European investors are holding their breath ahead of Trump's big announcement

LONDON — Britain's benchmark FTSE 100 opened slightly down on Wednesday morning while investors await an announcement from US President Trump, who is later expected to unveil plans to slash corporate taxes.

At 8.25 a.m. BST (3.25 a.m. ET) the FTSE 100 was down 0.10%, trading at 7,268 points.

Here is the chart:

Investing.comTrump is expected to make a raft of announcements this afternoon, including a pledge to lower the tax rate US companies play from 35% to 15%, which is pushing up US equities slightly, with the Dow Jones trending higher ahead of the open.

But investors are cautious about making any big moves given Trump's record in office so far. Michael van Dulken, head of research at Accendo Markets, says in a note: "Markets [are] excited to hear what Trump has to say on tax reform, giving him an opportunity to finally deliver on pro-growth policy, but conscious of having already failed miserably on healthcare and little to show for his first hundred days."

The biggest morning gainer on the FTSE 100 is chemicals company Croda International, gaining 4.32% by 8.30 a.m. BST (3.30 a.m. ET) after its sales for the quarter ending March 31 rose by 19.1% year-on-year.

The biggest losers are precious metals company Fresnillo and water company Severn Trent, down 1.6% and 1.29% respectively at the same time. A turn to equities is pushing down demand for safe-haven precious metals, with US gold and silver futures down 0.17% and 0.38% respectively at 8.30 a.m. BST (3.30 a.m. ET).

FTSE 250-listed Metro Bank was down 1.9% at the same after it posted below-expected quarterly results.

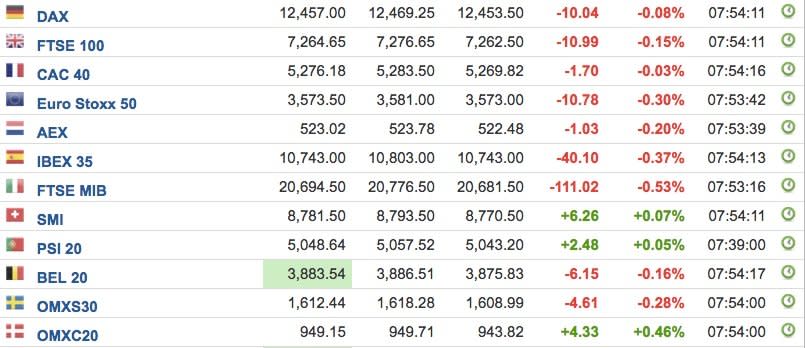

Here's how the rest of Europe looks shortly after the open:

Investing.com

NOW WATCH: These are the watches worn by the most powerful CEOs in the world

See Also:

SEE ALSO: Fast fashion retailer Boohoo grew sales by a huge 51% last year — but shares are falling

DON'T MISS: Credit Suisse is preparing to tap investors for $4 billion

Yahoo Finance

Yahoo Finance