Expert share tips: Pearson, RBS, AstraZeneca, Tate & Lyle and more (copy)

Here’s your round up of how the experts view key stocks.

1. AstraZeneca - BUY

Symbol: AZN.L

Index: FTSE 100

The international pharmaceutical giant focuses its operations on oncology, respiratory and cardiovascular/metabolic disease.

Analyst Roger Franklin at Liberum upgraded the stock at the end of November after concluding its valuation priced little to nothing for the high potential I-O franchise.

With the attractive valuation and reassurance from management on unchanged confidence surrounding MYSTIC – one of its trials – the stock is now up 10%.

“The real prize is the high risk / high reward potential for I-O to work in all comers and across multiple indications, at which point AZ is a £60+ stock in our view,” said Franklin.

Invest from just £50 a month with Fidelity's Stocks & Share ISA

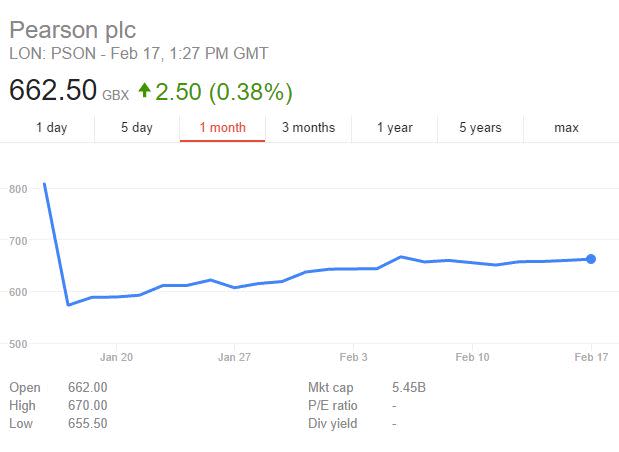

2. Pearson - HOLD

Symbol: PSON.L

Index: FTSE 100

It’s been a challenging time for the education giant with its own investors questioning whether the company should be broken up in the wake of a profit warning.

Ian Forrest, analyst at The Share Centre, describes it as a ‘weak hold’ for current investors only due to the uncertainty.

“It’s for medium to high-risk investors – and only those that think the changes are going to work,” he said. “It’s had a few profit warnings that have led to a certain amount of restructuring and it’s looking to reduce costs.”

3. Tate & Lyle - BUY

Symbol: TATE.L

Index: FTSE 250

Tate & Lyle, whose history goes back more than 150 years, produces a variety of ingredients and solutions for the food and drink industries.

It has just issued an upbeat trading update for the last quarter of 2016 and analysts believe its valuation looks attractive.

Robert Waldschmidt at Liberum is forecasting 38% growth in 2017 full-year pre-tax profits, partly driven by strength in its Bulk Ingredients division.

“Tate is on the path of sustained recovery and we expect improving returns, cash flow and margins, especially in Speciality Food Ingredients,” he said.

Earn tax-free returns with these top Stocks & Shares ISAs

4. Bodycote - BUY

Symbol: BOY.L

Index: FTSE 250

The company’s thermal processing services are used across the aerospace, defence, energy and automobile sectors.

Analyst Harry Philips at Peel Hunt favours the stock due to continued growth in specialist technologies and its desire to expand.

“The (recent) trading update noted the acquisition of several new sites, with annualised sales of £14 million,” he said. “We note from the trade press further recent acquisitions in Canada, the US and Germany.”

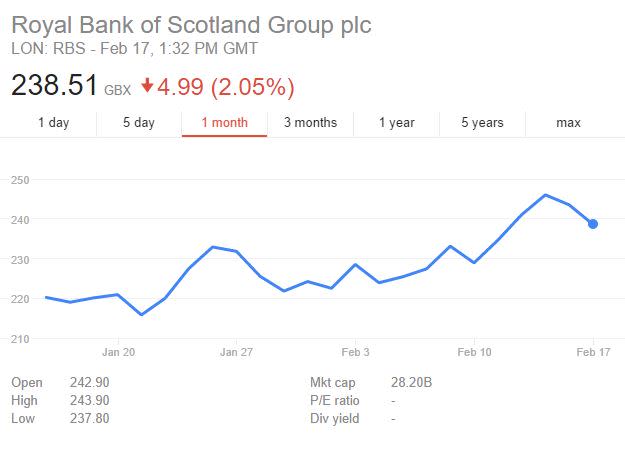

5. Royal Bank of Scotland - SELL

Symbol: RBS.L

Index: FTSE 100

This company remains on the sell list for The Share Centre – and is likely to come under the spotlight this week with a raft or rival banks expected to announce results.

Although the share price has recovered, analyst Ian Forrest insists the company still has a lot of legacy issues to resolve.

“It’s very frustrating for shareholders,” he said. “Until they make progress it’s difficult to see the Government selling its stake – and until the market sees that happening it’s going to be very hard to attract investors.”

Invest from just £50 a month with Fidelity's Stocks & Share ISA

The information included in this article does not constitute regulated financial advice. You should seek out independent, professional financial advice before making an investment decision.

Yahoo Finance

Yahoo Finance