Euronext Paris Stocks Estimated To Be Below Intrinsic Value In July 2024

As the French market navigates through heightened political uncertainty with upcoming elections, investors are closely monitoring shifts in the economic landscape. Amid these conditions, identifying stocks that appear undervalued relative to their intrinsic value could offer interesting opportunities for those looking to invest in Euronext Paris.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Wavestone (ENXTPA:WAVE) | €56.80 | €93.42 | 39.2% |

Lectra (ENXTPA:LSS) | €29.80 | €44.44 | 32.9% |

Thales (ENXTPA:HO) | €156.45 | €263.25 | 40.6% |

Tikehau Capital (ENXTPA:TKO) | €21.90 | €32.48 | 32.6% |

Arcure (ENXTPA:ALCUR) | €6.04 | €7.71 | 21.6% |

Vivendi (ENXTPA:VIV) | €9.998 | €16.04 | 37.7% |

Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.94 | €9.95 | 40.3% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.88 | €6.30 | 38.4% |

Esker (ENXTPA:ALESK) | €183.60 | €261.15 | 29.7% |

Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €12.32 | €15.49 | 20.5% |

Let's dive into some prime choices out of from the screener

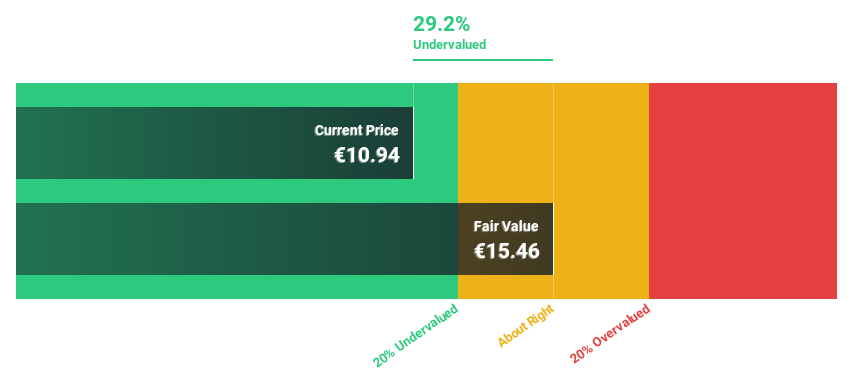

Antin Infrastructure Partners SAS

Overview: Antin Infrastructure Partners SAS is a private equity firm focused on infrastructure investments, with a market capitalization of approximately €2.21 billion.

Operations: The firm generates revenue primarily through its asset management segment, totaling approximately €282.87 million.

Estimated Discount To Fair Value: 20.5%

Antin Infrastructure Partners SAS, priced at €12.32, appears undervalued with a fair value estimated at €15.49, reflecting a 20.5% potential upside. Despite recent dividend increases to €0.71 per share, the payout is not fully supported by earnings or cash flows. The company's revenue growth outpaces the French market at 12.5% annually versus 5.7%, and its earnings are expected to rise significantly by 25.23% per year, although large one-off items have affected financial results.

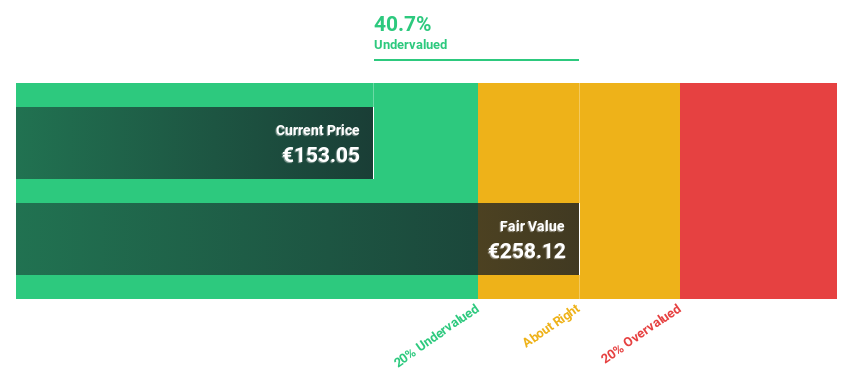

Thales

Overview: Thales S.A. is a global company offering solutions in defense, aerospace, digital identity and security, and transportation sectors with a market capitalization of approximately €32.33 billion.

Operations: Thales generates revenue through its segments in aerospace (€5.34 billion), digital identity and security (€3.42 billion), and defense and security excluding digital identity and security (€10.18 billion).

Estimated Discount To Fair Value: 40.6%

Thales, currently valued at €156.45, is trading significantly below the calculated fair value of €263.25, indicating a potential undervaluation based on cash flows. While its dividend track record may be unstable, Thales is set for robust growth with earnings expected to increase by 16.44% annually and revenue forecasted to grow at 6.3% per year—both rates surpassing general market trends in France. However, high levels of debt and large one-off financial items pose challenges despite these positive forecasts and recent strategic alliances enhancing its market position in cybersecurity and air traffic management.

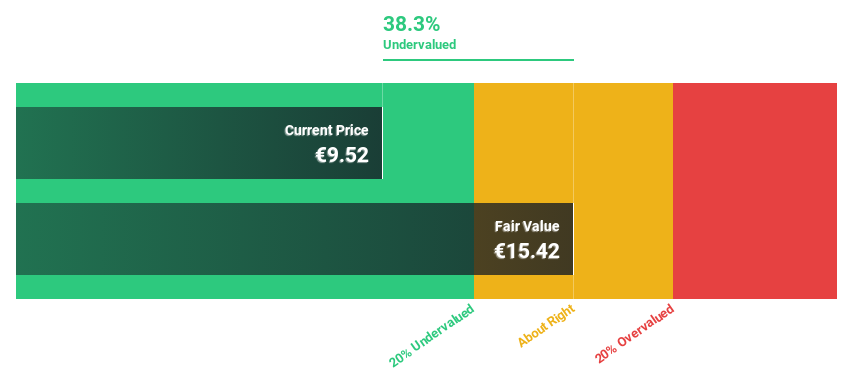

Vivendi

Overview: Vivendi SE, with a market cap of €10.25 billion, is an entertainment, media, and communication company operating across France, Europe, the Americas, Asia/Oceania, and Africa.

Operations: Vivendi's revenue is generated through various segments including Canal + Group at €6.06 billion, Havas Group at €2.87 billion, Lagardère at €0.67 billion, Gameloft at €0.31 billion, Prisma Media at €0.31 billion, Vivendi Village at €0.18 billion, and New Initiatives contributing €0.15 billion.

Estimated Discount To Fair Value: 37.7%

Vivendi, priced at €9.84, appears undervalued with a fair value estimate of €16.02, reflecting a significant discount. Despite an unstable dividend history, the company is poised for strong growth with earnings and revenue expected to increase by 29.3% and 18.5% annually—outpacing the French market significantly. Recent events include settling long-standing litigation without admitting fault, which removes legal uncertainties and supports financial stability moving forward.

According our earnings growth report, there's an indication that Vivendi might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of Vivendi.

Seize The Opportunity

Click through to start exploring the rest of the 10 Undervalued Euronext Paris Stocks Based On Cash Flows now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ANTIN ENXTPA:HO and ENXTPA:VIV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance