Exploring ASX Dividend Stocks In May 2024

The Australian stock market has shown robust performance, gaining 1.3% over the last week and an impressive 8.8% over the past year, with earnings projected to grow by 14% annually. In this favorable economic environment, dividend stocks can be particularly appealing for investors seeking both stability and potential income growth.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Fiducian Group (ASX:FID) | 3.98% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.93% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.65% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.47% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.56% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.40% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.83% | ★★★★☆☆ |

Macquarie Group (ASX:MQG) | 3.31% | ★★★★☆☆ |

Australian United Investment (ASX:AUI) | 3.57% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

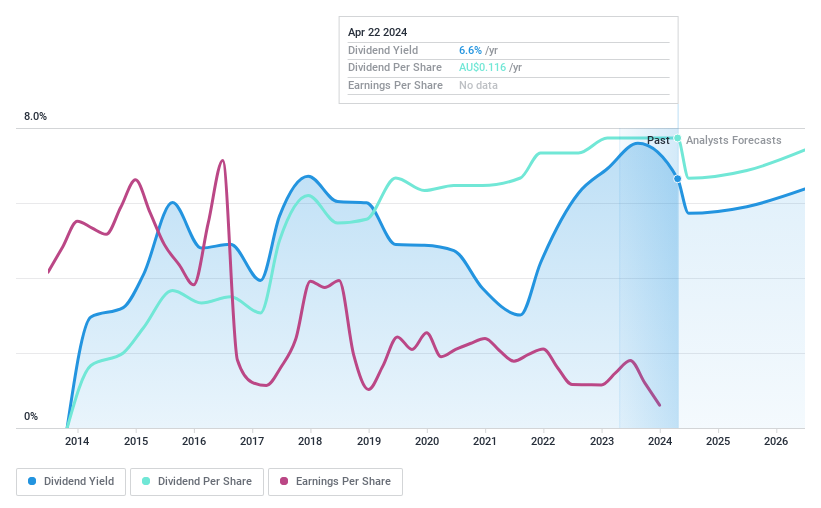

Centuria Capital Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Centuria Capital Group, an Australian investment manager, specializes in marketing and managing investment products with a market capitalization of approximately A$1.44 billion.

Operations: Centuria Capital Group generates revenue through several key segments, including Property Funds Management (A$178.53 million), Co-Investments (A$53.33 million), Non-Operating Items (A$51.53 million), Development (A$40.07 million), and Property and Development Finance (A$17.46 million).

Dividend Yield: 6.6%

Centuria Capital Group's dividend yield of 6.65% ranks in the top 25% of Australian dividend payers, reflecting a robust income potential. However, its history reveals volatility with significant annual fluctuations exceeding 20%. Despite this, dividends are sustainably covered by earnings and cash flows, with payout ratios at 76.1% and 73.5%, respectively. Looking ahead, earnings are expected to grow by 21.41% annually, which may support future dividend stability and growth despite a recent history of shareholder dilution and declining profit margins from 6.5% to 3.1%.

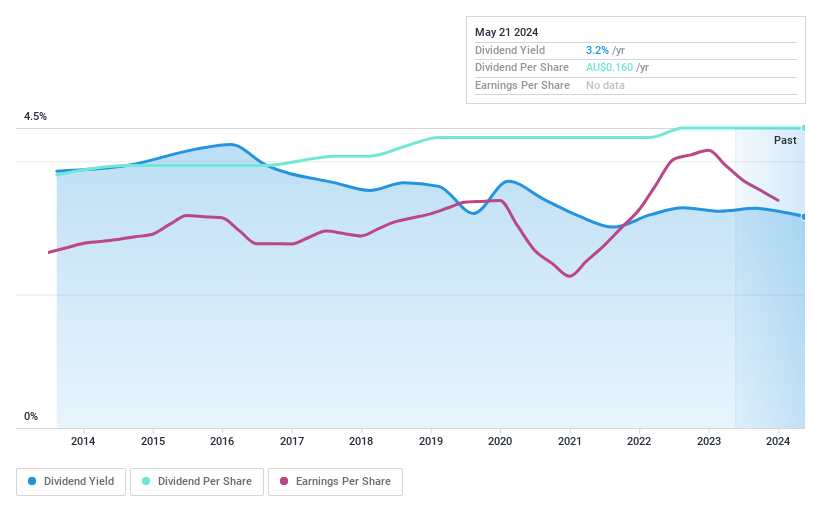

Diversified United Investment

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market capitalization of approximately A$1.09 billion.

Operations: Diversified United Investment Limited generates its revenue primarily through its investment management activities, totaling A$51.05 million.

Dividend Yield: 3.2%

Diversified United Investment has consistently increased its dividend over the last decade, offering a current yield of 3.17%. While this yield is lower than the top quartile of Australian dividend stocks, DUI's dividends are well-supported by both earnings and cash flows, with payout ratios at 87.8% and 88.1%, respectively. This financial structure suggests a reliable income stream, though it lacks competitiveness in yield compared to leading market players.

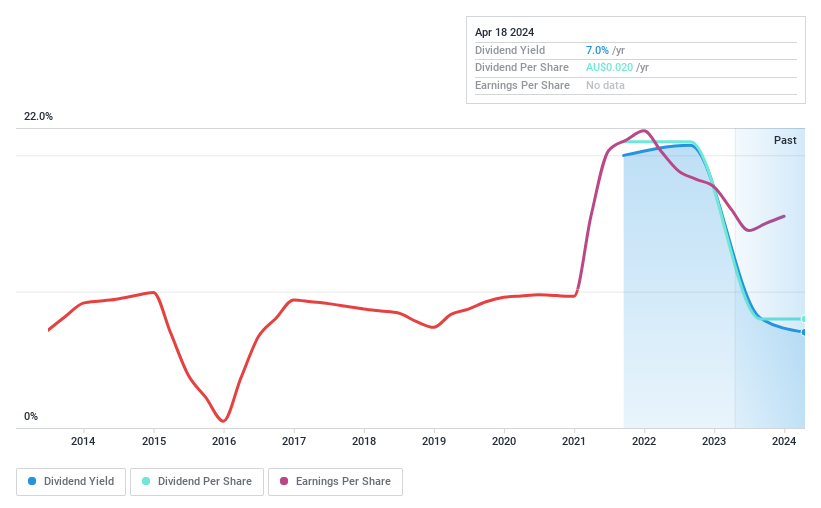

Fenix Resources

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fenix Resources Limited is a company focused on the exploration, development, and mining of mineral tenements in Western Australia, with a market capitalization of approximately A$218.80 million.

Operations: Fenix Resources Limited generates its revenue primarily from the exploration, development, and mining of mineral tenements, totaling A$311.38 million after adjustments.

Dividend Yield: 6.3%

Fenix Resources, recently added to the S&P/ASX All Ordinaries Index, showcased strong financial performance with sales rising to A$126.93 million and net income doubling to A$22.05 million in the last half of 2023. Despite this growth, Fenix's dividend history is marked by volatility and inconsistency over its three-year dividend-paying tenure. The company's dividends are currently supported by a low payout ratio of 31.5% and a cash payout ratio of 34.2%, indicating that payments are well-covered but not reliably growing or stable.

Where To Now?

Dive into all 32 of the Top ASX Dividend Stocks we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CNI ASX:DUI and ASX:FEX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance