Europe Tractor Market Report 2023 to 2028: Increasing Use of Bioenergy in Tractors

European Tractor Market

Dublin, Jan. 16, 2023 (GLOBE NEWSWIRE) -- The "Europe Tractor Market - Industry Analysis & Forecast 2023-2028" report has been added to ResearchAndMarkets.com's offering.

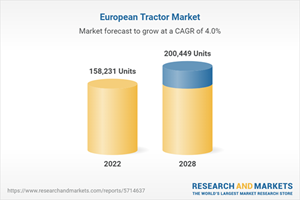

The Europe tractor market size witnessed shipments of 158,231 units in 2022, which is expected to reach 200,449 units by 2028 growing at a CAGR of 4.02% during the forecast period.

Market Trends and Opportunities

Increasing Use of Bioenergy in Tractors

Conventionally, farmers used diesel engine tractors known for their high power. Tractors are now more efficient and can complete tasks with fewer power requirements due to advances in machine technologies, fuel, and engines. The volatility in diesel prices hampers the budget management of farmers. Farm-produced bio-based energy can already be used to power several new, cutting-edge models of agricultural machinery.

Technological Advance in Tractor Technology

A new frontier of innovation emerged as agriculture met digital technology, opening various paths to a smart agricultural future in the Europe tractor market. Tractor manufacturers are competitive, and companies constantly strive to innovate and ensure product differentiation at affordable prices. State-of-the-art technology-based tractors are currently available in the market. GPS and remote sensing make farming more accurate and productive.

Industry Restraints

Lack of Awareness of the Latest Agricultural Equipment Innovations

There are many innovations and advances in the agricultural sector and agriculture tractors and machinery. Agriculture scientists develop ways to increase yield using innovative and efficient machinery. Implementing modern equipment and systems and adopting advanced scientific methods such as artificial intelligence help farmers make better decisions.

The number of farmers unaware of the latest innovations in agriculture technologies and equipment is very high in Europe. This is mainly due to limited awareness and information among the farming community.

The resistance from farmers to change and update their farming practices is another reason for the low adoption of the latest agricultural machinery. Such factors are expected to hamper the growth of the Europe tractor market during the forecast period.

Competitive Landscape

John Deere and New Holland dominated the Europe agriculture tractor market with a collective industry share of over 25% in 2022. The threat of rivalry is high in the Europe tractor market since more than 40% of the share is held by the top five players.

In March 2022, John Deere launched the new electric variable transmission (EVT) for select 8 Series Tractors and a new JD14X engine for 9 Series.

Massey Ferguson launched the MF 6S series tractors in February 2022. This machine provides up to 180 HP with advanced technology.

Massey Ferguson launched the MF 8S series tractors in July 2020. A guard-u install engine and a neo-retro design distinguish this series of tractors. These tractors are designed to advance smart farming technologies.

In March 2021, CNH Industrial partnered with Monarch Tractors, a US-based agri-technology company, to improve long-term sustainability and raise awareness of the importance of zero-emission agriculture among farmers.

Key Vendors

John Deere

CNH Industrial

AGCO

Kubota

Other Prominent Vendors

Zetor

Mahindra & Mahindra

Escorts

JCB

Foton Motor

MTW Holdings

SDF

Arbos Group

Yanmar

Key QuestionsAnswered:

1. How big is the Europe tractor market?

2. What is the growth rate of the Europe Tractor Market?

3. What are the expected units sold in the Europe tractor market by 2028?

4. Who are the key players in the Europe tractor market?

5. Which wheel drive holds the highest Europe tractor market share?

6. Which country dominates the Europe tractor market?

Report Attribute | Details |

No. of Pages | 179 |

Forecast Period | 2022 - 2028 |

Estimated Market Value in 2022 | 158231 Units |

Forecasted Market Value by 2028 | 200449 Units |

Compound Annual Growth Rate | 4.0% |

Regions Covered | Europe |

Key Topics Covered:

1 Research Methodology

2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

8 Introduction

8.1 Overview

8.2 Value Chain Analysis

8.2.1 Overview

8.2.2 Raw Material & Component Suppliers

8.2.3 Manufacturers

8.2.4 Dealers/Distributors

8.2.5 Retailers

8.2.6 End-Users

8.3 Common Agricultural Policy & Eu Agricultural Expenditure

8.4 Increasing Adoption of Precision Farming

8.5 Technological Advances

9 Market Opportunities & Trends

9.1 Technological Advances in Tractor Technology

9.1.1 Gps Technology

9.1.2 High Demand for Autonomous or Self-Driving Tractors

9.2 Shortage of Agricultural Laborers

9.3 Increasing Use of Bioenergy in Agricultural Machinery

10 Market Growth Enablers

10.1 Assistance to Farmers Through Loans & Subsidies

10.2 Strong Agricultural Commodity Prices Support Market

10.3 Growing Food Consumption & Export of Organic Products

11 Market Growth Restraints

11.1 Lack of Awareness of Latest Agricultural Equipment Innovations

11.1.1 Lack of Education Among Farmers

11.2 High Demand for Used & Rental Tractors

11.3 Climate Change Adversely Impacting Agricultural Activities

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 by Horsepower

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Less Than 50 Hp

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 50 Hp-100 Hp

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Above 100 Hp

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

14 by Wheel-Drive

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 2-Wheel-Drive

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 4-Wheel-Drive

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

15 Geography

16 Competitive Landscape

16.1 Competition Overview

17 Key Company Profiles

18 Other Prominent Vendors

19 Report Summary

19.1 Key Takeaways

19.2 Strategic Recommendations

20 Quantitative Summary

21 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/1tnjiy

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance