Evolve Education Group (NZSE:EVO) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Evolve Education Group Limited (NZSE:EVO) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Evolve Education Group

What Is Evolve Education Group's Debt?

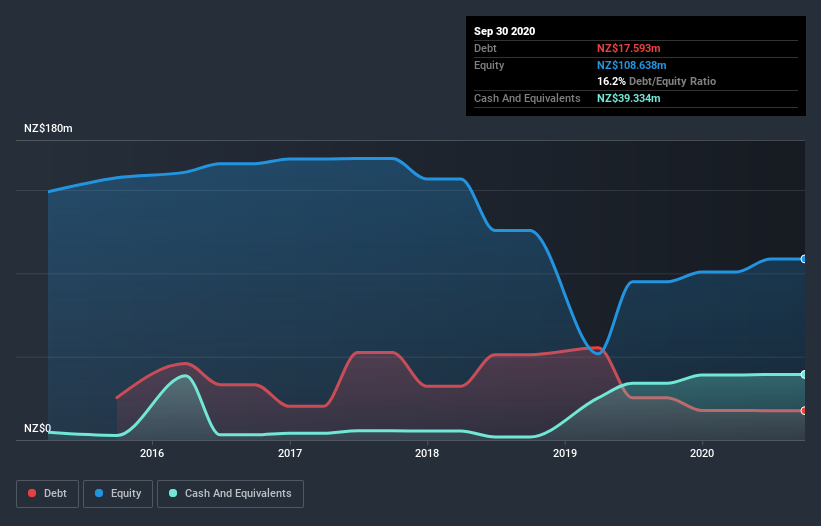

As you can see below, Evolve Education Group had NZ$17.6m of debt at September 2020, down from NZ$25.4m a year prior. However, it does have NZ$39.3m in cash offsetting this, leading to net cash of NZ$21.7m.

A Look At Evolve Education Group's Liabilities

We can see from the most recent balance sheet that Evolve Education Group had liabilities of NZ$45.7m falling due within a year, and liabilities of NZ$198.0m due beyond that. On the other hand, it had cash of NZ$39.3m and NZ$50.7k worth of receivables due within a year. So its liabilities total NZ$204.4m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's NZ$181.8m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Evolve Education Group boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Notably, Evolve Education Group's EBIT launched higher than Elon Musk, gaining a whopping 159% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Evolve Education Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Evolve Education Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Evolve Education Group actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

Although Evolve Education Group's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of NZ$21.7m. And it impressed us with free cash flow of NZ$36m, being 124% of its EBIT. So we are not troubled with Evolve Education Group's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Evolve Education Group that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance