Expedia Group (EXPE) Incurs Loss in Q1, Beats on Revenues

Expedia Group, Inc. EXPE reported an adjusted loss of $2.02 per share for first-quarter 2021, narrower than the Zacks Consensus Estimate of a loss of $2.52. Further, the bottom line is below the prior quarter’s loss of $2.64 per share but compares unfavorably with the year-ago quarter’s loss of $1.83 per share.

Revenues of $1.25 billion surpassed the Zacks Consensus Estimate of $1.09 billion. Further, the top line surged 35.4% sequentially but declined 44% year over year.

Disruptions caused by the pandemic on the travel industry continued to be a major headwind.

Nevertheless, beach and outdoor destinations witnessed recovery in travel trends in the reported quarter. Further, the company experienced strong growth in vacation rental and a rebound in domestic travel.

However, the demand for international travel continued to be sluggish. Also, softness in business travel and conventional lodging persisted in the first quarter.

Notably, Expedia Group’s gross bookings were $15.4 billion, which surpassed the Zacks Consensus Estimate of $11.5 billion. However, the figure declined 14% year over year.

The increasing number of COVID-19 cases worldwide, resulting in the shutdown of several travel markets,remains concerning.

Nevertheless, optimism regarding the widespread availability of coronavirus vaccines remains a tailwind.

Further, the improving performance of Vrbo remains a positive. The growing momentum of Vrbo in room nights stayed is likely to contribute well in the near term. Additionally, proper execution of the company’s cost-saving strategies remained a tailwind.

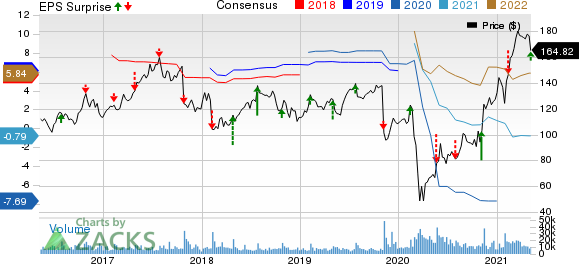

Expedia Group, Inc. Price, Consensus and EPS Surprise

Expedia Group, Inc. price-consensus-eps-surprise-chart | Expedia Group, Inc. Quote

Revenues by Segment

Retail: The company generated $1.03 billion in revenues (82.3% of total revenues) from the segment, which declined 35% year over year.

B2B: The segment yielded revenues of $184 million (14.8% of total revenues), which fell 62% from the year-ago quarter.

trivago: Revenues from the segment totaled $46 million (3.7% of revenues), down 70% year over year.

Revenues by Business Model

The Merchantmodel generated revenues of $796 million (63.9% of revenues), down 41% year over year. Merchant gross bookings were $8.7 billion, up 8% from the prior-year quarter.

The Agency division generated revenues of $323 million (25.9% of revenues), slumping 43% from the prior-year quarter. Agency gross bookings were $6.7 billion, down 31% year over year.

Advertising & Media and other generated $127 million of revenues (10.2% of the top line), decreasing 59% from the year-ago quarter. This can primarily be attributed to sluggishness in Expedia Group Media Solutions and trivago.

Revenues by Geography

Expedia Groupgenerated $1.001 billion in revenues (80.3% of total revenues) from domestic regions, down 24% from the prior-year quarter.

Further, revenues generated from international regions totaled$245 million (19.7% of revenues), down 73% on a year-over-year basis.

Revenues by Product Line

Lodging revenues, which accounted for 72% of total revenues, declined 41% from the prior-year quarter. Although the company witnessed a 10% rise in revenues per room night, stayed room nights declined 47%.

Air revenues accounted for 4% of revenues. The metric was down 55% year over year. Notably, air tickets soldand revenue per ticket plunged 50% and 10% year over year, respectively.

Operating Details

Adjusted EBITDA was ($58) million in the reported quarter compared with ($76) million in the year-ago quarter.

Further, adjusted selling and marketing expenses were $647 million, down 46% year over year. Additionally, adjusted general and administrative expenses were $122 million, down 26% year over year. Adjusted technology and content expenses were $220 million, down 25% from the year-ago quarter.

The company reported a first-quarter operating loss of $369 million against the operating income of $1.3 billion in the year-ago quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2021, cash and cash equivalents were $4.3 billion, up from $3.4 billion as of Dec 31, 2020. Short-term investments totaled $23 million, downfrom $24 million in the previous quarter.

Additionally, long-term debt was $8.5 billion at the end of the first quarter compared with $8.2 billion at the end of the fourth quarter of 2020.

Further, Expedia Group generated $2.2 billion of cash from operations in the quarter under review against $385 million of cash used in operations in the last reported quarter.

Moreover, free cash flow was $2 billion in the first quarter.

Zacks Rank & Stocks to Consider

Expedia Group currently carries a Zacks Rank #3 (Holdl).

Some better-ranked stocks in the broader sector worth consideration are Agilent Technologies A, Pure Storage PSTG and NVIDIA NVDA. All the stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank(Strong Buy) stocks here.

Long-term earnings growth rate of Pure Storage, NVIDIA and Agilent, is pegged at 52.21%, 15.05% and 9%, respectively.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance