Europe’s Credit Bulls See Rally Ahead With French Turmoil Fading

(Bloomberg) -- Credit bulls are expecting a fresh start for this year’s rally in European corporate bonds, saying concerns over the risks that were posed by the French parliamentary vote have mostly been allayed.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Powerful Hurricane Beryl Aims at Jamaica After Grenada Strike

Trump Immunity Ruling Means Any Trial Before Election Unlikely

‘Upflation’ Is the New Retail Trend Driving Up Prices for US Consumers

US Yields Fall as Powell Cites Disinflation Signs: Markets Wrap

Portfolio managers at AllianceBernstein LLP and TwentyFour Asset Management LLP say credit markets will likely shake off the turmoil that greeted the possibility of either the far right or far left gaining an absolute majority in France’s legislature.

Some of the factors that have pushed European credit markets to outperform their US counterparts in the first five months of the year are still in place and will again drive asset prices higher, they say.

President Emmanuel Macron’s decision to call the election has initially left traders fearing how the risk of fiscal loosening under parties on opposite ends of the political spectrum would impact credit markets. Due to French firms’ accounting for the biggest component in the main categories of European debt, the turmoil has weighed on all the region’s indexes.

Now, with Marine Le Pen’s far-right National Rally securing a smaller-than-expected portion in the first round and an alliance of leftist parties trailing in second place, investors say the risk of upheaval is fading. A run-off vote that will settle the composition of parliament is due this weekend.

“The far-left parties were the bigger risk to the French fiscal position through time, so the results of the first round have reduced the probability of that happening, and credit spreads have responded,” said John Taylor, head of European fixed income at AllianceBernstein. “As the ECB have started cutting rates, we expect money to move out of money market funds and into credit.”

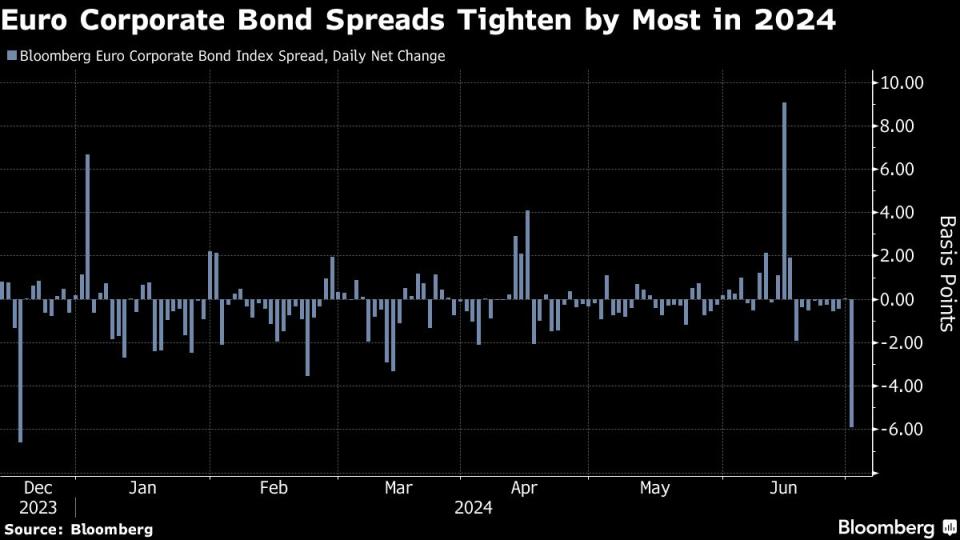

The spread pick-up of euro investment-grade corporate bonds over their US counterparts has fallen almost three basis points since Sunday’s vote, the most since mid-April, according to data compiled by Bloomberg. The gap between the two markets is now at its lowest since June 10, the day after Macron called the election.

For the vote, “there was a big premium on the tail-risk outcomes and those have likely been removed,” said Gordon Shannon, portfolio manager at TwentyFour Asset Managment LLP. “The market has decided that risk of an unstable government has dramatically fallen.”

The cautiously optimistic mood in debt markets has also allowed a trio of junk-bond buyout deals to hit the screens on Monday, including the bond portion of a mammoth Vodafone Spain €3.41 billion ($3.6 billion) leveraged finance package.

Still, Tuesday saw a tempering of Monday’s buoyant mood in some sections of the market.

The cost of insuring against European investment-grade defaults rose again after recording its largest intraday drop all year on Monday.

UBS Global Wealth Management also cautioned that a weaker minority government in France is unlikely to solve the country’s public finances, which were already deteriorating before the election.

“It now seems less likely that one group will have a majority after the second round, but investors would be unwise to place too much confidence in that,” said Paul Donovan, the asset manager’s chief economist.

Still, the Additional Tier 1 bonds — a type of debt that forces losses on holders to keep a bank in business — of French lenders such as Credit Agricole SA, Societe Generale SA and BNP Paribas SA held gains on Tuesday after hitting the highest level since June 12 the day before.

The failure of Le Pen’s party to score an absolute majority is the best possible scenario for French banks under the circumstances, said Sebastien Barthelemi, head of credit research at Kepler Cheuvreux.

“This could result in some political stability, with little significant change expected until the next presidential election, which is considered good news for the banking sector,” Barthelemi said.

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance