Exchange Income Leads Three Undervalued Small Caps With Insider Actions In Canada

In the first half of 2024, Canadian markets have shown resilience with the TSX index logging solid gains, despite a lower exposure to the high-flying technology sector that has buoyed indices like the S&P 500. Small-cap stocks in Canada, however, have not fared as well amidst this broader market strength, presenting potential opportunities for investors looking for undervalued assets. In such a market environment, identifying small caps with strong fundamentals and insider actions can be particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Nexus Industrial REIT | 2.4x | 3.0x | 20.97% | ★★★★★★ |

Dundee Precious Metals | 8.0x | 2.7x | 47.29% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.3x | 2.9x | 36.62% | ★★★★★☆ |

Russel Metals | 9.1x | 0.5x | 15.71% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 32.47% | ★★★★☆☆ |

Calfrac Well Services | 2.3x | 0.2x | 6.46% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -95.33% | ★★★★☆☆ |

Trican Well Service | 8.4x | 1.0x | -18.11% | ★★★☆☆☆ |

Freehold Royalties | 15.2x | 6.6x | 49.15% | ★★★☆☆☆ |

AutoCanada | 11.1x | 0.1x | -95.80% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

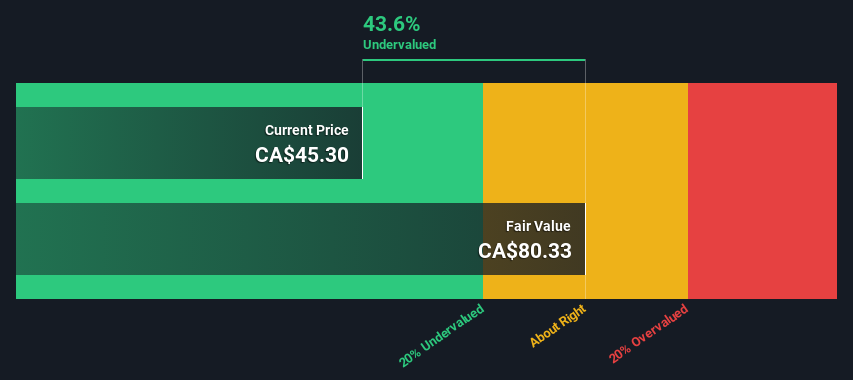

Exchange Income

Simply Wall St Value Rating: ★★★★★☆

Overview: Exchange Income is a diversified company operating primarily in the manufacturing and aerospace & aviation sectors, with a market capitalization of approximately CA$1.57 billion.

Operations: Manufacturing and Aerospace & Aviation are significant contributors to the company's revenue, generating CA$1.03 billion and CA$1.54 billion respectively. The gross profit margin has shown a trend of fluctuation over recent periods, with the latest recorded at 34.55%.

PE: 17.9x

Recently, Exchange Income demonstrated a commitment to shareholder returns, maintaining consistent monthly dividends of $0.22 per share, underscoring its stable cash flow despite a slight dip in net income from CAD 6.86 million to CAD 4.53 million year-over-year for Q1 2024. Revenue growth from CAD 526.84 million to CAD 601.77 million highlights potential underappreciation in the market. Insider confidence is evident as they recently purchased shares, signaling belief in long-term value amidst external borrowing risks and earnings coverage concerns.

Unlock comprehensive insights into our analysis of Exchange Income stock in this valuation report.

Evaluate Exchange Income's historical performance by accessing our past performance report.

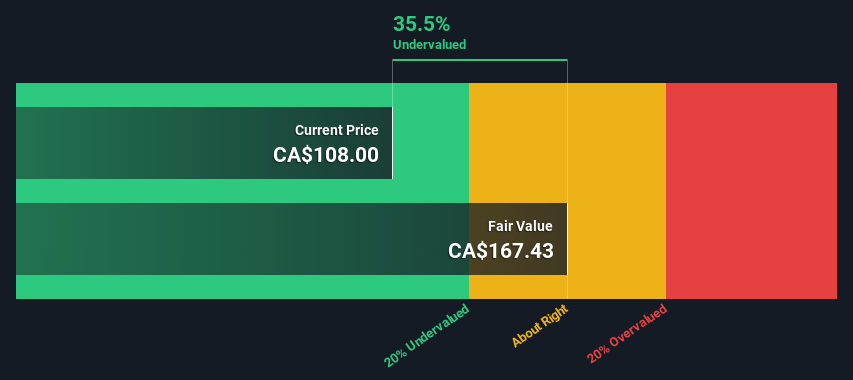

Hammond Power Solutions

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of approximately CA$0.10 billion.

Operations: The company generates CA$729.61 million from the manufacture and sale of transformers, with a gross profit margin of 32.49% in the latest reporting period. This reflects an increase from previous years, indicating an improvement in efficiency or pricing strategies that enhance profitability per unit sold.

PE: 23.9x

Hammond Power Solutions, a lesser-known entity in the Canadian market, recently showcased a significant uptick in insider confidence with substantial share purchases by insiders. This move aligns with their reported sales increase to CAD 190.68 million and an earnings forecast promising growth of nearly 18.59% annually. Despite a dip in net income this quarter to CAD 7.95 million from last year's CAD 15.73 million, these internal investments suggest optimism about the company’s strategic direction following its latest Shelf Registration filing for Class A Subordinate Voting Shares on June 20, 2024.

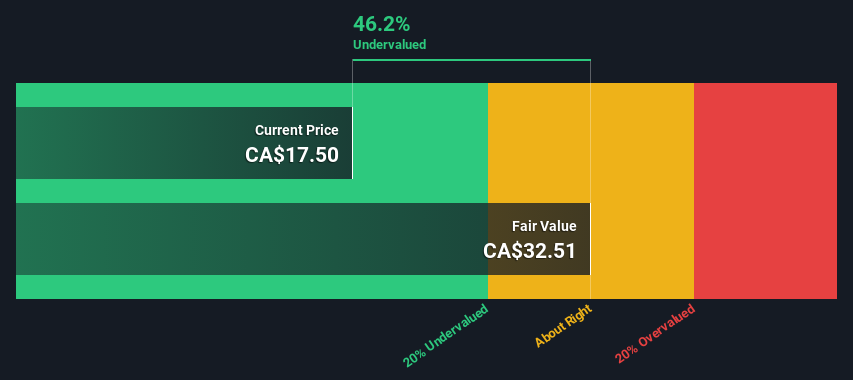

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company specializing in IT solutions and services, with a market capitalization of approximately $1.55 billion.

Operations: From 2018 to 2024, the company's gross profit margin increased from 23.91% to 41.82%. In the most recent fiscal period, revenue was $777.35 million with a net income of $40.47 million, reflecting a net income margin of 5.21%.

PE: 19.1x

Recently, Softchoice's insiders demonstrated confidence in the company by purchasing shares, signaling a belief in its growth potential despite a challenging quarter where sales dipped to US$169.76 million from US$208.82 million year-over-year, and net losses were reported at US$1.03 million. With earnings expected to grow annually by 17.66%, this tech firm stands out among smaller Canadian enterprises for its proactive management and strategic direction underlined at their latest AGM with new board appointments enhancing governance structures.

Dive into the specifics of Softchoice here with our thorough valuation report.

Assess Softchoice's past performance with our detailed historical performance reports.

Seize The Opportunity

Take a closer look at our Undervalued TSX Small Caps With Insider Buying list of 30 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:EIF TSX:HPS.A and TSX:SFTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance