Is Eventbrite's (NYSE:EB) Share Price Gain Of 117% Well Earned?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Eventbrite, Inc. (NYSE:EB) share price had more than doubled in just one year - up 117%. On top of that, the share price is up 31% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Eventbrite hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Eventbrite

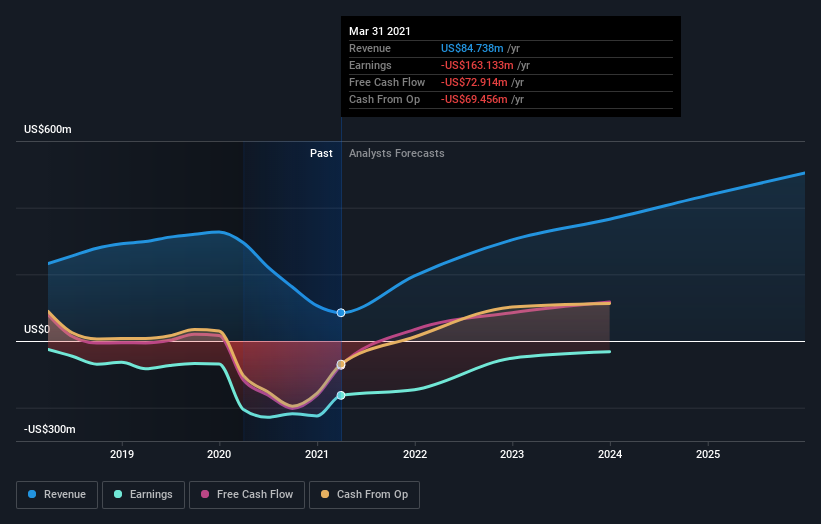

Eventbrite wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Eventbrite actually shrunk its revenue over the last year, with a reduction of 71%. So we would not have expected the share price to rise 117%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Eventbrite's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Eventbrite shareholders should be happy with the total gain of 117% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 31% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Eventbrite you should be aware of.

Of course Eventbrite may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance