Everest Re (RE) Q3 Earnings Lag Estimates, Revenues Rise Y/Y

Everest Re Group, Ltd. RE incurred third-quarter 2021 operating loss per share of $1.34, wider than the Zacks Consensus Estimate of a loss of $1.29. The bottom line compared unfavorably with an income of $2.42 in the year-ago quarter.

The company witnessed higher premiums across its reinsurance and insurance businesses and higher net investment income. However, higher catastrophe loss stemming from Hurricane Ida and European Floods offset the upside.

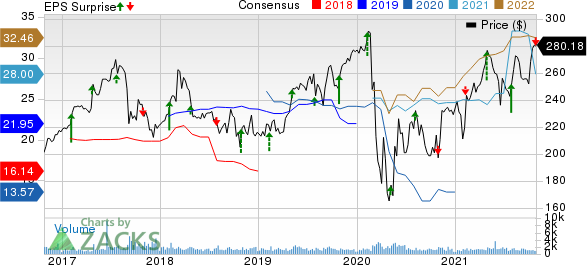

Everest Re Group, Ltd. Price, Consensus and EPS Surprise

Everest Re Group, Ltd. price-consensus-eps-surprise-chart | Everest Re Group, Ltd. Quote

Operational Update

Everest Re’s total operating revenues of nearly $2.9 billion increased 17.3% year over year on higher premiums earned and net investment income.

Gross written premiums improved 25% year over year to $3.5 billion. The Reinsurance segment generated premiums of $2.5 billion, up 19% year over year, driven by the continued partnership with its core clients and Everest’s position as a preferred reinsurance platform. The Insurance segment generated a premium of $2 billion, up a record 43% year over year, driven by increasingly favorable economic conditions, new business growth, the combined impact of strong renewal retention and a continuing favorable rate environment.

Net investment income was $293 million in the quarter under review, up about 25% year over year led by outstanding alternative asset performance.

Total claims and expenses increased 28.9% to $3 billion primarily due to higher incurred losses and loss adjustment expenses, commission, brokerage, taxes and fees, other underwriting expenses, interest, fees and bond issue cost amortization expense, and corporate expenses.

Underwriting loss of $323.4 million in the quarter was wider than $114.6 million incurred in the year-ago quarter. Catastrophe losses from Hurricane Ida and European Floods amounted to $635 million net of recoveries and reinstatement premiums, wider than $300 million incurred in the year-ago quarter.

Underwriting loss for the Reinsurance segment was $306.2 million, wider than $90.4 million loss incurred in the year-ago quarter. Underwriting loss in the Insurance segment was $17.2 million compared with the year-ago loss of $24.2 million.

The combined ratio deteriorated 700 basis points year over year to 112.2 in the reported quarter. The combined ratio of the Reinsurance segment deteriorated 1010 bps to 115.5 while the same improved 200 bps to 102.5 for the Insurance segment.

Financial Update

Everest Re exited the quarter with total investments and cash of $27.8 billion, up 9.1% from the 2020 level. Shareholder equity at the end of the reported quarter increased 2.6% from 2020 end to about $10 billion.

Book value per share was $253.40 as of Sep 30, 2021, up 4.2% from the 2020-end level.

The annualized net income return on equity was (2.2%) versus 4.4% in the year-ago period.

Everest Re’s cash flow from operations was $1.2 billion in the third quarter, up 9.1% year over year.

The company paid common share dividends of $185.7 million during the quarter.

The company bought back shares worth $160 million in the quarter.

Zacks Rank

Everest Re currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among the other insurance industry players, which have reported third-quarter earnings so far, the bottom line of RLI Corp. RLI and The Travelers Companies, Inc. TRV beat the Zacks Consensus Estimate while that of The Progressive Corporation PGR missed estimates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance