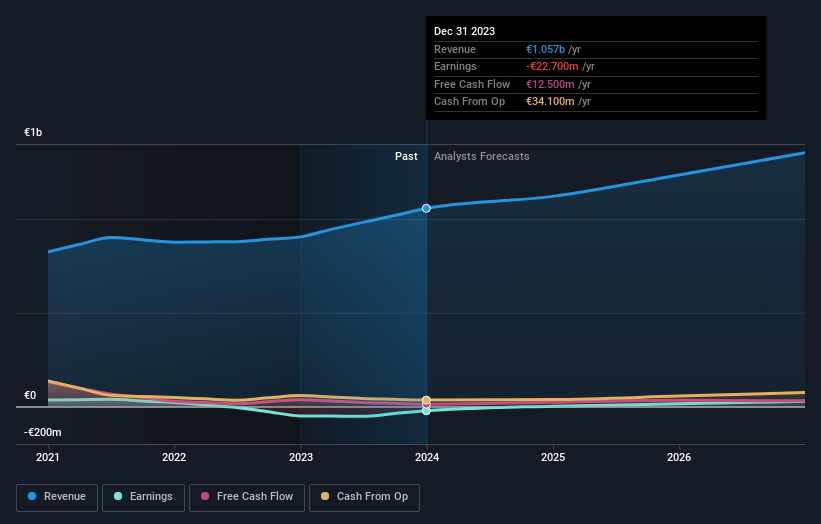

Operations: The company generates €1.06 billion from its computer services segment.

Insider Ownership: 16.2%

Solutions 30 SE, despite a challenging financial year with a net loss reported, is positioned for recovery with reaffirmed revenue growth expectations in key European markets. The company's significant insider ownership aligns interests with shareholders, enhancing trust during its strategic expansions like the substantial contract to upgrade Flanders' electricity network. Analysts predict a notable potential stock price increase and an impressive profit growth forecast as the firm progresses towards profitability within three years.

Click to explore a detailed breakdown of our findings in Solutions 30's earnings growth report.

Our valuation report unveils the possibility Solutions 30's shares may be trading at a discount.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.53 billion.

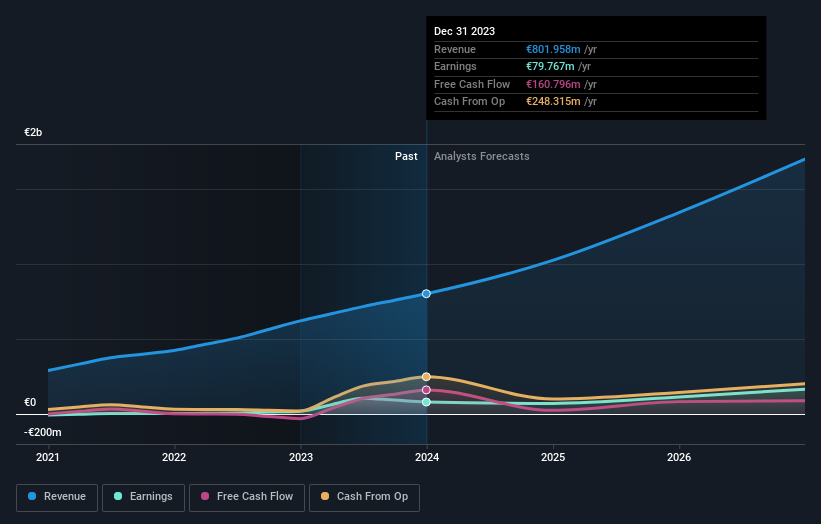

Operations: The company generates revenue by providing digitalization services for the commercial sector across Europe, Asia, and North America.

Insider Ownership: 13.3%

VusionGroup S.A. has demonstrated robust growth, with a significant increase in earnings and revenue over the past year. The company's revenue grew to €801.96 million, up from €620.86 million, while net income surged to €79.77 million from €18.95 million previously. Forecasted annual profit and revenue growth rates are substantially above the French market average, promising continued expansion at an accelerated pace compared to peers despite a highly volatile share price recently.

Click here to discover the nuances of VusionGroup with our detailed analytical future growth report.

Turning Ideas Into Actions

Navigate through the entire inventory of 21 Fast Growing Euronext Paris Companies With High Insider Ownership here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:OVH ENXTPA:S30 and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance