Evercore Inc (EVR) Q1 2024 Earnings: Meets EPS Estimates, Reports Modest Revenue Growth

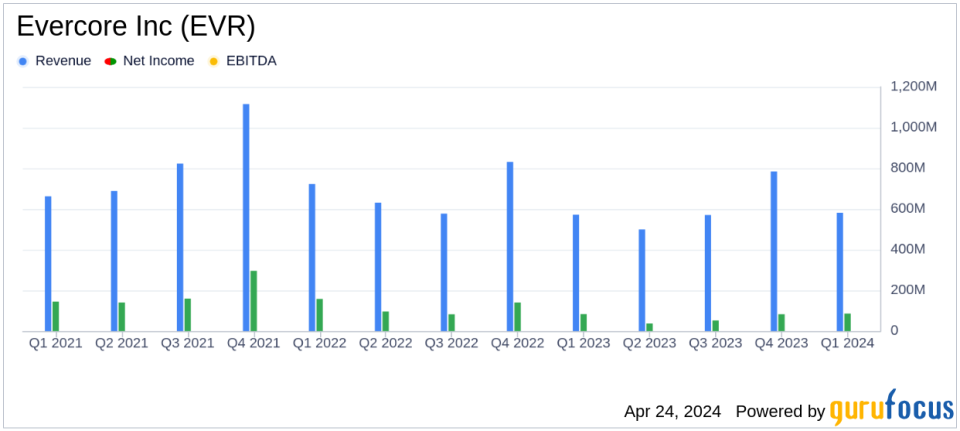

Revenue: Reported at $580.8 million, up by 1.5% year-over-year, falling short of estimates of $636.38 million.

Net Income: Achieved $85.7 million, slightly above the estimated $85.66 million.

Earnings Per Share (EPS): Met expectations at $2.09, aligning with analyst estimates.

Dividend: Increased quarterly dividend by 5% to $0.80 per share, enhancing shareholder returns.

Underwriting Fees: Saw a significant increase of 143% year-over-year, driven by a higher number of transactions.

Advisory Fees: Decreased by 7% from the previous year, reflecting a decline in revenue from large transactions.

Assets Under Management (AUM): Grew by 18% year-over-year to $12,999 million, indicating strong asset accumulation and management performance.

On April 24, 2024, Evercore Inc (NYSE:EVR) disclosed its financial results for the first quarter of 2024, revealing earnings that aligned with analyst expectations and showcased a slight revenue increase. The detailed earnings can be reviewed in their recent 8-K filing.

Evercore, a leading independent investment bank primarily engaged in financial advisory services, reported a net revenue of $580.8 million on a U.S. GAAP basis for Q1 2024, marking a 2% increase from $572.1 million in Q1 2023. The firm's adjusted net revenue also saw a similar increment, reaching $587.3 million. This performance was buoyed by significant advisory roles in major global transactions and a stronger quarter in underwriting revenues, reflecting increased activity in the equity capital markets.

Key Financial Metrics

The company reported a diluted earnings per share (EPS) of $2.09, consistent with analyst estimates and slightly up from $2.06 in the prior year. Notably, Evercore's operating income for the quarter was $84.1 million, a decrease from $106.9 million reported in Q1 2023, with an operating margin of 14.5%, down from 18.7% in the previous year. This decline in operating income and margin reflects an increased compensation ratio, which rose to 66.8% from 64.1% year-over-year, and higher non-compensation costs associated with professional fees and travel.

The firm's effective tax rate showed a significant shift, recording at (7.7%) compared to 14.9% in Q1 2023, influenced by deductions associated with the appreciation in Evercore's share price upon vesting of employee share-based awards.

Strategic Achievements and Capital Management

During the quarter, Evercore advised on five of the fifteen largest global transactions, including high-profile deals such as General Electric's $37 billion spin-off of GE Vernova and Synopsys's acquisition of Ansys for $35 billion. These advisory roles underscore Evercore's strong positioning and expertise in the market.

In terms of capital return, Evercore increased its quarterly dividend by 5% to $0.80 per share and returned $308.5 million to shareholders through dividends and share repurchases. The firm's robust balance sheet was further highlighted by a strong liquidity position, with cash and cash equivalents standing at $569.8 million as of March 31, 2024.

Outlook and Commentary

Leadership remains optimistic about the firm's trajectory. John S. Weinberg, Chairman and CEO, commented on the strong start to the year and the ongoing momentum across Evercore's businesses. Roger C. Altman, Founder and Senior Chairman, reflected on the firm's improved market position, ranking #4 globally in league tables, indicative of Evercore's expanding platform and broadening capabilities.

Evercore's first-quarter performance, characterized by steady advisory revenues and significant capital management activities, positions the firm well for sustained growth in the evolving financial landscape. The alignment of EPS with analyst projections and modest revenue growth highlights the company's resilience and strategic execution amid market fluctuations.

For additional details on Evercore's financial performance and strategic initiatives, investors and stakeholders are encouraged to review the full earnings report and listen to the earnings call scheduled for April 24, 2024.

Explore the complete 8-K earnings release (here) from Evercore Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance