Exploring ASX Dividend Stocks: Avoiding Lottery And Highlighting One Superior Option

In the pursuit of reliable dividend income from ASX-listed companies, investors should be cautious about high payout ratios. While a generous dividend can be appealing, it's essential to verify if these payouts are supported by the company's earnings. A high payout ratio may indicate that dividends are not sustainable over time, potentially leading to financial difficulties for the company, as seen with some firms like Lottery.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.14% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.27% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.11% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 4.05% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.29% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.21% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.10% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at one of the choices from the screener and one that may be safer to dodge.

Top Pick

New Hope

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited, with a market cap of A$4.37 billion, is engaged in the exploration, development, production, and processing of coal and oil and gas properties.

Operations: The company generates revenue primarily from its coal mining operations in New South Wales and Queensland, totaling A$1.93 billion.

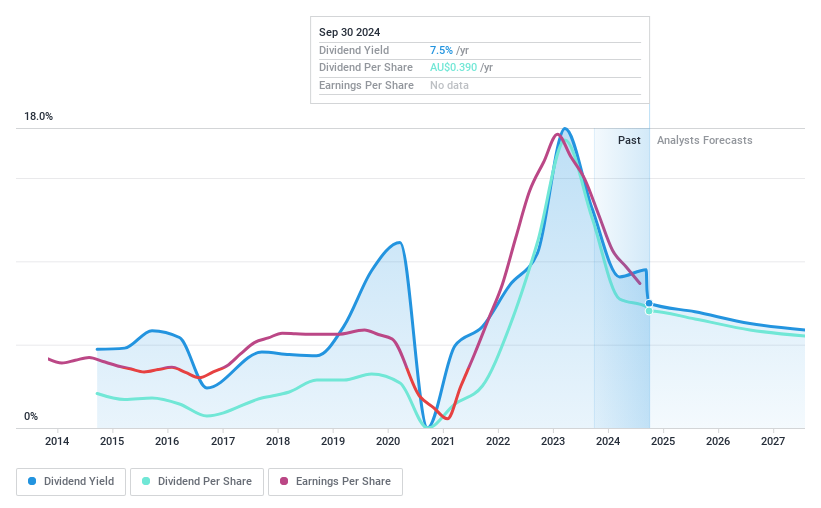

Dividend Yield: 8.3%

New Hope's dividend yield of 8.32% ranks in the top quartile of Australian dividend payers, offering an attractive return compared to the market average of 6.59%. However, its dividends are not well supported by cash flows, with a high cash payout ratio of 90.2%, indicating potential sustainability issues despite a more moderate earnings payout ratio at 48.4%. Recent board changes could influence future financial strategies, but historically, dividend payments have been volatile and unreliable over the past decade.

Unlock comprehensive insights into our analysis of New Hope stock in this dividend report.

Our valuation report unveils the possibility New Hope's shares may be trading at a discount.

One To Reconsider

Lottery

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: The Lottery Corporation Limited operates in the lottery and keno sectors within Australia, with a market capitalization of approximately A$11.11 billion.

Operations: The company generates revenue primarily through its lotteries and keno segments, totaling approximately A$3.20 billion and A$279.70 million respectively.

Dividend Yield: 2.8%

Lottery's recent initiation of dividends, with a yield of 2.81%, falls below the top quartile benchmark of 6.59% in the Australian market, making it less attractive for those seeking high dividend returns. The company's dividend sustainability is questionable as both earnings and cash flows do not adequately cover its payouts, evidenced by payout ratios exceeding 100%. This financial strain is exacerbated by inadequate coverage from operating cash flow to debt, posing risks to future dividend reliability and growth.

Make It Happen

Explore the 27 names from our Top ASX Dividend Stocks screener here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NHC and ASX:TLC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance