Exelon's (EXC) Q2 Earnings and Revenues Surpass Estimates

Exelon Corporation’s EXC second-quarter 2021 earnings of 89 cents per share beat the Zacks Consensus Estimate of 70 cents by 27.1%. In the year-ago quarter, the company reported earnings of 55 cents per share.

The year-over-year improvement in earnings was primarily due to higher earnings, and contribution from its ComEd and Generation units.

On a GAAP basis, quarterly earnings were 41 cents per share compared with 53 cents in the year-ago quarter.

Total Revenues

Exelon's total revenues of $7,915 million surpassed the Zacks Consensus Estimate of $7,757 million by 2.1%. The top line also improved 8.1% from the year-ago figure of $7,322 million.

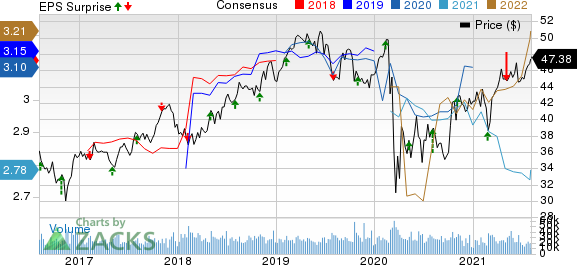

Exelon Corporation Price, Consensus and EPS Surprise

Exelon Corporation price-consensus-eps-surprise-chart | Exelon Corporation Quote

Highlights of the Release

Exelon utilities announced a "path to clean" goal to collectively reduce operations-driven emissions by 50% within 2030 from a 2015 baseline and reach net-zero operations-driven emissions by 2050.

Exelon's total operating expenses increased nearly 11.7% year over year to $7,561 million.

Interest expenses were $396 million, down 7.3% from the year-ago quarter.

Exelon-operated nuclear plants at ownership achieved a 93.7% capacity factor for the quarter compared with 95.4% in second-quarter 2020.

Planned Separation

On Feb 25, 2021, Exelon announced that its board of directors approved a plan to separate the utilities business, comprising the company’s six regulated electric and gas utilities, and Exelon Generation, its competitive power generation and customer-facing energy businesses. This will create two publicly-traded companies with the necessary resources to best serve customers, and help it sustain long-term investment as well as operating excellence.

The company has already filed for necessary approvals and is expecting the completion of this separation, subject to necessary approvals, in first-quarter 2022.

Hedges

Exelon's hedging program involves safeguarding of commodity risks for expected generation. As of Jun 30, 2021, the proportion of expected generation hedged is 98-101% for 2021.

Financial Highlights

Cash and cash equivalents were $1,578 million as of Jun 30, 2021 compared with $663 million on Dec 31, 2020.

Long-term debt was $35,077 million as of Jun 30, 2021 compared with $35,093 million on Dec 31, 2020.

Cash provided from operating activities for first-half 2021 was $1,138 million compared with $2,680 million in the first half of 2020.

Guidance

Exelon reaffirmed its 2021 earnings guidance in the range of $2.60-$3.00 per share. The midpoint of the above guided range is $2.80, higher than the Zacks Consensus Estimate of $2.78 per share for the period.

The company plans to invest $6.6 billion in 2021 to strengthen operations.

Zacks Rank

Exelon currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Xcel Energy Inc. XEL posted second-quarter 2021 operating earnings of 58 cents per share, surpassing the Zacks Consensus Estimate of 56 cents by 3.6%.

DTE Energy Company DTE reported second-quarter 2021 operating earnings per share of $1.70, which beat the Zacks Consensus Estimate of $1.44 by 18.1%.

NextEra Energy, Inc. NEE reported second-quarter 2021 adjusted earnings of 71 cents per share, which beat the Zacks Consensus Estimate of 67 cents by 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance