Evergy (EVRG) to Report Q2 Earnings: Here's What to Expect

Evergy Inc. EVRG is scheduled to release second-quarter 2023 results on Aug 4, before market open. The company delivered an earnings surprise of 5.4% in the last reported quarter.

Let’s discuss the factors that are likely to be reflected in the upcoming quarterly results.

Factors to Consider

EVRG’s second-quarter revenues are expected to have benefited from higher transmission margin. Its ongoing cost saving initiatives are likely to have lowered operating and maintenance expenses, just like in the previous quarter. Our model predicts operating and maintenance expenses of $212.1 million, down 25% from the year-ago quarter’s reported figure.

However, higher interest expenses and depreciation and amortization costs might have offset some positives.

Q2 Expectations

The Zacks Consensus Estimate for earnings is pegged at 79 cents per share, indicating a year-over-year decrease of 8.1%.

The Zacks Consensus Estimate for revenues is pinned at $1.24 billion, implying a year-over-year decline of 14.2%.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Evergy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here as you will see below.

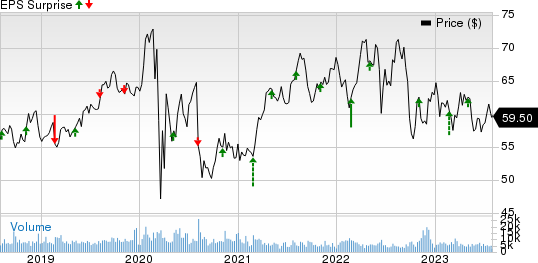

Evergy Inc. Price and EPS Surprise

Evergy Inc. price-eps-surprise | Evergy Inc. Quote

Earnings ESP: The company’s Earnings ESP is -3.80%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, Evergy carries a Zacks Rank #3. You can see the complete list of today's Zacks #1 Rank stocks here.

Stocks to Consider

Investors can consider the following players that have the right combination of elements to beat on earnings this reporting cycle.

BCE Inc. BCE is expected to come up with an earnings beat when it reports second-quarter results on Aug 3, before market open. It has an Earnings ESP of +2.94% and a Zacks Rank #3 at present.

BCE’s long-term (three to five years) earnings growth rate is 2.98%. It delivered an average earnings surprise of 3.6% in the last four quarters.

TransAlta TAC is likely to come up with an earnings beat when it reports second-quarter results on Aug 4, before market open. It has an Earnings ESP of +440.01% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for earnings is pegged at 3 cents per share, indicating a year-over-year increase of 112.5%. The consensus mark for 2023 earnings is pinned at $1.03 per share, implying a year-over-year improvement of 1,475%.

ALLETE ALE is likely to report an earnings beat when it announces second-quarter results on Aug 8, before market open. It has an Earnings ESP of +2.56% and a Zacks Rank #3 at present.

ALE’s long-term earnings growth rate is 8.1%. The Zacks Consensus Estimate for earnings is pegged at 78 cents per share, indicating a year-over-year increase of 16.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BCE, Inc. (BCE) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Evergy Inc. (EVRG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance