Evercore (EVR) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

Evercore EVR reported adjusted earnings per share of $3.8 for first-quarter 2022, surpassing the Zacks Consensus Estimate of $3.1. Also, the bottom line was 15.5%, up from the prior-year quarter’s level of $3.29 per share.

Impressive revenue growth with support from higher advisory fees aided the results. Also, a rise in assets under management (“AUM”) was a tailwind. In addition, Evercore’s liquidity position was consistently strong. However, escalating expenses were a major drag.

On a GAAP basis, net income available to common shareholders was $158 million or $3.79 per share, up from $144.4 million or $3.25 per share reported in the year-ago quarter.

Revenues Climb, Expenses Flare Up

Total revenues increased 9% year over year to a record $727.1 million in the reported quarter. Also, the top line surpassed the consensus estimate of $673.6 million. A jump in advisory fees, as well in asset management and administration fees, led to the uptick. On an adjusted basis, net revenues came in at $728.3 million, up 8.7% year over year.

Total expenses rose 9.7% to $513.5 million from the prior-year quarter’s level. This was partly offset by a decrease in execution, clearing and custody fees.

Adjusted compensation ratio was 59%, flat compared with the year-earlier quarter.

Adjusted operating margin came in at 29.5%, down from the prior-year quarter’s 30.1%.

Quarterly Segmental Performance (Adjusted)

Investment Banking: Net revenues climbed 8.7% year over year to $708.9 million. Operating income increased 6.6% to $208.4 million. Underwriting fees of $36.3 million in the quarter dropped 54% from the prior-year period’s level.

Investment Management: Net revenues were $19.4 million, up 8.4% from the prior-year quarter’s reading. Operating income was $6.5 million, up 3.3% from the year-ago quarter’s tally. AUM of $11.6 billion was witnessed in the first quarter, up 9% from the year-ago quarter’s level.

Balance Sheet Position

As of Mar 31, 2022, cash and cash equivalents were $454.8 million, and investment securities and certificates of deposit were $1.1 billion. Current assets exceeded current liabilities by $1.4 billion as of the same date.

Capital Deployment Activities

On Apr 26, 2022, Evercore announced a 6% increase in its quarterly cash dividend to 72 cents per share. The dividend will be paid out on Jun 10, to its stockholders of record as of May 27.

Earlier in February, the board approved share repurchase authorization of up to the lesser of $1.4 billion or 10 million shares and/or LP units.

Further, Evercore returned capital worth $289.3 million to its shareholders during the quarter through dividends and repurchases of two million shares at an average price of $128.14.

Our Viewpoint

Evercore displayed an impressive performance during the first quarter. Its top-line strength reflects earnings stability. This apart, EVR’s strategic initiatives to bolster its investment banking segment bode well. Though its escalating expenses are a concern, EVR is well poised to undertake any opportunistic expansion, given its sound liquidity position.

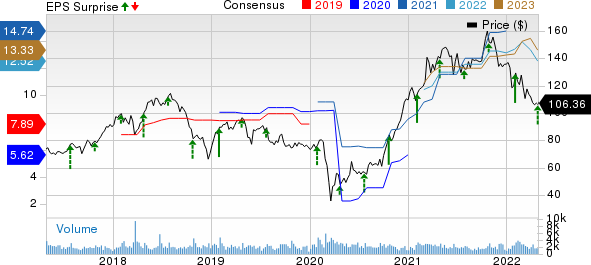

Evercore Inc Price, Consensus and EPS Surprise

Evercore Inc price-consensus-eps-surprise-chart | Evercore Inc Quote

Currently, Evercore has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Banks

UMB Financial UMBF reported first-quarter 2022 net operating income per share of $2.17, surpassing the Zacks Consensus Estimate of $1.65. The bottom line also compares favorably with the prior-year quarter’s earnings of $1.91.

UMBF’s results were supported by higher revenues, driven by an increase in net interest income (“NII”) and fee income. A solid balance sheet position was another positive. Increased expenses and deteriorating credit quality were headwinds. Capital ratios witnessed a decline.

Northern Trust Corporation NTRS delivered an earnings beat of 6.63% for first-quarter 2022. Earnings per share of $1.77 surpassed the Zacks Consensus Estimate of $1.66. The bottom line improved 4% year over year.

Higher revenues, aided by a rise in fee income and NII, were a driving factor for NTRS. Most credit metrics also marked significant improvements. However, a rising expense base and weak capital ratios were headwinds.

UBS Group AG UBS reported first-quarter 2022 net profit attributable to shareholders of $2.1 billion, up 17.1% from the prior-year quarter’s level.

UBS’ performance was driven by a 10% rise in NII compared with the prior-year quarter. Strong capital position was a tailwind.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Evercore Inc (EVR) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance