Exploring Alternatives To First Sponsor Group On SGX With One Better Dividend Stock Option

Investors often gravitate towards dividend stocks for their potential to provide a reliable income stream. However, it's crucial to examine the sustainability of these dividends. A high payout ratio, such as that seen with First Sponsor Group, might suggest that a company is distributing more money to shareholders than it can afford, which could jeopardize future payouts. Today, we will explore two stocks on the SGX, highlighting one attractive option and cautioning against another where such risks are evident.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.41% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.35% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.88% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.61% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.71% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.84% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.82% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.01% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

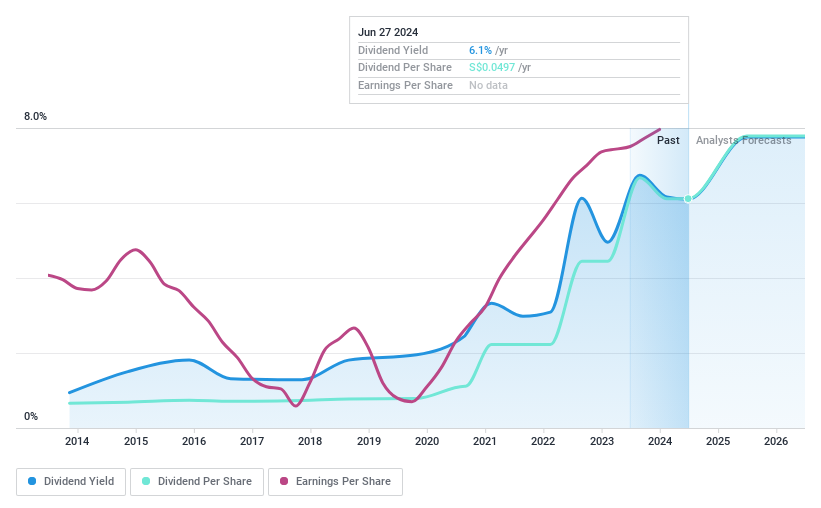

Civmec

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company, offers construction and engineering services across sectors like energy, resources, infrastructure, and marine and defense in Australia, with a market capitalization of approximately SGD 428.91 million.

Operations: The company's revenue is derived from three primary sectors: energy (A$46.02 million), resources (A$752.82 million), and infrastructure, marine & defense (A$105.52 million).

Dividend Yield: 5.9%

Civmec, with a dividend yield of 5.88%, offers a sustainable payout due to its low payout ratio of 45.4% and cash payout ratio of 27%, ensuring dividends are well-covered by both earnings and cash flows. Unlike some peers with risky high payout ratios, Civmec maintains financial health, crucial for ongoing dividend reliability. However, its yield is below the top quartile in Singapore's market, suggesting room for improvement in attractiveness compared to the highest payers.

Get an in-depth perspective on Civmec's performance by reading our dividend report here.

Our valuation report here indicates Civmec may be undervalued.

One To Reconsider

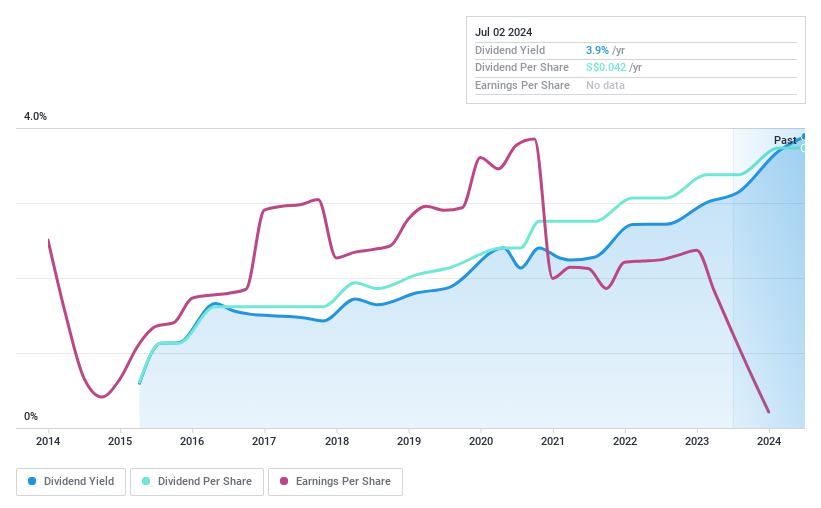

First Sponsor Group

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: First Sponsor Group Limited is an investment holding company that focuses on investing in, developing, and selling residential and commercial properties across the People’s Republic of China, Europe, and other international markets, with a market capitalization of approximately SGD 1.22 billion.

Operations: The company generates revenue primarily through hotel operations (SGD 178.95 million), property financing (SGD 63.11 million), property investment (SGD 23.70 million), and property development (SGD 37.24 million).

Dividend Yield: 3.9%

First Sponsor Group Limited faces challenges as a dividend stock primarily due to its unsustainable payout practices. With a high payout ratio of 325.4%, dividends are not adequately covered by earnings, indicating potential risk for future payouts. Additionally, the company has no free cash flows to support its dividend payments. Despite recent increases in dividend per share to 3.10 Singapore cents, First Sponsor's overall financial health is concerning, exacerbated by recent executive changes and a significant decline in earnings over the past five years (13.2% annually).

Taking Advantage

Explore the 20 names from our Top SGX Dividend Stocks screener here.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:P9DSGX:ADN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance