European inflation sucked once again

REUTERS/China Daily

Inflation in the eurozone remained stagnant in August, according to a preliminary reading released by Eurostat on Wednesday morning.

Consumer price inflation, the key measure of price growth, came in at just 0.2% year-on-year in August, a disappointing reading against forecasts, which had predicted growth of 0.3% in the month. July's final inflation reading also sat at 0.2%.

On a year-to-year basis core consumer prices grew by 0.8%, against a forecast of 0.9%, and a previous reading of the same number, also disappointing against forecasts.

Core prices are an important measure because they strip out the most volatile items — things like fuel and food prices, which are subject to massive variations.

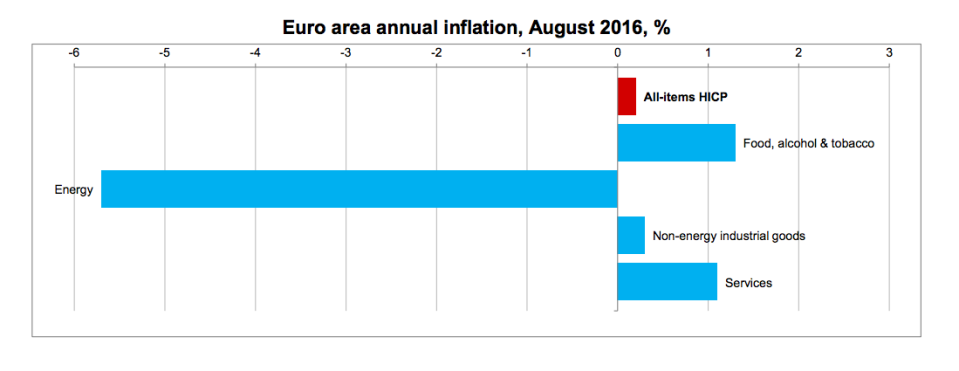

"Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (1.3%, compared with 1.4% in July), followed by services (1.1%, compared with 1.2% in July), non-energy industrial goods (0.3%, compared with 0.4% in July) and energy (-5.7%, compared with -6.7% in July)," Eurostat said in a release.

Here is the chart:

REUTERS/China Daily

The weaker than expected eurozone-wide figures follow on from poor numbers from individual eurozone economies. On Tuesday, German consumer price inflation came in at just 0.3%, down from 0.4% in July, and against a 0.5% forecast from economists.

The inflation release comes just over a week before the European Central Bank's September monetary policy meeting, in which it is expected to signal the potential for further easing of some sort by the end of 2016. That easing could come in the form of another interest rate cut, or the extension of the bank's already widespread programme of quantitative easing.

Claus Vistesen, the Chief Eurozone Economist at Pantheon Macroeconomics believes that Wednesday's numbers present: "A dovish headline which should be enough to push the ECB to extend QE by six months next week."

The measures currently being implemented by the ECB are designed to try and boost stalling inflation, as well as growth, within the eurozone.

So far the ECB's negative interest rate policy (NIRP) has not managed to stimulate inflation, although Draghi has repeatedly said that he and other senior bank officials are convinced the measures are working. The ECB's official inflation target is close to but less than 2%.

NOW WATCH: Kobe Bryant is starting a $100-million venture capital fund

See Also:

SEE ALSO: STIGLITZ: Italy could be the 'cataclysmic event' that leads to the fall of the eurozone

Yahoo Finance

Yahoo Finance