Exploring 3 SGX Dividend Stocks With Yields Up To 7.7%

As the global economy continues to embrace technological advancements, such as the widespread adoption and integration of artificial intelligence, markets like Singapore's SGX are reflecting these dynamic changes. In this context, understanding the stability and potential growth offered by dividend stocks becomes increasingly relevant. This article will explore three SGX-listed dividend stocks that not only promise regular income but also align with current economic resilience and market trends influenced by technological progress.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.05% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.31% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.27% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.76% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.73% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.69% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.53% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.83% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Aztech Global

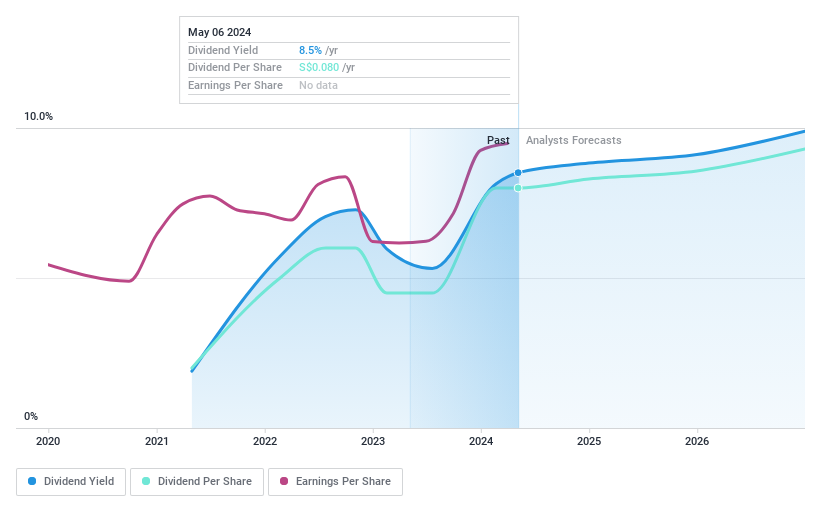

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. specializes in the design and manufacturing of IoT devices, data-communication products, and LED lighting, operating across Singapore, North America, China, Europe, and other international markets with a market capitalization of approximately SGD 0.80 billion.

Operations: Aztech Global Ltd. generates its revenue primarily from the sale of IoT devices, data-communication products, and LED lighting across various regions including Singapore, North America, China, and Europe.

Dividend Yield: 7.8%

Aztech Global Ltd., despite its relatively short dividend history of three years, has demonstrated a commitment to shareholder returns with a recent increase in dividends to SGD 0.05 per share for FY2023. The company's dividends appear sustainable, supported by a payout ratio of 61.7% and cash payout ratio of 77.9%. However, the track record for dividend stability is not robust, marked by volatility in payments over the years. Financial performance shows promise with a significant earnings growth and an earnings per share increase in the latest quarter, suggesting potential for future sustainability if trends continue.

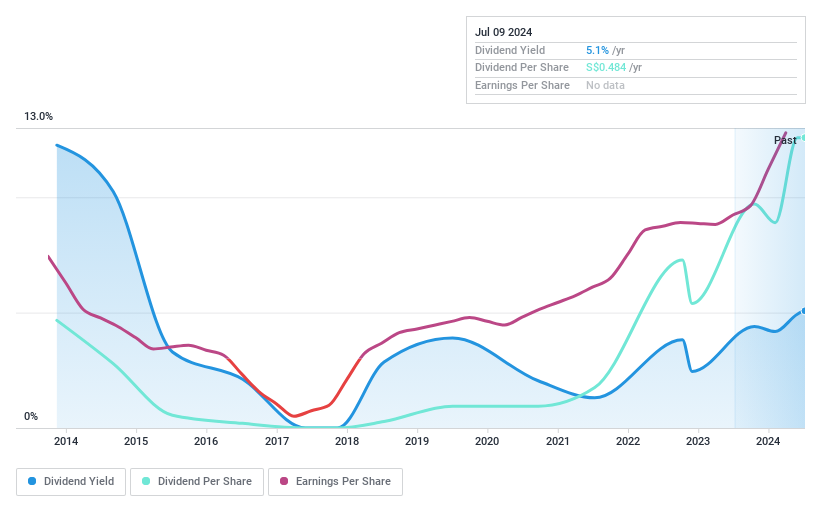

Azeus Systems Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azeus Systems Holdings Ltd. is an investment holding company that provides IT products and services across various global regions including Hong Kong, Asia, the United Kingdom, Europe, Australia, New Zealand, North America, South America, the Middle East, and Africa; it has a market capitalization of approximately SGD 285.90 million.

Operations: Azeus Systems Holdings Ltd. generates revenue from IT products and services across diverse regions such as Hong Kong and Asia, the United Kingdom and Europe, Australia and New Zealand, North America and South America, as well as the Middle East and Africa.

Dividend Yield: 5.1%

Azeus Systems Holdings Ltd. proposed a final dividend of HKD 1.9 per share for FY2024, totaling HKD 2.8 annually, reflecting a high payout ratio of 99%. The company's recent financials show robust growth with sales reaching HKD 328.94 million and net income at HKD 84.99 million, both marking significant increases from the previous year. Despite this positive performance and a commitment to shareholder returns, the dividend yield remains below the top tier in Singapore's market, and historical dividend payments have shown volatility which may concern long-term stability-focused investors.

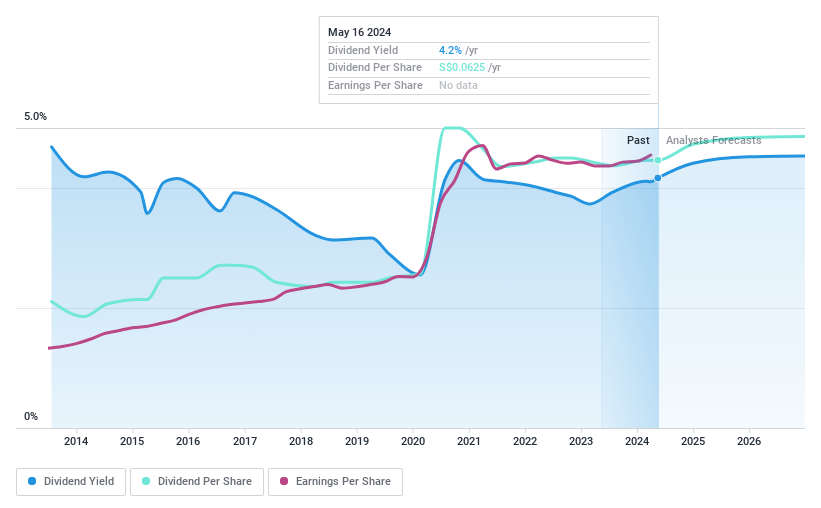

Sheng Siong Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market capitalization of SGD 2.24 billion.

Operations: Sheng Siong Group Ltd generates its revenue primarily from supermarket operations, which amounted to SGD 1.39 billion in selling consumer goods.

Dividend Yield: 4.2%

Sheng Siong Group Ltd. has demonstrated a 10.7% annual earnings growth over the past five years, with expectations of continued growth at 2.39% annually. Despite trading at a value deemed reasonable compared to its peers, its dividend yield of 4.19% lags behind the top quartile in Singapore's market, which stands at 6.25%. Dividend sustainability is supported by a payout ratio of 68.7% and cash payout ratio of 50.1%, yet the dividend history has been marked by volatility and inconsistency over the last decade, reflecting potential concerns for those seeking stable returns from dividends.

Turning Ideas Into Actions

Unlock our comprehensive list of 21 Top SGX Dividend Stocks by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:8AZ SGX:BBW and SGX:OV8.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance