Expedia CEO Calls Out Rival Agoda: How They Get Those Cheap Prices

Online Travel This Week

You see it everyday on hotel price comparison platforms such as Google: There’s the hotel’s official price on its website, and in swoops Singapore-based online travel agency Agoda with a lower rate, that’s $20 or $30 lower.

That sets up a seemingly ever-present clash of hotel industry rules, where online travel agencies aren’t supposed to undercut the rates posted on official hotel websites, versus some metasearch sites and online travel agencies that want to offer the lowest rates possible.

Expedia Group CEO Peter Kern recently called out rival Agoda at Expedia’s partner conference in Seattle as “one of the worst when it comes to this sort of rate abuse.”

“You’re in a marketplace where one competitor [Expedia] spends every day trying to do the right thing, not perfectly, but is trying, but then another competitor [Agoda] actively tries to do the opposite,” Kern said in a Skift interview at the conference.

Here’s what’s going on, as seen in one recent example: A traveler in Singapore can search Google and find a listing for $85 per night from the Hotel du Parc Hanoi on its own website for a June 23-24 stay for a room with a king bed. Agoda has the same room on that night for $20 less, or $65.

In a common scenario, the hotel might have given a private $65 rate to a wholesaler to insert into a vacation package, meaning the room rate wouldn’t be readily apparent in this flight-hotel bundle, or maybe it was meant to be a non-public rate for business travel, but then the wholesaler, unbeknownst to the hotel, releases it to an online travel agency.

Here’s how Agoda.com marketed that rate ($56) before taxes and fees for the Hotel du Parc Hanoi, touting it’s the “CHEAPEST PRICE YOU’VE SEEN.”

Source: Agoda

It takes little work to find these discrepancies. You can find them for Expedia, as well, but Expedia would argue not at the same magnitude as Agoda.

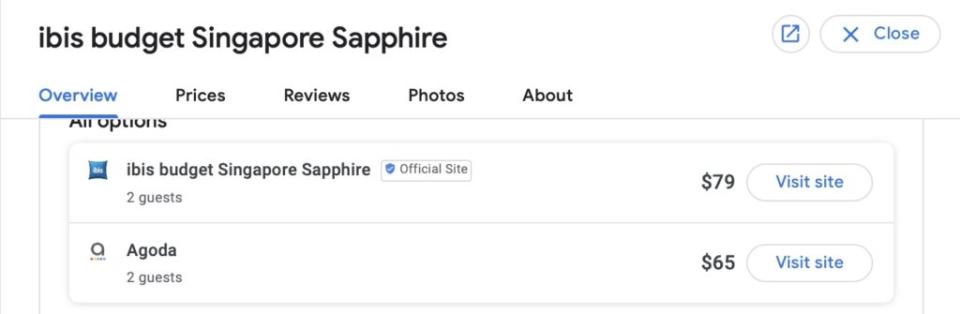

Here’s another example as seen on Google Hotels for a June 16-17 stay at the Ibis Budget Singapore Sapphire hotel. The hotel’s published rate on its own website is $79, but Agoda has it for $65.

Then-Agoda CEO John Brown detailed his company’s philosophy on hotel prices at Skift Forum East in 2019 in Singapore. See the accompanying video. (Brown relinquished his CEO duties in 2022, and chairperson role in March this year.)

Source: Skift/YouTube

“If there is a rate out here for $80 that is bookable by customers around the world and Agoda doesn’t have it, I feel like it’s our duty to customers to go off and to get it,” Brown said in the video. “So whether we will contract it directly with our partners, whether we will connect to a wholesaler etc. We even have something … where we will advance cash and take inventory positions.”

He said Agoda has lots of tools it can use to find these types of cheap rates. “The bottom line is if the rates are out there, we will do whatever we need to do to put them in the hands of the customer,” Brown said.

A Win for Travelers, A Blow to the Hotel Industry

Brown added that Agoda’s relations with hoteliers “has not been easy, for sure” because of these practices, adding that hoteliers have the option to tell wholesalers (who often pass these rates along to Google, Kayak, Tripadvisor, Trivago, Expedia, Booking.com or Agoda) where their rates should appear and where they shouldn’t.

Agoda is a Booking Holdings brand, and a Booking Holdings spokesperson defended Agoda’s practices. “Agoda does get many different rates from partners – including wholesale – but they distribute them according to partner agreements,” the spokesperson said. “Transparency with our partners is key.”

Expedia, meanwhile, has skin in the game on this issue on several levels. Expedia has a tech tool called Optimized Distribution to help hotels weed out wholesale and other rates showing up in unauthorized outlets. Expedia’s partners include Marriott, IHG, and others, and it hopes to sign on more.

And, as Kern acknowledges, Agoda is a competitor.

Some point out that Expedia’s hands weren’t totally clean when it came to violating hotel rate parity provisions in the past, and Kern said Expedia isn’t perfect, but it is trying to make good on pledges to do the right thing.

Kern said he’s amazed that some hotels don’t realize how their rates are being mishandled. Sometimes this rate undercutting might only appear from a non-U.S. point of sale, complicating matters for hotel brands that may not be headquartered in that market.

“Frankly, when I talk to major CEOs of major or mid-size hospitality companies, and talk about rate issues, and speak about what optimized distribution can do, almost to a person, they’ll say they didn’t realize that,” Kern said, referring to how third parties are misusing their rates.

Get breaking travel news and exclusive hotel, airline, and tourism research and insights at Skift.com.

Yahoo Finance

Yahoo Finance