Sustainable Dividend Picks for 2020

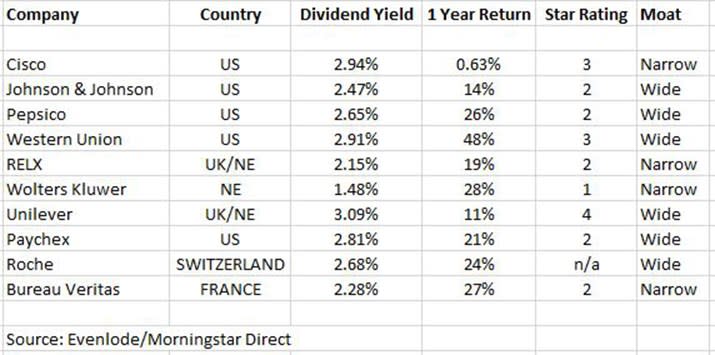

Two FTSE 100 names have made it on to boutique investment manager Evenlode’s 2020 global sustainable dividend list. Consumer goods giant Unilever (ULVR) and publishing company RELX (REL) are among those the investment firm tips as the most reliable dividend payers across the globe.

Income is a vital component of any investment portfolio, and companies that can not only sustain their dividend but grow it every year have obvious attractions. A growing dividend can help stave off the erosive effects of inflation and, if reinvested, a welcome capital boost.

Finding the best dividend-payers across the world can be like finding a needle in a haystack. Yet this is the sole focus of many a fund manager, and this latest effort has been compiled by Ben Peters and Chris Elliott, portfolio managers of the Evenlode Global Income Fund, which gained 24.5% in 2019.

The report hones in on 10 companies across the world providing steady and realiable income to their shareholders; among them are two FTSE names.

Unilever, which grew its dividends by 6.3% in pounds last year, currently yields 3.1%. The consumer goods giant is a regular on our list of top FTSE dividend yields – Morningstar analysts think the company has a strong competitive advantage due to the strength of its supply chain, and believe its shares are undervalued at £45.60, with a fair value of £47. The company is a favourite of fund managers such as Nick Train and has performed very strongly over a 20-year period.

RELX, meanwhile, owns business publishing company Elsevier and grew its dividend by 8% in 2019, now offering a yield of 2.3%. Morningstar analyst Michael Field says the firm has a small competitive advantage or "narrow moat" but that over the long-term it will continue to perform strongly as the company positions itself to continually transition from print products to database products.

What Makes a Good Dividend Payer?

To make the list, companies are screened on a number of factors. Firstly, they must yield at least 2% - this cut off should ensure that investors receive an income that beats inflation.

The average yield of the 10 companies is above their benchmark, the MSCI World Dividend Growth index, but Peters says it is important that income-seeking investors don't just focus on the headline yield: “We look to balance a good yield today with the prospect of growth in the future."

And while the companies on the list have beaten the total return of the MSCI World since 2007, the report’s authors don’t look at the share price in isolation either. “We view dividend growth as a better indicator of the underlying health of a business’ fundamentals than the share price, which represents market confidence and is prone to bouts of optimism and pessimism,” the report’s authors say.

To make it on to Evenlode’s list, a company must have a sound balance sheet, with manageable debt levels, as well as a decent dividend. “A lower level of debt reduces the risk that the company will have to divert cash from investment or paying the dividend. This increases the stability or defensiveness of these businesses,” Peters and Elliott say.

Consumer-facing companies Pepsico (PEP), Johnson & Johnson (JNJ), Western Union (WU) are among the other names to make the grade, as well as business-to-business firms Cisco (CSCO) and Paychex (PAYX). Wolters Kluwer (WKL) has hung onto its place in the 2020 list despite only yielding 1.6% (below the 2% cut-ff) because the managers are positive on its strong cashflow and prospects for future dividend growth.

Brand power is important to Peters and Elliott because it encourages consumers to keep buying these companies' products even during leaner times, and it gives the businesses pricing power. “These companies have built long-term relationships with customers that help drive a recurring stream of revenues,” Elliott says.

While the top dividend-payers on the UK stock market don't often change, there are several new entrants in Evenlode's report since last year's iteration. Two names have fallen out of the list in 2020, Finnish lift maker Kone (KNEBV) and Swiss fragrance firm Givaudan (GIVN). They are replaced by pharma giant Roche (RO) and Bureau Veritas (BVI), a French testing and inspection company. Looking back on the 2019 list, Evenlode notes that US companies increased their dividends faster than their European counterparts.

Yahoo Finance

Yahoo Finance