Examining Three Indian Dividend Stocks With Yields From 3.1% To 4.4%

Amidst a backdrop of fluctuating global cues and domestic market consolidation, the Indian stock market presents a mixed bag of opportunities and challenges. As investors navigate these uncertain waters, dividend stocks remain a focal point for those seeking potential stability and steady returns in their portfolios.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Bhansali Engineering Polymers (BSE:500052) | 4.12% | ★★★★★★ |

Castrol India (BSE:500870) | 3.88% | ★★★★★☆ |

NMDC (BSE:526371) | 3.30% | ★★★★★☆ |

Balmer Lawrie Investments (BSE:532485) | 4.49% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.90% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.75% | ★★★★★☆ |

Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.61% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.85% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.60% | ★★★★★☆ |

Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.71% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

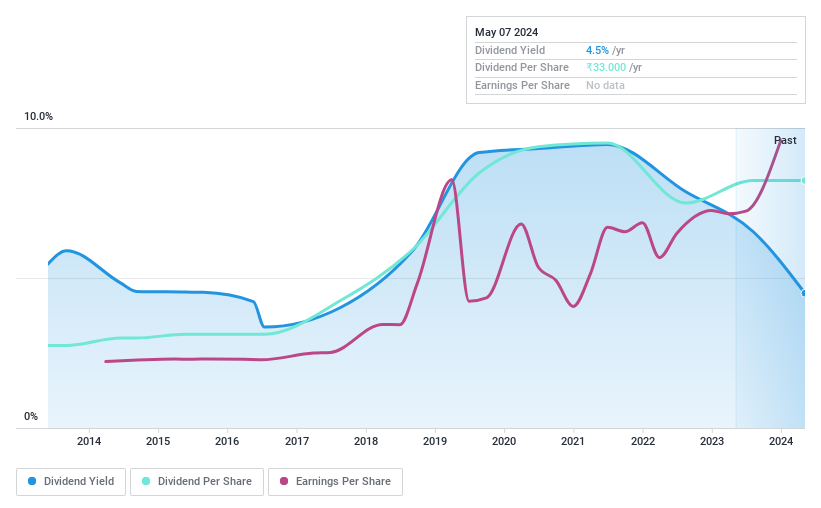

Balmer Lawrie Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Balmer Lawrie Investments Limited operates in various sectors including industrial packaging, greases and lubricants, chemicals, logistics services and infrastructure, as well as refinery and oil field services, and travel and vacation businesses across India, with a market capitalization of ₹16.31 billion.

Operations: Balmer Lawrie Investments Limited generates revenue from several key segments: ₹8.22 billion from Industrial Packaging, ₹6.74 billion from Greases & Lubricants, ₹4.48 billion from Logistics Services, ₹2.31 billion from Logistics Infrastructure, and ₹2.04 billion from Travel & Vacations.

Dividend Yield: 4.5%

Balmer Lawrie Investments demonstrated robust financial performance with a significant increase in both quarterly and nine-month revenues and net incomes, as evidenced by its latest earnings report. The company's basic and diluted earnings per share also saw considerable growth. In terms of dividends, Balmer Lawrie offers a compelling yield of 4.49%, ranking in the top 25% for Indian dividend payers. Its dividends are not only high but have shown stability and growth over the past decade, supported by a reasonable payout ratio of 66%. However, there is insufficient data to confirm if dividends are fully covered by free cash flow, suggesting potential areas for investor caution.

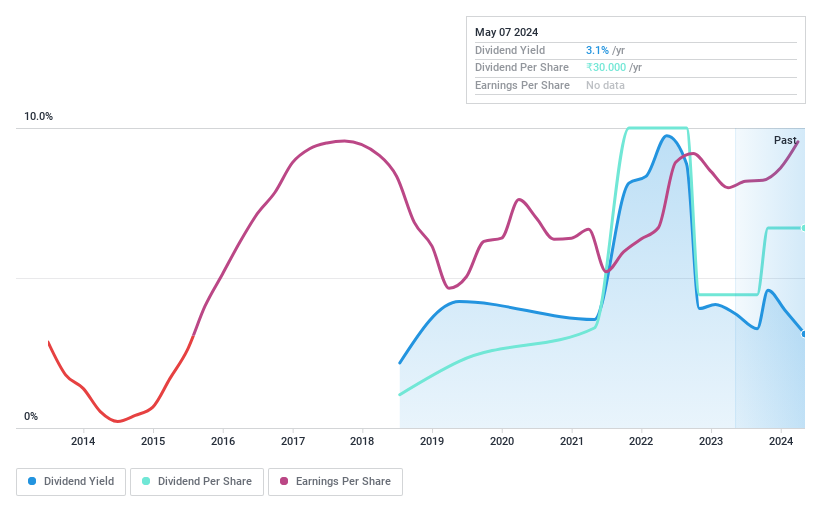

Allsec Technologies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Allsec Technologies Limited, operating in India, specializes in business process solutions with a market capitalization of approximately ₹14.59 billion.

Operations: Allsec Technologies Limited generates its revenue primarily from business process solutions in India.

Dividend Yield: 3.1%

Allsec Technologies has shown a 31% increase in earnings over the past year, with recent dividends recommended at INR 15 per share, pending shareholder approval. Despite a dividend yield of 3.13%, placing it in the top quartile of Indian dividend stocks, its dividend history is marked by instability and volatility over its short six-year payout period. The company’s dividends are currently supported by an earnings coverage ratio of 82.5% and a cash flow coverage ratio of 67.8%. Its P/E ratio stands favorably at 22.8x compared to the broader Indian market average of 31.6x.

Delve into the full analysis dividend report here for a deeper understanding of Allsec Technologies.

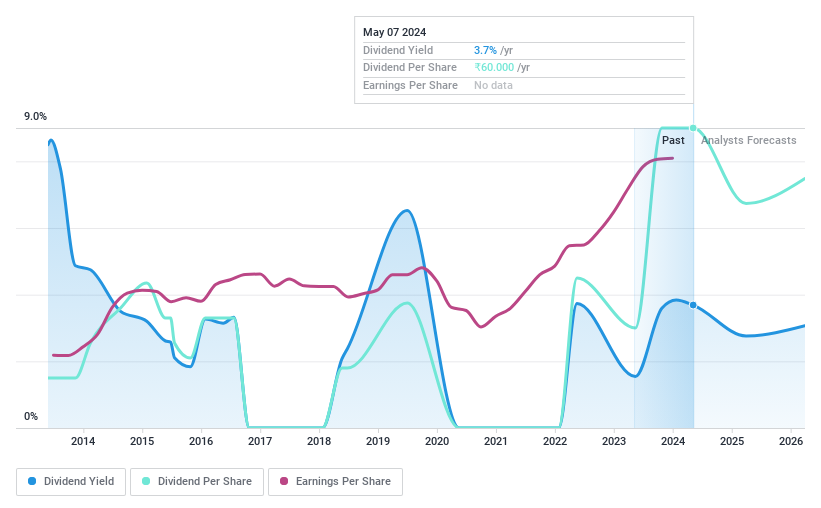

MPS

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPS Limited operates in content creation, production, and distribution, serving publishers, educational companies, and institutions globally with a market cap of approximately ₹27.63 billion.

Operations: MPS Limited generates revenue through three primary segments: Content Solutions (₹2.74 billion), Platform Solutions (₹1.18 billion), and e-Learning Solutions (₹1.32 billion).

Dividend Yield: 3.7%

MPS has experienced earnings growth of 13.4% annually over the past five years, with a P/E ratio of 22.6x, below the Indian market average of 31.6x. Despite a dividend yield of 3.69%, ranking in the top quartile for Indian dividend stocks, MPS's dividends have shown volatility and unreliability over the last decade. The company maintains a low payout ratio at 31.3%, suggesting earnings sufficiently cover dividends; however, a high cash payout ratio at 93.7% raises concerns about its sustainability from cash flow perspectives.

Click to explore a detailed breakdown of our findings in MPS' dividend report.

Upon reviewing our latest valuation report, MPS' share price might be too optimistic.

Seize The Opportunity

Navigate through the entire inventory of 27 Top Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BSE:532485 NSEI:ALLSEC and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance