Existing Home Sales Dwindles in March: What's Causing It?

Existing home sales, which make up approximately 90% of the United States home sales, pulled back in March 2024, showcasing a decline from the prior month’s levels and year over year. The housing market seems to be reeling ]under increasing mortgage rates, which are making homebuyers wary of spending a penny.

Key Takeaways

On Apr 18, 2024, the National Association of Realtors (“NAR”) said that existing home sales slipped 4.3% to a seasonally adjusted annual rate of 4.19 million units last month from February. The decline was also visible on a year-over-year basis by 3.7% (down from 4.35 million units in March 2023), signaling the cautious behavior of the homebuyers post a jump in sales in February 2024.

Among the four main regions of the United States, home sales declined in three of the regions, forecasting mixed views against the current market backdrop. In March 2024, the sales in the Midwest, South and West retreated 1.9%, 5.9% and 8.2%, respectively, from the numbers of February 2024. On the other hand, the existing home sales marched up 4.2% from February, making it the only region to register an increase.

On a year-over-year basis, the sales dipped in all the four regions.

That said, total housing inventory witnessed an improvement in March at 1.11 million units, up 4.7% from February and 14.4% from the comparable year-ago period’s levels. Despite a wary housing market environment, the supply of existing homes increased. According to NAR, it would take 3.2 months to exhaust the current inventory, up from 2.9 months in February and 2.7 months in the prior-year period.

The median existing home sales prices in March grew to a record high of $393,500, up 4.8% from $375,300 in the year-ago period. The sales price hiked in all four regions of the United States. Even though the housing supply went up, it did not cool down the sales price, making the recorded price the highest ever for March.

Mortgage Rates: Increase is a Disadvantage

According to the mortgage finance agency Freddie Mac, the 30-year fixed-rate mortgage registered a 6 basis points (bps) increase to 6.88% for the week concluded on Apr 11, 2024. This fixed rate happened to have moved up again by 22 bps for the week concluded on Apr 18, 2024. This marked the third consecutive weekly hike in April 2024.

Even though the supply of existing homes has climbed up and the market has almost recovered from the cyclical lows, the awareness about fewer chances of rate cuts in 2024, given the still high inflation, is repelling homebuyers.

Despite high mortgage rates, first-time buyers registered 32% of sales in March, up 26% from the prior month’s levels and 28% year over year.

Lawrence Yun, NAR chief economist, said, “Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves.” He added, “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

Our Take

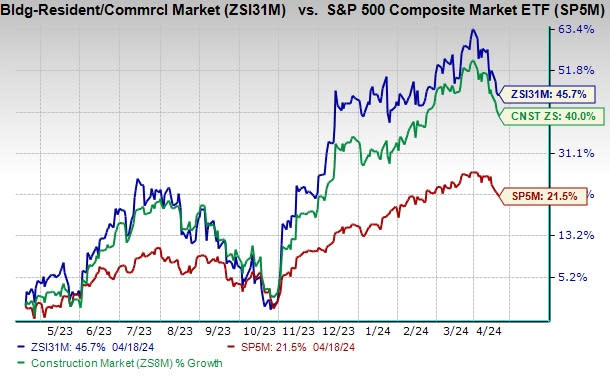

Despite the immeasurable problems hurting the homebuilding industry, certain favorable conditions have been sparking growth prospects, as evident from its share price increase of 45.7% in the past year compared with the broader sector’s rise of 40% and the Zacks S&P 500 Composite’s gain of 21.5%.

Image Source: Zacks Investment Research

Homebuilders, like Dream Finders Homes, Inc. DFH, KB Home KBH, NVR, Inc. NVR, Toll Brothers, Inc. TOL and PulteGroup, Inc. PHM have been benefiting from the industry-specific and company-specific tailwinds amid ongoing market challenges.

Discussions on the Above-Mentioned Homebuilders

Dream Finders: This Florida-based homebuilding company currently flaunts a Zacks Rank #1 (Strong Buy). The company’s shares have surged 137.3% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

DFH’s earnings per share (EPS) estimates for 2024 have increased to $3.45 from $3.14 in the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 144.9%. Earnings for 2024 are expected to grow 23.7% year over year.

KB Home: Based in Los Angeles, CA, this homebuilder also flaunts a Zacks Rank #1. The stock has gained 48.3% in the past year.

KBH’s EPS estimates for 2024 have increased to $8.01 from $7.59 in the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 26.1%. Earnings for 2024 are expected to grow 13.9% year over year.

NVR: Headquartered in Reston, VA, this homebuilder also sports a Zacks Rank #1. The stock has increased 32% in the past year.

NVR’s EPS estimates for 2024 have increased to $499.45 from $497.80 in the past seven days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 8.1%. Earnings for 2024 are expected to grow 7.8% year over year.

Toll Brothers: This Horsham, PA-based homebuilder currently flaunts a Zacks Rank #1. Shares of the company have hiked 82.1% in the past year.

TOL’s EPS estimates for fiscal 2024 have increased to $13.71 from $12.23 in the past 60 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 30.2%. Earnings for 2024 are expected to grow 10.9% year over year.

PulteGroup: Based in Atlanta, GA, PulteGroup currently carries a Zacks Rank #2 (Buy). Shares of the company have risen 70.9% in the past year.

PHM’s EPS estimates for 2024 have increased to $11.79 from $11.77 in the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 15.1%. Earnings for 2024 are expected to grow 0.6% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Dream Finders Homes, Inc. (DFH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance